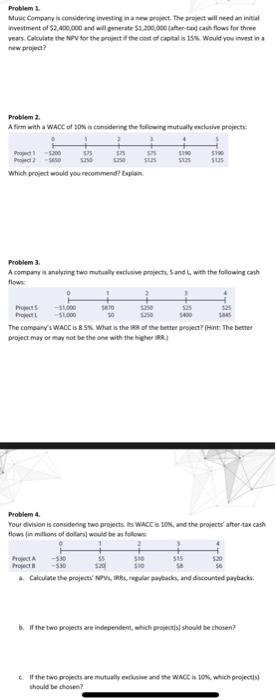

Question: (please answer all questions) Problem 1. Music Company is considering investing new. There will need an initial investment of $2,400,000 and will generate 1.200.000 atau

Problem 1. Music Company is considering investing new. There will need an initial investment of $2,400,000 and will generate 1.200.000 atau cash flows for three yeats. Calculate the NPV for the project if the cost capitals 15 Would you invest na new project? Problem 2. Afirm with a WACC of 30% is considering the following mutually exclusive projects Pro 300 PSD Which project would you recommend F Problem 3. A company is analysing two mutually exclusive projects, Sand, with the following anh flow: Pos-1000 How 0 1 The company's WACC 8.SK What is the of the better print the better project may or may not be the one with the higher Problem 4 your division is considering two projects WACCE 30, and the projects' after tax cash flows in millions of dollars would be as follows PA --530 515 ho -590 500 Calculate the projects, reparacks, and discounted paybacks. b. It the two projects are independent, which project should be chosen? t. If the two projects are mutually excuse and she WACC is 10% which project should be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts