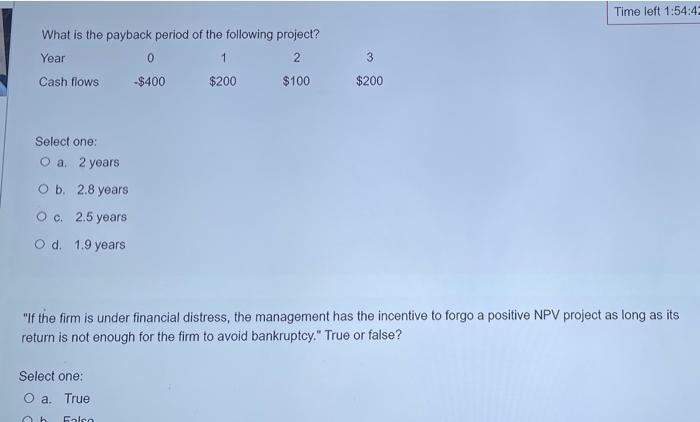

Question: please answer all questions Time left 1:54:4: What is the payback period of the following project? Year 0 1 2 Cash flows -$400 $200 $100

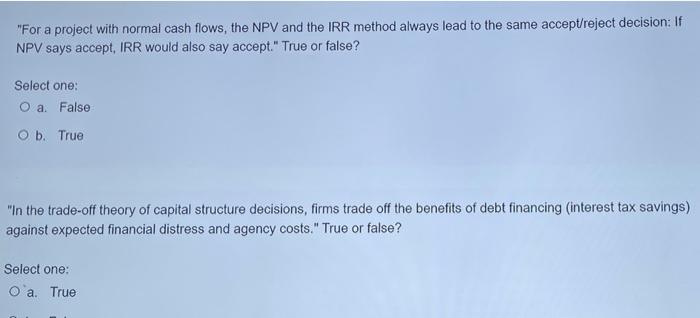

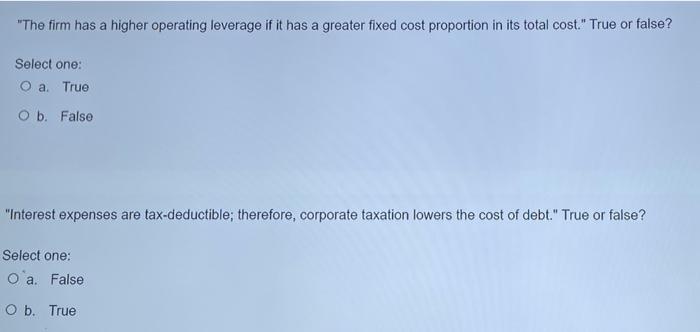

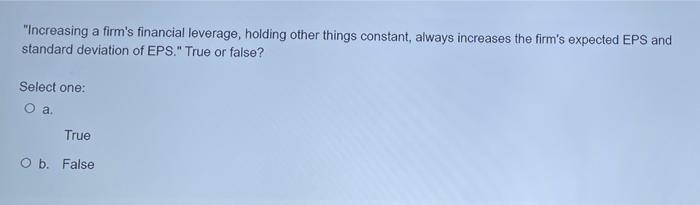

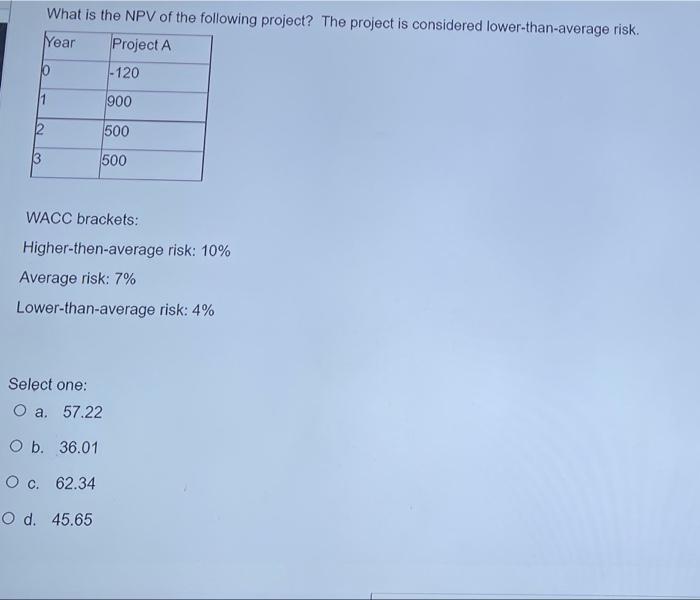

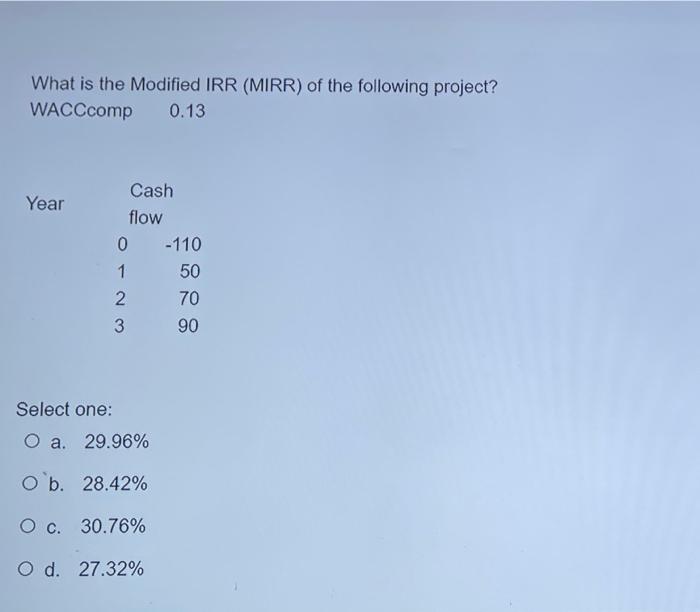

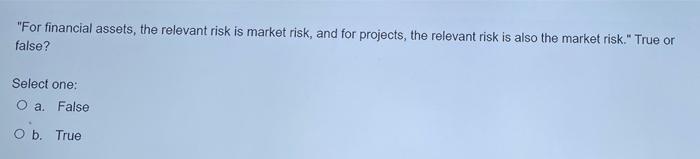

Time left 1:54:4: What is the payback period of the following project? Year 0 1 2 Cash flows -$400 $200 $100 $200 Select one: O a. 2 years Ob. 2.8 years O c. 2.5 years O d. 1.9 years "If the firm is under financial distress, the management has the incentive to forgo a positive NPV project as long as its return is not enough for the firm to avoid bankruptcy." True or false? Select one: O a. True Salsa "For a project with normal cash flows, the NPV and the IRR method always lead to the same accept/reject decision: If NPV says accept, IRR would also say accept." True or false? Select one: O a. False O b. True "In the trade-off theory of capital structure decisions, firms trade off the benefits of debt financing (interest tax savings) against expected financial distress and agency costs." True or false? Select one: O a. True "The firm has a higher operating leverage if it has a greater fixed cost proportion in its total cost." True or false? Select one: O a True Ob False "Interest expenses are tax-deductible; therefore, corporate taxation lowers the cost of debt." True or false? Select one: O a. False O b. True "Increasing a firm's financial leverage, holding other things constant, always increases the firm's expected EPS and standard deviation of EPS." True or false? Select one: a. True O b. False What is the NPV of the following project? The project is considered lower-than-average risk. Year Project A 10 -120 900 500 3 500 WACC brackets: Higher-then-average risk: 10% Average risk: 7% Lower-than-average risk: 4% Select one: O a. 57.22 O b. 36.01 O c. 62.34 O d. 45.65 What is the Modified IRR (MIRR) of the following project? WACCcomp 0.13 Year Cash flow 0 -110 1 50 2 3 90 70 WN Select one: O a. 29.96% Ob. 28.42% O c. 30.76% O d. 27.32% "For financial assets, the relevant risk is market risk, and for projects, the relevant risk is also the market risk." True or false? Select one: O a False O b. True Time left 1:54:4: What is the payback period of the following project? Year 0 1 2 Cash flows -$400 $200 $100 $200 Select one: O a. 2 years Ob. 2.8 years O c. 2.5 years O d. 1.9 years "If the firm is under financial distress, the management has the incentive to forgo a positive NPV project as long as its return is not enough for the firm to avoid bankruptcy." True or false? Select one: O a. True Salsa "For a project with normal cash flows, the NPV and the IRR method always lead to the same accept/reject decision: If NPV says accept, IRR would also say accept." True or false? Select one: O a. False O b. True "In the trade-off theory of capital structure decisions, firms trade off the benefits of debt financing (interest tax savings) against expected financial distress and agency costs." True or false? Select one: O a. True "The firm has a higher operating leverage if it has a greater fixed cost proportion in its total cost." True or false? Select one: O a True Ob False "Interest expenses are tax-deductible; therefore, corporate taxation lowers the cost of debt." True or false? Select one: O a. False O b. True "Increasing a firm's financial leverage, holding other things constant, always increases the firm's expected EPS and standard deviation of EPS." True or false? Select one: a. True O b. False What is the NPV of the following project? The project is considered lower-than-average risk. Year Project A 10 -120 900 500 3 500 WACC brackets: Higher-then-average risk: 10% Average risk: 7% Lower-than-average risk: 4% Select one: O a. 57.22 O b. 36.01 O c. 62.34 O d. 45.65 What is the Modified IRR (MIRR) of the following project? WACCcomp 0.13 Year Cash flow 0 -110 1 50 2 3 90 70 WN Select one: O a. 29.96% Ob. 28.42% O c. 30.76% O d. 27.32% "For financial assets, the relevant risk is market risk, and for projects, the relevant risk is also the market risk." True or false? Select one: O a False O b. True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts