Question: Please answer all questions to a, b, c and d! Thank you!! Problem 3 - Investments in Securities On January 1, 20x2, HIGHTOP invested cash

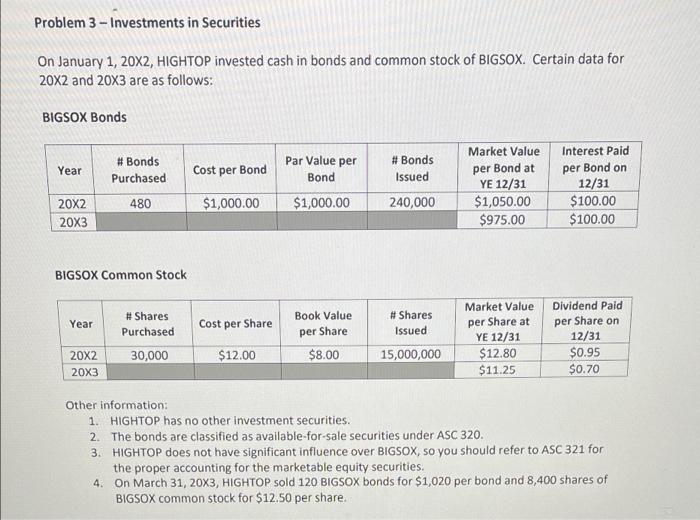

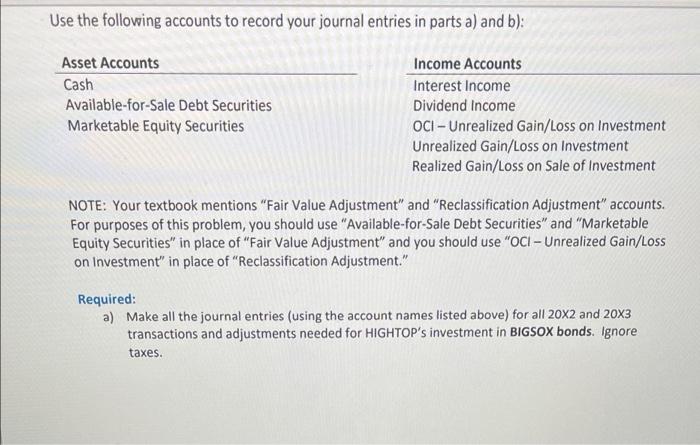

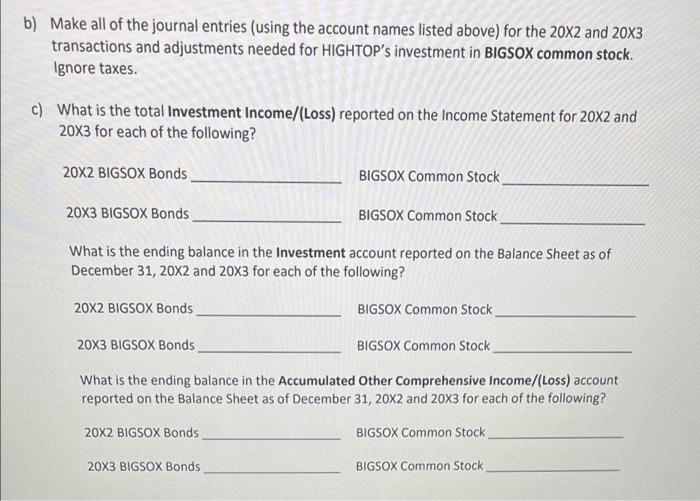

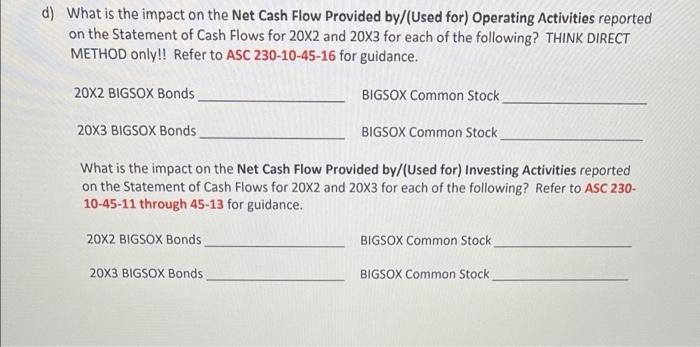

Problem 3 - Investments in Securities On January 1, 20x2, HIGHTOP invested cash in bonds and common stock of BIGSOX. Certain data for 20x2 and 20x3 are as follows: BIGSOX Bonds Year # Bonds Purchased Cost per Bond Par Value per Bond # Bonds Issued Market Value per Bond at YE 12/31 $1,050.00 $975.00 Interest Paid per Bond on 12/31 $100.00 $100.00 480 $1,000.00 $1,000.00 20X2 20X3 240,000 BIGSOX Common Stock Year Cost per Share # Shares Purchased 30,000 Book Value per Share # Shares Issued Market Value per Share at YE 12/31 $12.80 $11.25 Dividend Paid per Share on 12/31 $0.95 $0.70 $12.00 $8.00 15,000,000 20X2 20x3 Other information: 1. HIGHTOP has no other investment securities. 2. The bonds are classified as available for sale securities under ASC 320. 3. HIGHTOP does not have significant influence over BIGSOX, so you should refer to ASC 321 for the proper accounting for the marketable equity securities. 4. On March 31, 20X3, HIGHTOP sold 120 BIGSOX bonds for $1,020 per bond and 8,400 shares of BIGSOX common stock for $12.50 per share. Use the following accounts to record your journal entries in parts a) and b): Asset Accounts Cash Available for Sale Debt Securities Marketable Equity Securities Income Accounts Interest Income Dividend Income OCI - Unrealized Gain/Loss on Investment Unrealized Gain/Loss on Investment Realized Gain/Loss on Sale of Investment NOTE: Your textbook mentions "Fair Value Adjustment" and "Reclassification Adjustment" accounts. For purposes of this problem, you should use "Available-for-Sale Debt Securities" and "Marketable Equity Securities" in place of "Fair Value Adjustment" and you should use "OCI - Unrealized Gain/Loss on Investment" in place of "Reclassification Adjustment." Required: a) Make all the journal entries (using the account names listed above) for all 20x2 and 20x3 transactions and adjustments needed for HIGHTOP's investment in BIGSOX bonds. Ignore taxes. b) Make all of the journal entries (using the account names listed above) for the 20x2 and 20x3 transactions and adjustments needed for HIGHTOP's investment in BIGSOX common stock. Ignore taxes. c) What is the total Investment Income/(Loss) reported on the Income Statement for 20x2 and 20x3 for each of the following? 20x2 BIGSOX Bonds BIGSOX Common Stock 20X3 BIGSOX Bonds BIGSOX Common Stock What is the ending balance in the Investment account reported on the Balance Sheet as of December 31, 20x2 and 20x3 for each of the following? 20X2 BIGSOX Bonds BIGSOX Common Stock 20x3 BIGSOX Bonds BIGSOX Common Stock What is the ending balance in the Accumulated Other Comprehensive Income/(Loss) account reported on the Balance Sheet as of December 31, 20x2 and 20x3 for each of the following? 20X2 BIGSOX Bonds BIGSOX Common Stock 20x3 BIGSOX Bonds BIGSOX Common Stock d) What is the impact on the Net Cash Flow Provided by/(Used for) Operating Activities reported on the Statement of Cash Flows for 20x2 and 20x3 for each of the following? THINK DIRECT METHOD only!! Refer to ASC 230-10-45-16 for guidance. 20X2 BIGSOX Bonds BIGSOX Common Stock 20X3 BIGSOX Bonds BIGSOX Common Stock What is the impact on the Net Cash Flow Provided by/(Used for) Investing Activities reported on the Statement of Cash Flows for 20x2 and 20x3 for each of the following? Refer to ASC 230- 10-45-11 through 45-13 for guidance. 20X2 BIGSOX Bonds BIGSOX Common Stock 20X3 BIGSOX Bonds BIGSOX Common Stock Problem 3 - Investments in Securities On January 1, 20x2, HIGHTOP invested cash in bonds and common stock of BIGSOX. Certain data for 20x2 and 20x3 are as follows: BIGSOX Bonds Year # Bonds Purchased Cost per Bond Par Value per Bond # Bonds Issued Market Value per Bond at YE 12/31 $1,050.00 $975.00 Interest Paid per Bond on 12/31 $100.00 $100.00 480 $1,000.00 $1,000.00 20X2 20X3 240,000 BIGSOX Common Stock Year Cost per Share # Shares Purchased 30,000 Book Value per Share # Shares Issued Market Value per Share at YE 12/31 $12.80 $11.25 Dividend Paid per Share on 12/31 $0.95 $0.70 $12.00 $8.00 15,000,000 20X2 20x3 Other information: 1. HIGHTOP has no other investment securities. 2. The bonds are classified as available for sale securities under ASC 320. 3. HIGHTOP does not have significant influence over BIGSOX, so you should refer to ASC 321 for the proper accounting for the marketable equity securities. 4. On March 31, 20X3, HIGHTOP sold 120 BIGSOX bonds for $1,020 per bond and 8,400 shares of BIGSOX common stock for $12.50 per share. Use the following accounts to record your journal entries in parts a) and b): Asset Accounts Cash Available for Sale Debt Securities Marketable Equity Securities Income Accounts Interest Income Dividend Income OCI - Unrealized Gain/Loss on Investment Unrealized Gain/Loss on Investment Realized Gain/Loss on Sale of Investment NOTE: Your textbook mentions "Fair Value Adjustment" and "Reclassification Adjustment" accounts. For purposes of this problem, you should use "Available-for-Sale Debt Securities" and "Marketable Equity Securities" in place of "Fair Value Adjustment" and you should use "OCI - Unrealized Gain/Loss on Investment" in place of "Reclassification Adjustment." Required: a) Make all the journal entries (using the account names listed above) for all 20x2 and 20x3 transactions and adjustments needed for HIGHTOP's investment in BIGSOX bonds. Ignore taxes. b) Make all of the journal entries (using the account names listed above) for the 20x2 and 20x3 transactions and adjustments needed for HIGHTOP's investment in BIGSOX common stock. Ignore taxes. c) What is the total Investment Income/(Loss) reported on the Income Statement for 20x2 and 20x3 for each of the following? 20x2 BIGSOX Bonds BIGSOX Common Stock 20X3 BIGSOX Bonds BIGSOX Common Stock What is the ending balance in the Investment account reported on the Balance Sheet as of December 31, 20x2 and 20x3 for each of the following? 20X2 BIGSOX Bonds BIGSOX Common Stock 20x3 BIGSOX Bonds BIGSOX Common Stock What is the ending balance in the Accumulated Other Comprehensive Income/(Loss) account reported on the Balance Sheet as of December 31, 20x2 and 20x3 for each of the following? 20X2 BIGSOX Bonds BIGSOX Common Stock 20x3 BIGSOX Bonds BIGSOX Common Stock d) What is the impact on the Net Cash Flow Provided by/(Used for) Operating Activities reported on the Statement of Cash Flows for 20x2 and 20x3 for each of the following? THINK DIRECT METHOD only!! Refer to ASC 230-10-45-16 for guidance. 20X2 BIGSOX Bonds BIGSOX Common Stock 20X3 BIGSOX Bonds BIGSOX Common Stock What is the impact on the Net Cash Flow Provided by/(Used for) Investing Activities reported on the Statement of Cash Flows for 20x2 and 20x3 for each of the following? Refer to ASC 230- 10-45-11 through 45-13 for guidance. 20X2 BIGSOX Bonds BIGSOX Common Stock 20X3 BIGSOX Bonds BIGSOX Common Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts