Question: please answer all questions! Special Order Decision, Alternatives, Relevant Costs Redwood Elegance Company, manufactures wooden coffee tables for sale to specialty furniture stores. Currently, the

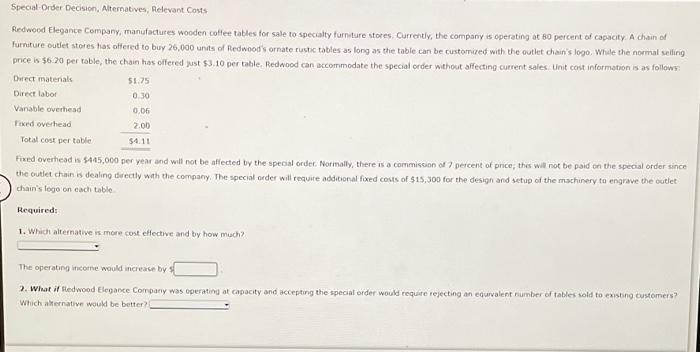

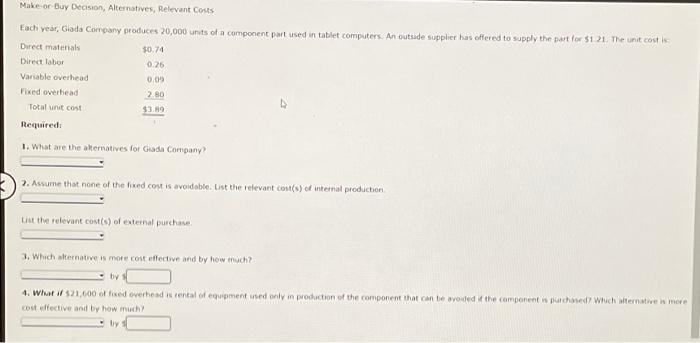

Special Order Decision, Alternatives, Relevant Costs Redwood Elegance Company, manufactures wooden coffee tables for sale to specialty furniture stores. Currently, the company is operating at 80 percent of capacity. A chain of Furniture outlet stores has offered to buy 26,000 units of Redwood's ornate rustic tables as long as the table can be customized with the outlet chain's logo. While the normal selling price is $6.20 per table, the chain has offered just $3.10 per table. Redwood can accommodate the special order without affecting current sales Unit cost information is as follows: Dect matenals $1.75 Direct labor 030 Vanable overhead 0.06 Fixed overhead 2.00 Total cost per table 54.11 Fixed overhead is 5445,000 per year and will not be affected by the special order. Normally, there is a commission of percent of price, this will not be paid on the special order since the outlet chain is dealing directly with the company. The special order will require additional fixed costs of $15,300 for the design and setup of the machinery to engrave the outlet chain's logo on each table Required: 1. Which alternative is more cost effective and by how much The operating income would increase by 2. What if sledwood Elegance Company was operating at capacity and accepting the special order would require rejecting an equivalent number of tables sold to existing customers Which alternative would be better? Make or Buy Decision, Alternatives, Relevant costs Each year, Giada Company produces 20,000 units of a component part used in tablet computers. An outside supplier has offered to supply the part for 512. The unit cost is Direct matenals $0.74 Direct labor 0.26 Variable overhead 0.05 Fixed overhead 2.80 Total unit cost $3.89 Required: 1. What are the alternatives for Glada Company? 2. Assume that none of the fixed cost is avoidable. List the relevant cont(s) of internal production list the relevant costs) of external purchase 3. Which alternative is more cost effective and by how much? by 4. What if 521,600 of fixed overhead rental of equipment used only in production of the component that can be avoided the component is purchased? Whichternative more cost efective and by how much by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts