Question: PLEASE ANSWER ALL QUESTIONS Use Apple's financial statements in Appendix A to answer the following. 1. Identify the total amount of cash and cash equivalents

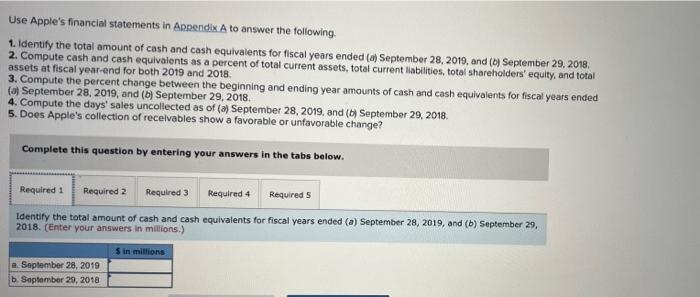

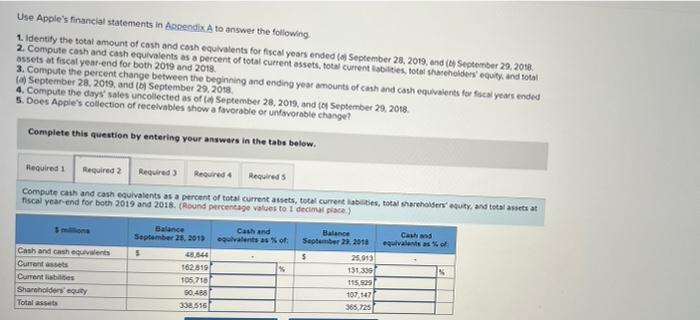

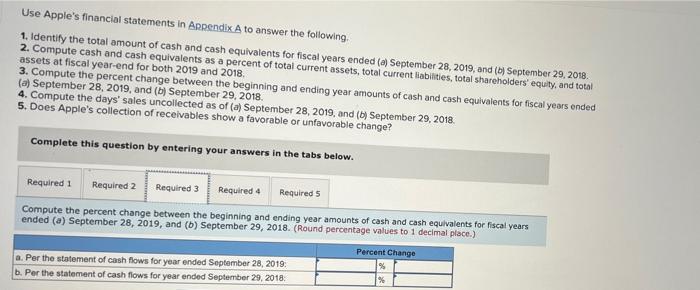

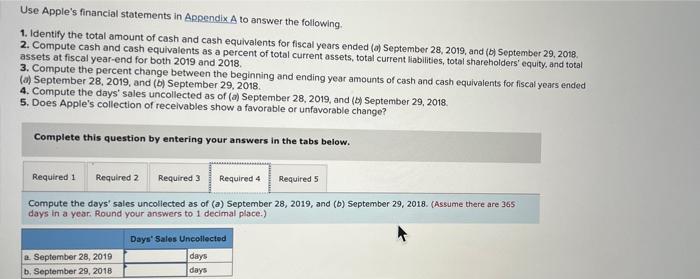

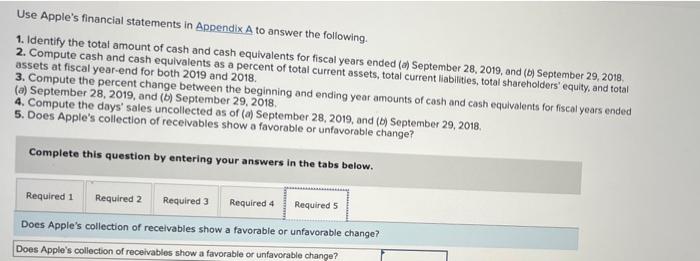

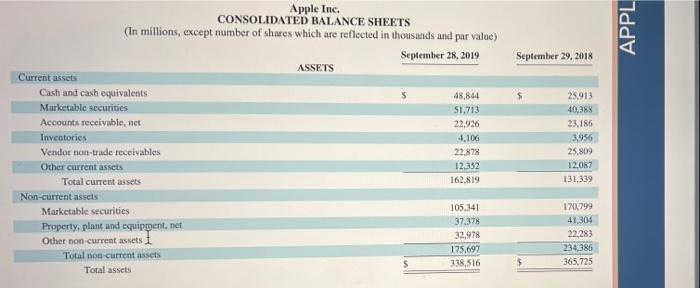

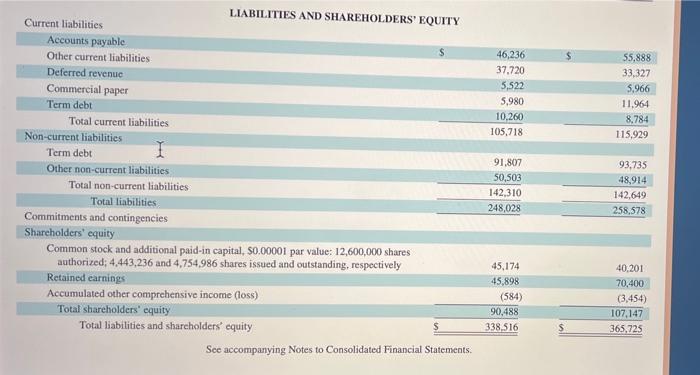

Use Apple's financial statements in Appendix A to answer the following. 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. (Enter your answers in millions.) $ in millions a. September 28, 2019 b. September 29, 2018 Use Apple's financial statements in Appendix A to answer the following. 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (0) September 29, 2018 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (2) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. (Round percentage values to 1 decimal place.) 5 millions Balance September 25, 2019 Cash and equivalents as % of Cash and equivalents as % of Balance September 29, 2018 $ Cash and cash equivalents S 48,044 25,913 Current assets 162.819 % 131,339 11% Current liabilities 105,718 115,929 Shareholders' equity 90,488 107,147 Total assets 338.516 365,725 Use Apple's financial statements in Appendix A to answer the following. 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018, 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. (Round percentage values to 1 decimal place.) Percent Change a. Per the statement of cash flows for year ended September 28, 2019: b. Per the statement of cash flows for year ended September 29, 2018: Use Apple's financial statements in Appendix A to answer the following. 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. (Assume there are 365 days in a year. Round your answers to 1 decimal place.) Days' Sales Uncollected a. September 28, 2019 days b. September 29, 2018 days Use Apple's financial statements in Appendix A to answer the following. 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 28, 2019, and (b) September 29, 2018, 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2019 and 2018. ended 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years (a) September 28, 2019, and (b) September 29, 2018. 4. Compute the days' sales uncollected as of (a) September 28, 2019, and (b) September 29, 2018. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Does Apple's collection of receivables show a favorable or unfavorable change? Does Apple's collection of receivables show a favorable or unfavorable change? Current assets Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 28, 2019 ASSETS S 48,844 51,713 22,926 4,106 22,878 12,352 162,819 105,341 37,378 32,978 175,697 338,516 Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets Non-current assets Marketable securities Property, plant and equipment, net Other non-current assets t Total non-current assets Total assets September 29, 2018 $ 25,913 40,388 23,186 3,956 25,809 12,087 131,339 170,799 41,304 22,283 234,386 365,725 APPL Current liabilities Accounts payable LIABILITIES AND SHAREHOLDERS' EQUITY Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities Non-current liabilities Term debt Other non-current liabilities Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 4,443,236 and 4,754,986 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and shareholders' equity Total non-current liabilities Total liabilities See accompanying Notes to Consolidated Financial Statements. 46,236 37,720 5,522 5,980 10,260 105,718 91,807 50,503 142,310 248,028 45,174 45,898 (584) 90,488 338,516 55,888 33,327 5,966 11,964 8,784 115,929 93,735 48,914 142,649 258,578 40,201 70,400 (3,454) 107,147 365,725

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts