Question: PLEASE ANSWER ALL QUESTIONS; THEY ARE FORMATTED AS SUB QUESTIONS AND I CANNOT MOVE ON WITHOUT ALL ANSWERED!!! The current 1-year bond and 2-year bond

PLEASE ANSWER ALL QUESTIONS; THEY ARE FORMATTED AS SUB QUESTIONS AND I CANNOT MOVE ON WITHOUT ALL ANSWERED!!!

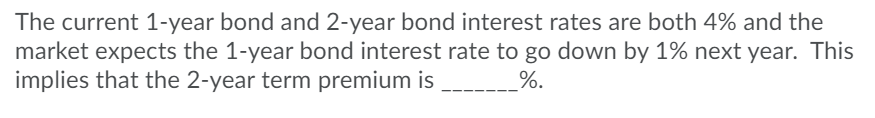

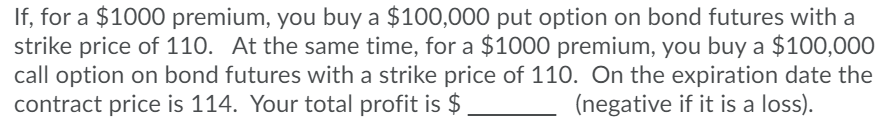

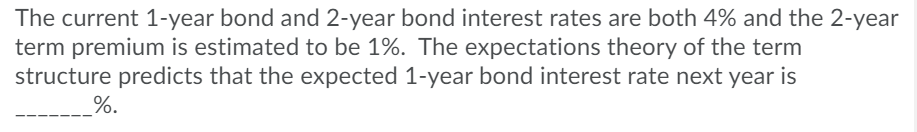

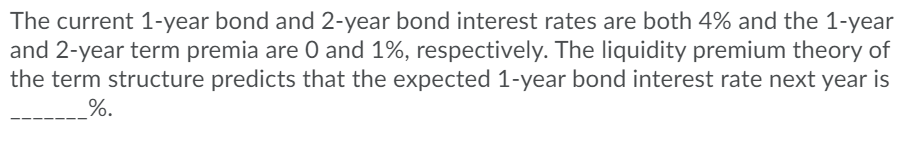

The current 1-year bond and 2-year bond interest rates are both 4% and the market expects the 1-year bond interest rate to go down by 1% next year. This implies that the 2-year term premium is %. If, for a $1000 premium, you buy a $100,000 put option on bond futures with a strike price of 110. At the same time, for a $1000 premium, you buy a $100,000 call option on bond futures with a strike price of 110. On the expiration date the contract price is 114. Your total profit is $ (negative if it is a loss). The current 1-year bond and 2-year bond interest rates are both 4% and the 2-year term premium is estimated to be 1%. The expectations theory of the term structure predicts that the expected 1-year bond interest rate next year is %. The current 1-year bond and 2-year bond interest rates are both 4% and the 1-year and 2-year term premia are 0 and 1%, respectively. The liquidity premium theory of the term structure predicts that the expected 1-year bond interest rate next year is %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts