Question: please answer all questions True and false questions 2. 3. 4. For income tax purposes, improvements made by a lessee (tenant) are income to the

please answer all questions

True and false questions

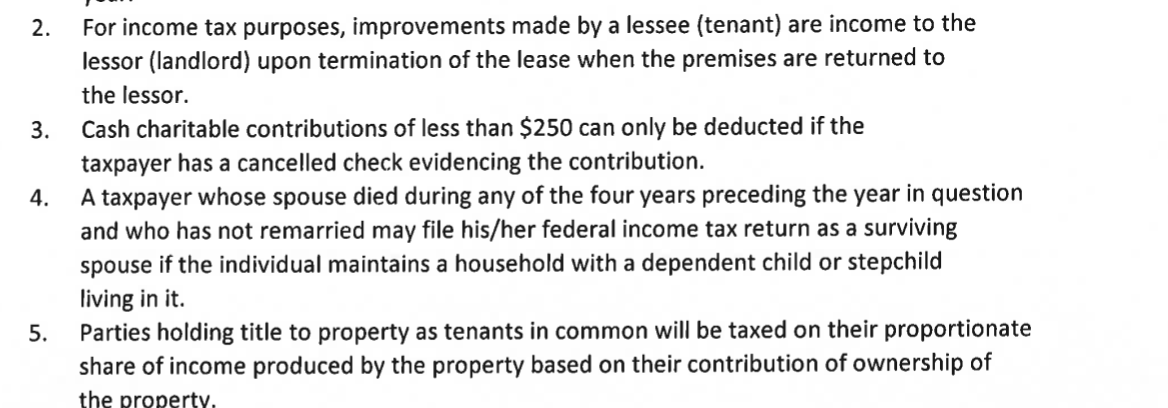

2. 3. 4. For income tax purposes, improvements made by a lessee (tenant) are income to the lessor (landlord) upon termination of the lease when the premises are returned to the lessor. Cash charitable contributions of less than $250 can only be deducted if the taxpayer has a cancelled check evidencing the contribution. A taxpayer whose spouse died during any of the four years preceding the year in question and who has not remarried may file his/her federal income tax return as a surviving spouse if the individual maintains a household with a dependent child or stepchild living in it. Parties holding title to property as tenants in common will be taxed on their proportionate share of income produced by the property based on their contribution of ownership of the property. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts