Question: Please answer all questions, Thank you! 1. 2. 3. 4. 5. 6. Jan sold her house on December 31 and took a $20,000 mortgage as

Please answer all questions, Thank you!

1.

2.

3.

4.

5.

6.

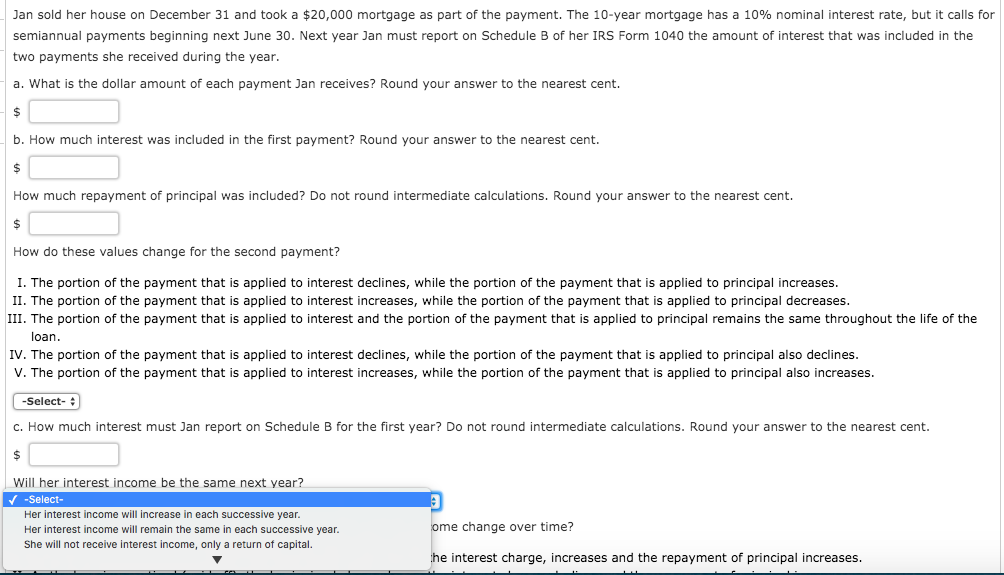

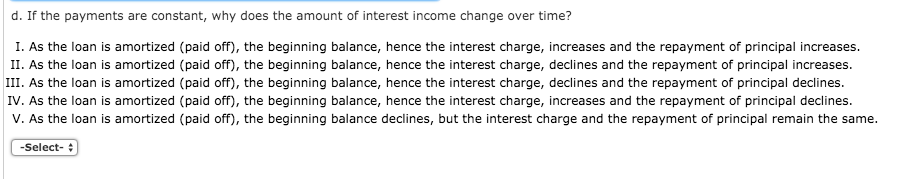

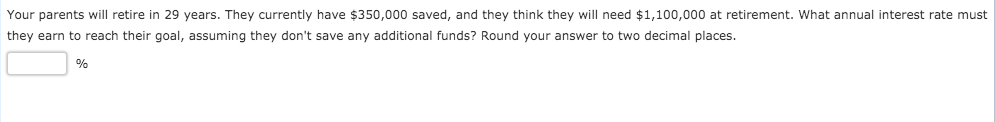

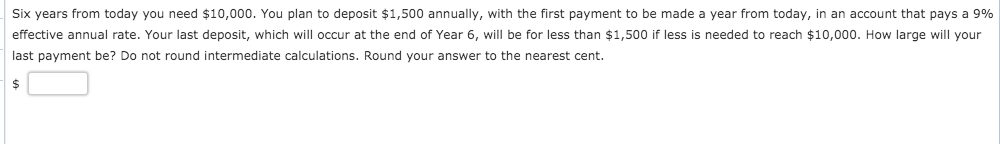

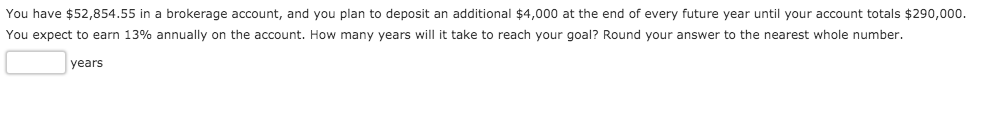

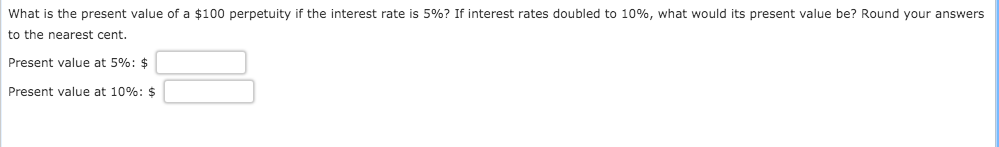

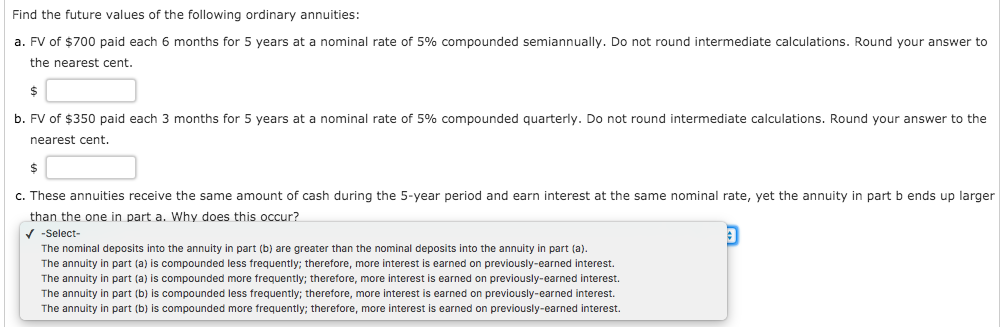

Jan sold her house on December 31 and took a $20,000 mortgage as part of the payment. The 10-year mortgage has a 10% nominal interest rate, but it calls for semiannual payments beginning next June 30. Next year Jan must report on Schedule B of her IRS Form 1040 the amount of interest that was included in the two payments she received during the year. a. What is the dollar amount of each payment Jan receives? Round your answer to the nearest cent. b. How much interest was included in the first payment? Round your answer to the nearest cent. How much repayment of principal was included? Do not round intermediate calculations. Round your answer to the nearest cent. How do these values change for the second payment? I. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal increases. II. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal decreases. III. The portion of the payment that is applied to interest and the portion of the payment that is applied to principal remains the same throughout the life of the loan. IV. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal also declines. V. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal also increases. -Select- c. How much interest must Jan report on Schedule B for the first year? Do not round intermediate calculations. Round your answer to the nearest cent. Will her interest income be the same next year? -Select- Her interest income will increase in each successive year. Her interest income will remain the same in each successive year. She will not receive interest income, only a return of capital. ome change over time? the interest charge, increases and the repayment of principal increases. d. If the payments are constant, why does the amount of interest income change over time? I. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal increases. II. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal increases. III. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal declines. IV. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal declines. V. As the loan is amortized (paid off), the beginning balance declines, but the interest charge and the repayment of principal remain the same. -Select- Your parents will retire in 29 years. They currently have $350,000 saved, and they think they will need $1,100,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places. Six years from today you need $10,000. You plan to deposit $1,500 annually, with the first payment to be made a year from today, in an account that pays a 9% effective annual rate. Your last deposit, which will occur at the end of Year 6, will be for less than $1,500 if less is needed to reach $10,000. How large will your last payment be? Do not round intermediate calculations. Round your answer to the nearest cent. You have $52,854.55 in a brokerage account, and you plan to deposit an additional $4,000 at the end of every future year until your account totals $290,000. You expect to earn 13% annually on the account. How many years will it take to reach your goal? Round your answer to the nearest whole number. years What is the present value of a $100 perpetuity if the interest rate is 5%? If interest rates doubled to 10%, what would its present value be? Round your answers to the nearest cent. Present value at 5%: $ Present value at 10%: $ Find the future values of the following ordinary annuities: a. FV of $700 paid each 6 months for 5 years at a nominal rate of 5% compounded semiannually. Do not round intermediate calculations. Round your answer to the nearest cent. b. FV of $350 paid each 3 months for 5 years at a nominal rate of 5% compounded quarterly. Do not round intermediate calculations. Round your answer to the nearest cent. c. These annuities receive the same amount of cash during the 5-year period and earn interest at the same nominal rate, yet the annuity in part b ends up larger than the one in part a. Why does this occur? -Select- The nominal deposits into the annuity in part (b) are greater than the nominal deposits into the annuity in part (a). The annuity in part (a) is compounded less frequently; therefore, more interest is earned on previously-earned interest. The annuity in part (a) is compounded more frequently; therefore, more interest is earned on previously-earned interest. The annuity in part (b) is compounded less frequently, therefore, more interest is earned on previously-earned interest. The annuity in part (b) is compounded more frequently; therefore, more interest is earned on previously-earned interest. Jan sold her house on December 31 and took a $20,000 mortgage as part of the payment. The 10-year mortgage has a 10% nominal interest rate, but it calls for semiannual payments beginning next June 30. Next year Jan must report on Schedule B of her IRS Form 1040 the amount of interest that was included in the two payments she received during the year. a. What is the dollar amount of each payment Jan receives? Round your answer to the nearest cent. b. How much interest was included in the first payment? Round your answer to the nearest cent. How much repayment of principal was included? Do not round intermediate calculations. Round your answer to the nearest cent. How do these values change for the second payment? I. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal increases. II. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal decreases. III. The portion of the payment that is applied to interest and the portion of the payment that is applied to principal remains the same throughout the life of the loan. IV. The portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal also declines. V. The portion of the payment that is applied to interest increases, while the portion of the payment that is applied to principal also increases. -Select- c. How much interest must Jan report on Schedule B for the first year? Do not round intermediate calculations. Round your answer to the nearest cent. Will her interest income be the same next year? -Select- Her interest income will increase in each successive year. Her interest income will remain the same in each successive year. She will not receive interest income, only a return of capital. ome change over time? the interest charge, increases and the repayment of principal increases. d. If the payments are constant, why does the amount of interest income change over time? I. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal increases. II. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal increases. III. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal declines. IV. As the loan is amortized (paid off), the beginning balance, hence the interest charge, increases and the repayment of principal declines. V. As the loan is amortized (paid off), the beginning balance declines, but the interest charge and the repayment of principal remain the same. -Select- Your parents will retire in 29 years. They currently have $350,000 saved, and they think they will need $1,100,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places. Six years from today you need $10,000. You plan to deposit $1,500 annually, with the first payment to be made a year from today, in an account that pays a 9% effective annual rate. Your last deposit, which will occur at the end of Year 6, will be for less than $1,500 if less is needed to reach $10,000. How large will your last payment be? Do not round intermediate calculations. Round your answer to the nearest cent. You have $52,854.55 in a brokerage account, and you plan to deposit an additional $4,000 at the end of every future year until your account totals $290,000. You expect to earn 13% annually on the account. How many years will it take to reach your goal? Round your answer to the nearest whole number. years What is the present value of a $100 perpetuity if the interest rate is 5%? If interest rates doubled to 10%, what would its present value be? Round your answers to the nearest cent. Present value at 5%: $ Present value at 10%: $ Find the future values of the following ordinary annuities: a. FV of $700 paid each 6 months for 5 years at a nominal rate of 5% compounded semiannually. Do not round intermediate calculations. Round your answer to the nearest cent. b. FV of $350 paid each 3 months for 5 years at a nominal rate of 5% compounded quarterly. Do not round intermediate calculations. Round your answer to the nearest cent. c. These annuities receive the same amount of cash during the 5-year period and earn interest at the same nominal rate, yet the annuity in part b ends up larger than the one in part a. Why does this occur? -Select- The nominal deposits into the annuity in part (b) are greater than the nominal deposits into the annuity in part (a). The annuity in part (a) is compounded less frequently; therefore, more interest is earned on previously-earned interest. The annuity in part (a) is compounded more frequently; therefore, more interest is earned on previously-earned interest. The annuity in part (b) is compounded less frequently, therefore, more interest is earned on previously-earned interest. The annuity in part (b) is compounded more frequently; therefore, more interest is earned on previously-earned interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts