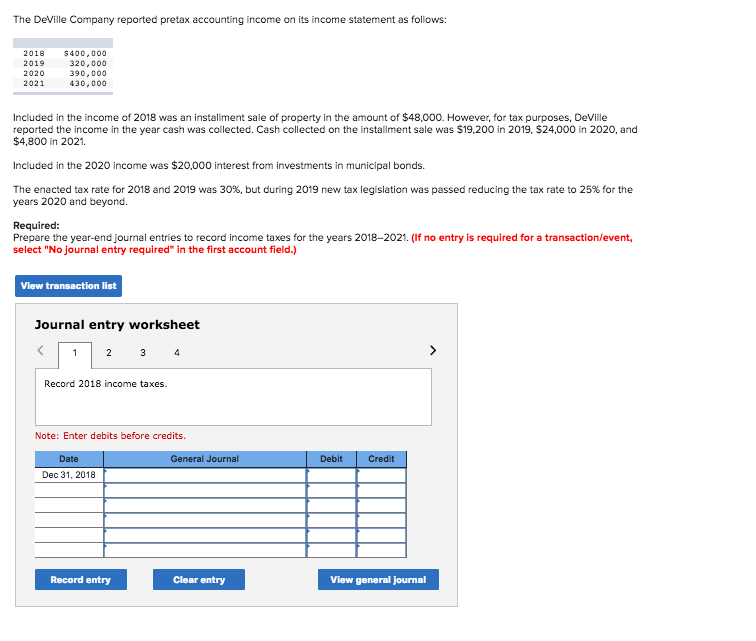

Question: Please Answer All questions The DeVille Company reported pretax accounting income on its income statement as follows: 2018 2019 2020 2021 $400,00o 320,000 390,000 430,000

Please Answer All questions

The DeVille Company reported pretax accounting income on its income statement as follows: 2018 2019 2020 2021 $400,00o 320,000 390,000 430,000 Included in the income of 2018 was an installment sale of property in the amount of $48,000. However, for tax purposes, DeVille reported the income in the year cash was collected. Cash collected on the installment sale was $19,200 in 2019, $24,000 in 2020, and $4,800 in 2021 Included in the 2020 income was $20,000 interest from investments in municipal bonds. The enacted tax rate for 2018 and 2019 was 30%, but during 2019 new tax legislation was passed reducing the tax rate to 25% for the years 2020 and beyond. Required: Prepare the year-end journal entries to record income taxes for the years 2018-2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list ournal entry worksheet Record 2018 income taxes. Note: Enter debits before credits. Debit Credit Date Dec 31, 2018 General J Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts