Question: Please answer all questions QUESTION2 When conducting an impairment test, a company must estimate future cash inflows from its use of the asset and eventual

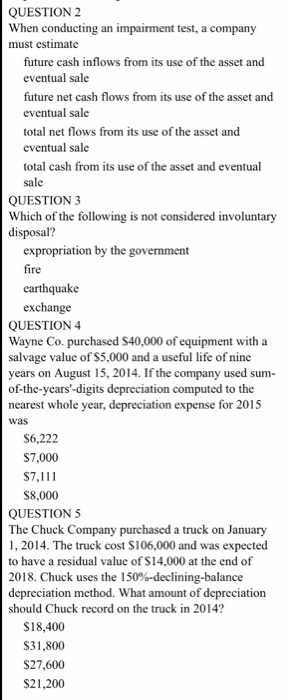

QUESTION2 When conducting an impairment test, a company must estimate future cash inflows from its use of the asset and eventual sale future net cash flows from its use of the asset and eventual sale total net flows from its use of the asset and eventual sale total cash from its use of the asset and eventual sale QUESTION 3 Which of the following is not considered involuntary disposal? expropriation by the government fire earthquake exchange QUESTION 4 Wayne Co. purchased S40,000 of equipment with a salvage value of $5,000 and a useful life of nine years on August 15, 2014. If the company used sum- of-the-years'-digits depreciation computed to the nearest whole year, depreciation expense for 2015 was S6,222 $7,000 S7,111 $8,000 QUESTION 5 The Chuck Company purchased a truck on January 1, 2014. The truck cost S106,000 and was expected to have a residual value of $14,000 at the end of 2018, Chuck uses the 150%-declining-balance depreciation method. What amount of depreciation should Chuck record on the truck in 2014? $18,400 $31,800 $27,600 $21,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts