Question: PLEASE ANSWER ALL QUESTIONS PLEASE USE THIS FOR REFERENCE Required: 1. What does the company report for the following items for the most current fiscal

PLEASE ANSWER ALL QUESTIONS

PLEASE USE THIS FOR REFERENCE

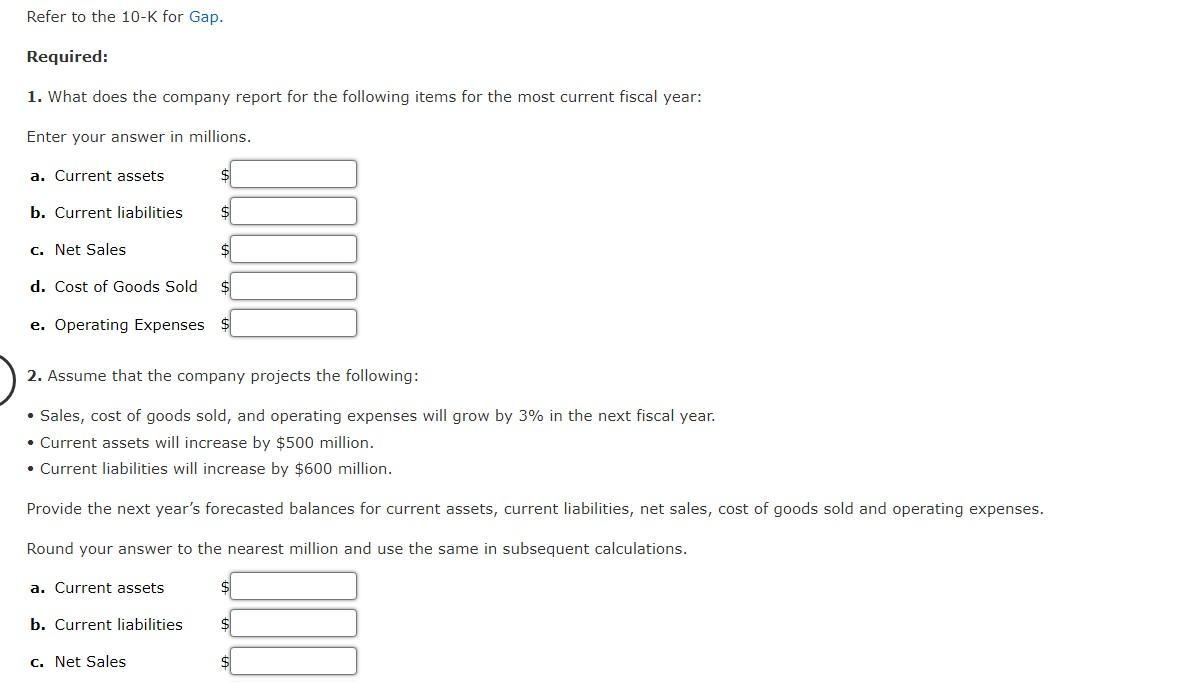

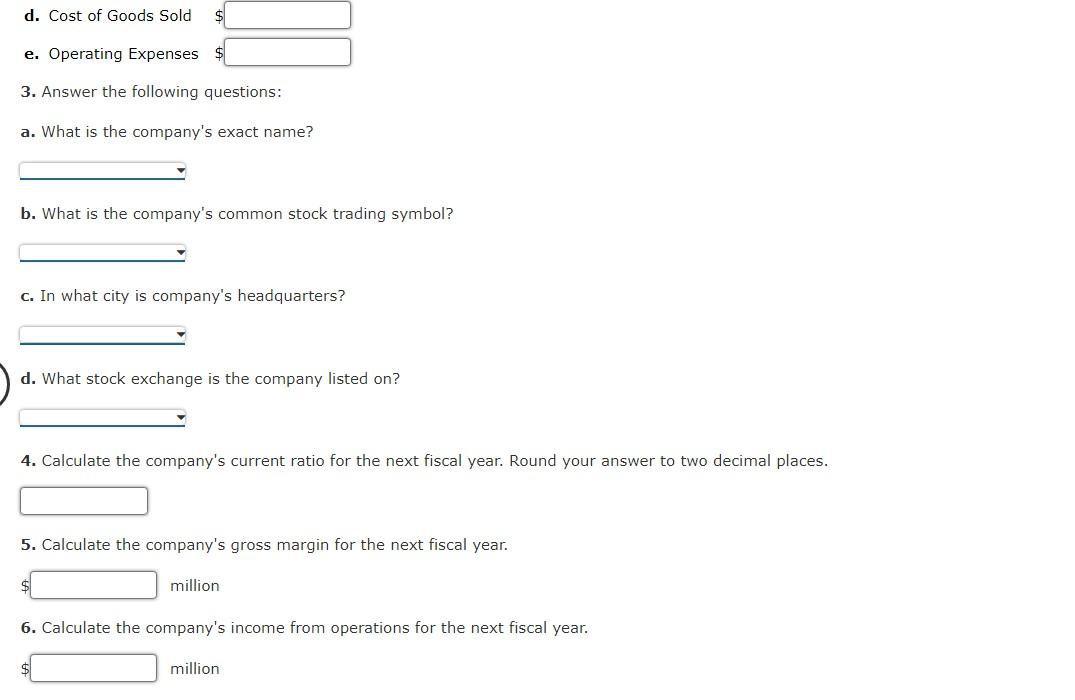

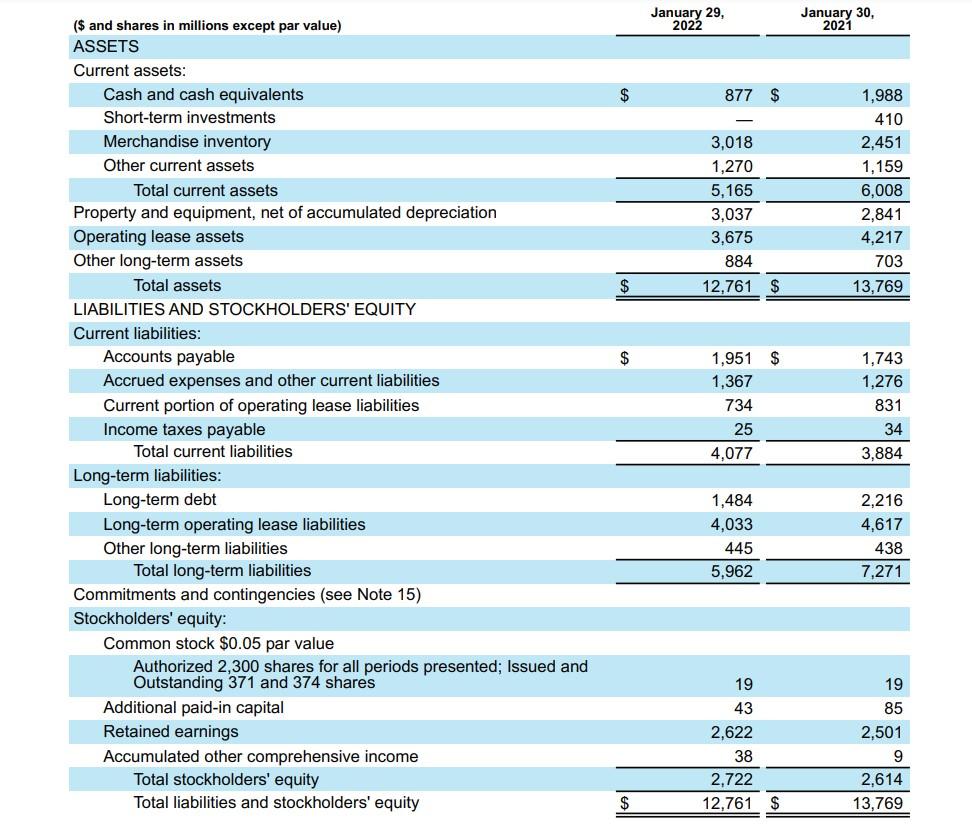

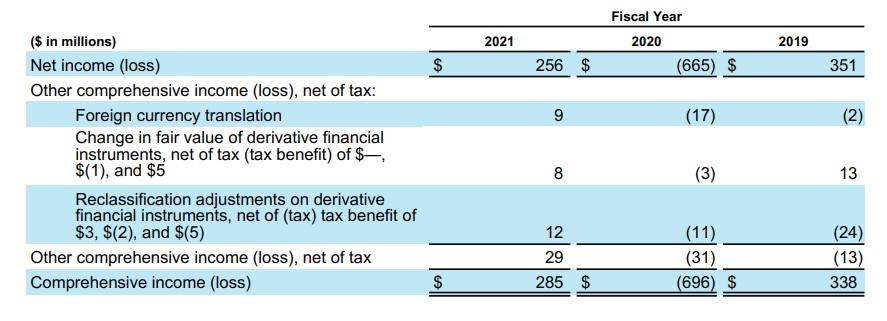

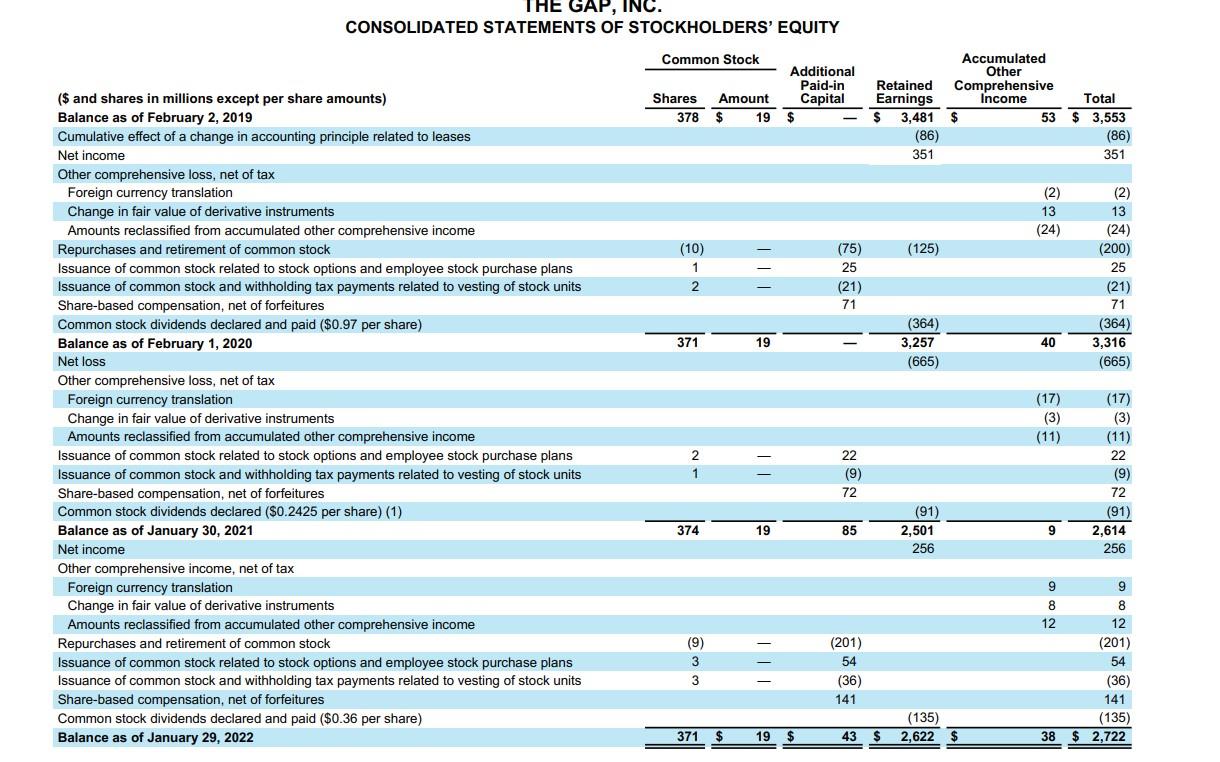

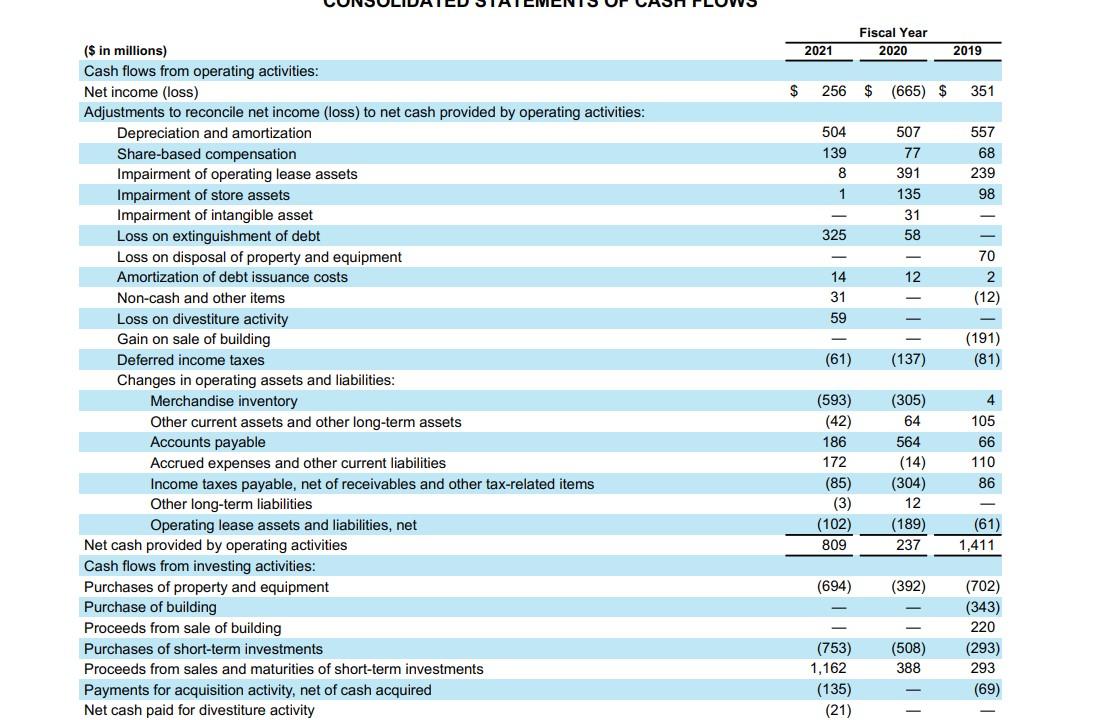

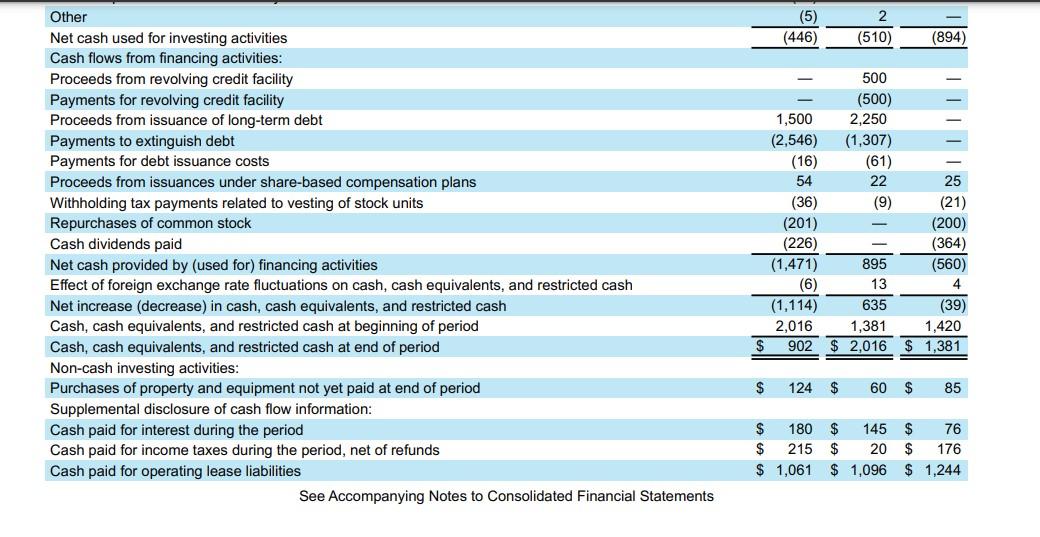

Required: 1. What does the company report for the following items for the most current fiscal year: Enter your answer in millions. a. Current assets \$ b. Current liabilities \$ c. Net Sales \$ d. Cost of Goods Sold \$ e. Operating Expenses \$ 2. Assume that the company projects the following: - Sales, cost of goods sold, and operating expenses will grow by 3% in the next fiscal year. - Current assets will increase by $500 million. - Current liabilities will increase by $600 million. Provide the next year's forecasted balances for current assets, current liabilities, net sales, cost of goods sold and operating expenses. Round your answer to the nearest million and use the same in subsequent calculations. a. Current assets \$ b. Current liabilities \$ c. Net Sales $ d. Cost of Goods Sold $ e. Operating Expenses $ 3. Answer the following questions: a. What is the company's exact name? b. What is the company's common stock trading symbol? c. In what city is company's headquarters? d. What stock exchange is the company listed on? 4. Calculate the company's current ratio for the next fiscal year. Round your answer to two decimal places. 5. Calculate the company's gross margin for the next fiscal year. $ million 6. Calculate the company's income from operations for the next fiscal year. $ million IHE GAP, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY See Accompanying Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts