Question: PLEASE answer all questions please. what is the reasonable estimate given the information? what is the cost of public (bond) debt? what is the cost

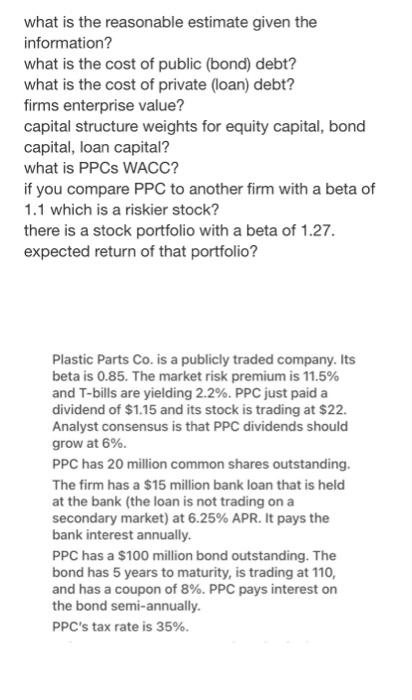

what is the reasonable estimate given the information? what is the cost of public (bond) debt? what is the cost of private (loan) debt? firms enterprise value? capital structure weights for equity capital, bond capital, loan capital? what is PPCs WACC? if you compare PPC to another firm with a beta of 1.1 which is a riskier stock? there is a stock portfolio with a beta of 1.27. expected return of that portfolio? Plastic Parts Co. is a publicly traded company. Its beta is 0.85. The market risk premium is 11.5% and T-bills are yielding 2.2%. PPC just paid a dividend of $1.15 and its stock is trading at $22. Analyst consensus is that PPC dividends should grow at 6%. PPC has 20 million common shares outstanding. The firm has a $15 million bank loan that is held at the bank (the loan is not trading on a secondary market) at 6.25% APR. It pays the bank interest annually. PPC has a $100 million bond outstanding. The bond has 5 years to maturity, is trading at 110, and has a coupon of 8%. PPC pays interest on the bond semi-annually. PPC's tax rate is 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts