Question: PLEASE ANSWER ALL QUESTIONS Q 5 . On OCT 1 0 , 2 0 2 4 a portfolio manager, PM , observes that the DJIA

PLEASE ANSWER ALL QUESTIONS

Q

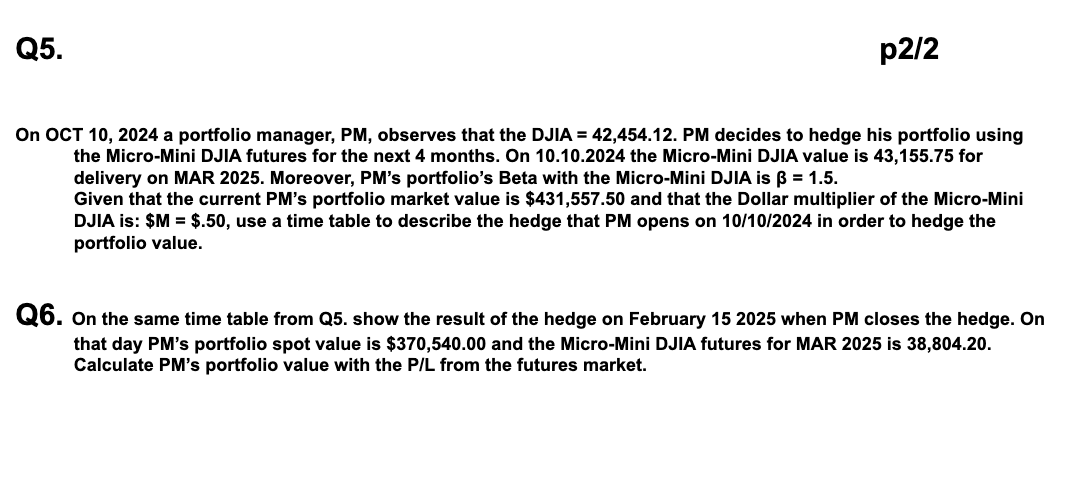

On OCT a portfolio manager, PM observes that the DJIA PM decides to hedge his portfolio using the MicroMini DJIA futures for the next months. On the MicroMini DJIA value is for delivery on MAR Moreover, PMs portfolio's Beta with the MicroMini DJIA is beta

Given that the current PMs portfolio market value is $ and that the Dollar multiplier of the MicroMini DJIA is: $ M$ use a time table to describe the hedge that PM opens on in order to hedge the portfolio value.

Q On the same time table from Q show the result of the hedge on February when PM closes the hedge. On that day PMs portfolio spot value is $ and the MicroMini DJIA futures for MAR is Calculate PMs portfolio value with the PL from the futures market.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock