Question: PLEASE ANSWER ALL QUESTIONS! Probate Fact Pattern #1 Tom and Rita have been married for 19 years. Tom has recently been diagnosed with a malignant

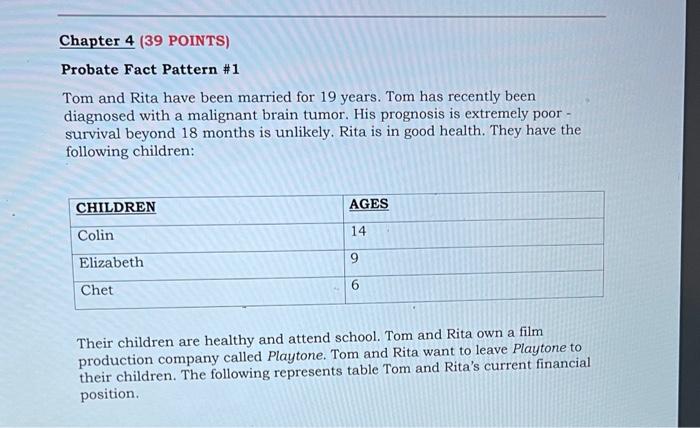

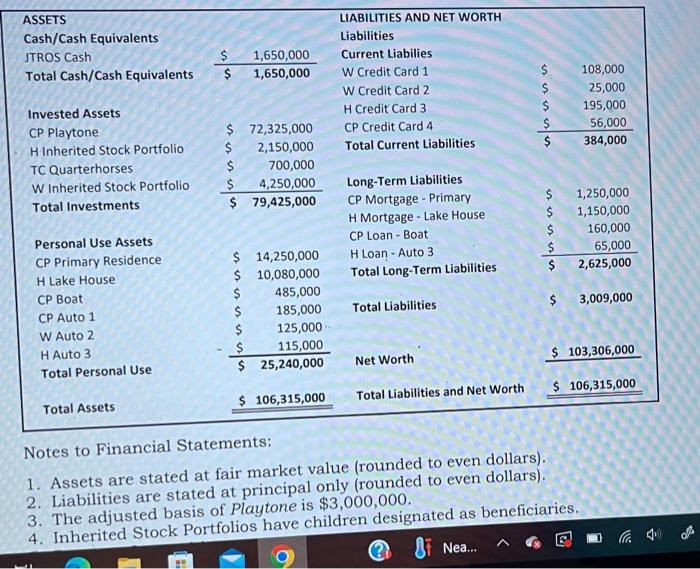

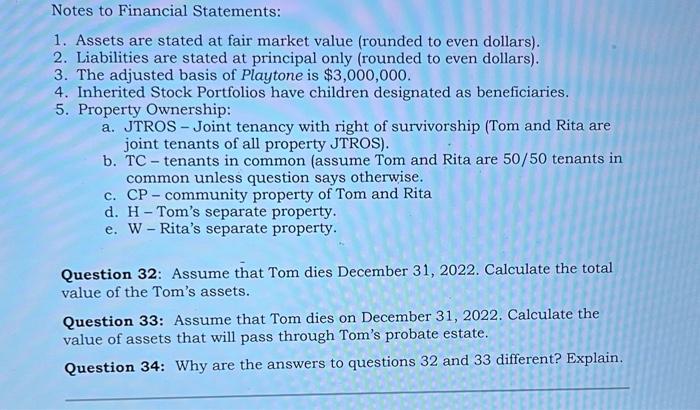

Probate Fact Pattern \#1 Tom and Rita have been married for 19 years. Tom has recently been diagnosed with a malignant brain tumor. His prognosis is extremely poor survival beyond 18 months is unlikely. Rita is in good health. They have the following children: Their children are healthy and attend school. Tom and Rita own a film production company called Playtone. Tom and Rita want to leave Playtone to their children. The following represents table Tom and Rita's current financial position. Notes to Financial Statements: 1. Assets are stated at fair market value (rounded to even dollars). 2. Liabilities are stated at principal only (rounded to even dollars). 3. The adjusted basis of Playtone is $3,000,000. 4. Inherited Stock Portfolios have children designated as beneficiaries. 5. Property Ownership: a. JTROS - Joint tenancy with right of survivorship (Tom and Rita are joint tenants of all property JTROS). b. TC - tenants in common (assume Tom and Rita are 50/50 tenants in common unless question says otherwise. c. CP community property of Tom and Rita d. H - Tom's separate property. e. W-Rita's separate property. Question 32: Assume that Tom dies December 31, 2022. Calculate the total value of the Tom's assets. Question 33: Assume that Tom dies on December 31, 2022. Calculate the value of assets that will pass through Tom's probate estate. Question 34: Why are the answers to questions 32 and 33 different? Explain. Notes to Financial Statements: 1. Assets are stated at fair market value (rounded to even dollars). 2. Liabilities are stated at principal only (rounded to even dollars). 3. The adjusted basis of Playtone is $3,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts