Question: Please answer all questions please! Question 1 (5.25 points) 4) Listen Tim Burr, who is claimed as a dependent by his parents, received taxable interest

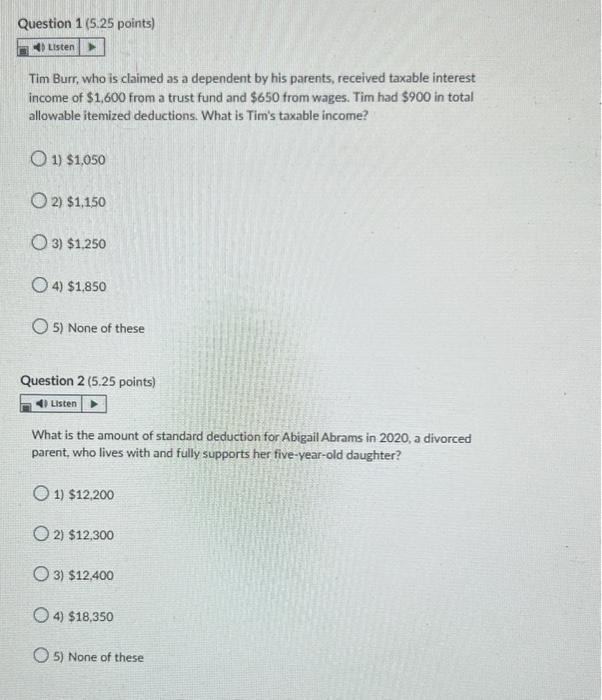

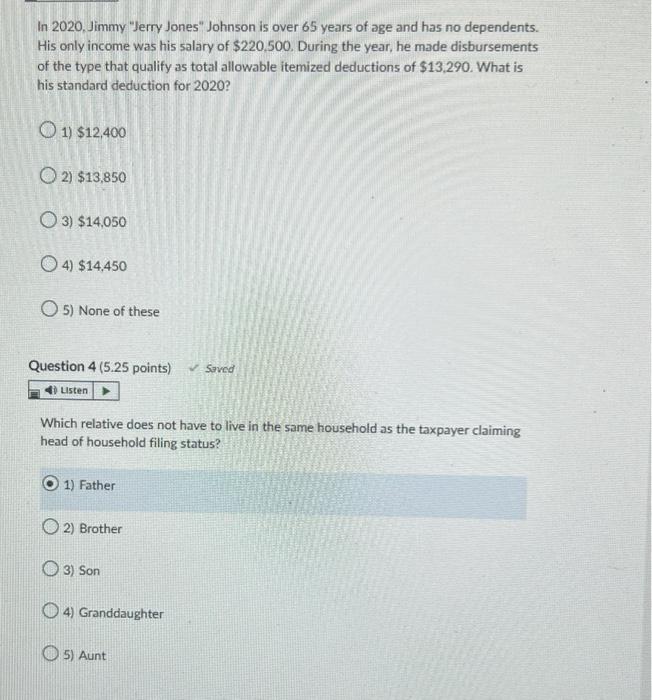

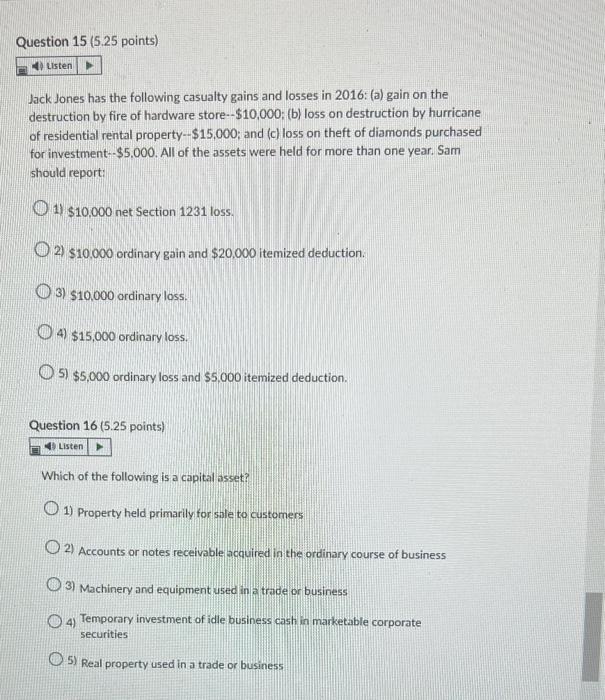

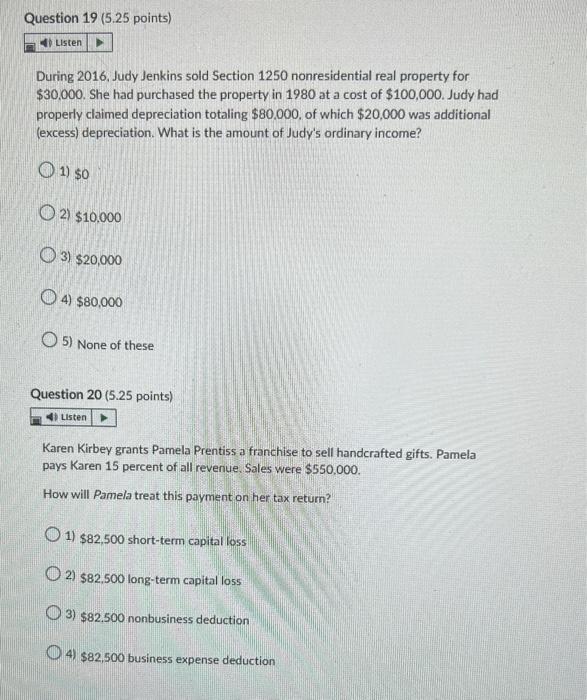

Question 1 (5.25 points) 4) Listen Tim Burr, who is claimed as a dependent by his parents, received taxable interest income of $1,600 from a trust fund and $650 from wages. Tim had $900 in total allowable itemized deductions. What is Tim's taxable income? 1) $1,050 O2) $1,150 O3) $1,250 O4) $1,850 5) None of these Question 2 (5.25 points) 4) Listen What is the amount of standard deduction for Abigail Abrams in 2020, a divorced parent, who lives with and fully supports her five-year-old daughter? 1) $12,200 O2) $12,300 3) $12,400 O4) $18,350 O5) None of these In 2020, Jimmy "Jerry Jones" Johnson is over 65 years of age and has no dependents. His only income was his salary of $220.500. During the year, he made disbursements of the type that qualify as total allowable itemized deductions of $13,290. What is his standard deduction for 2020? 1) $12,400 2) $13,850 3) $14,050 4) $14,450 O5) None of these Question 4 (5.25 points) Saved 4) Listen Which relative does not have to live in the same household as the taxpayer claiming head of household filing status? 1) Father O2) Brother 3) Son 4) Granddaughter 5) Aunt Question 15 (5.25 points) 4) Listen Jack Jones has the following casualty gains and losses in 2016: (a) gain on the destruction by fire of hardware store--$10,000; (b) loss on destruction by hurricane of residential rental property--$15,000; and (c) loss on theft of diamonds purchased for investment--$5.000. All of the assets were held for more than one year. Sam should report: 1) $10,000 net Section 1231 loss. 2) $10,000 ordinary gain and $20,000 itemized deduction. 3) $10,000 ordinary loss. 4) $15,000 ordinary loss. 5) $5,000 ordinary loss and $5,000 itemized deduction. Question 16 (5.25 points) Listen Which of the following is a capital asset? 1) Property held primarily for sale to customers 2) Accounts or notes receivable acquired in the ordinary course of business 3) Machinery and equipment used in a trade or business 4) Temporary investment of idle business cash in marketable corporate securities 5) Real property used in a trade or business Question 19 (5.25 points) Listen During 2016, Judy Jenkins sold Section 1250 nonresidential real property for $30,000. She had purchased the property in 1980 at a cost of $100,000. Judy had properly claimed depreciation totaling $80,000, of which $20,000 was additional (excess) depreciation. What is the amount of Judy's ordinary income? 1) $0 2) $10,000 3) $20,000 4) $80,000 5) None of these Question 20 (5.25 points) 4) Listen Karen Kirbey grants Pamela Prentiss a franchise to sell handcrafted gifts. Pamela pays Karen 15 percent of all revenue. Sales were $550,000. How will Pamela treat this payment on her tax return? 1) $82,500 short-term capital loss O2) $82,500 long-term capital loss 3) $82.500 nonbusiness deduction 4) $82,500 business expense deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts