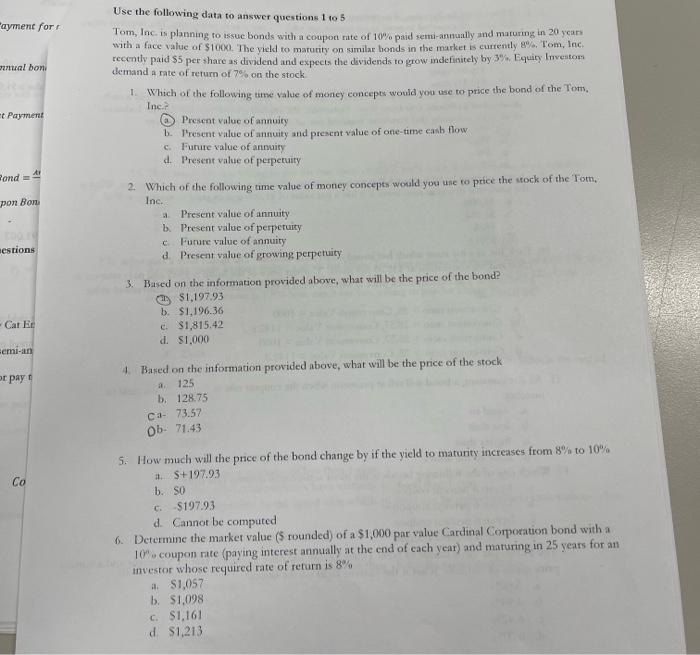

Question: Please answer ALL questions. Use the following data to answer questions 1 to 5 Tom, Inc is planning to issuc bonds with a coupon rite

Use the following data to answer questions 1 to 5 Tom, Inc is planning to issuc bonds with a coupon rite of 10% paid semi-annually and maturing in 20 ycar with a face value of $10(0). The yeld to maturity on similar bonds in the market is currently 8%. Fom, Inc. recently paid $5 per share as dividend and expects the dividends to grow indefinitely by 3%. Equity Inveatom demand a nate of return of 7% on the stock 1. Which of the following time value of money eoncepts would you use to price the bond of the Toms. Inc.? (a) Present valuc of annuity b. Present value of annuity and present value of one-time easb flow c. Furure value of annuisy d. Present value of perperuity 2. Which of the following time value of money concepes wosld you uie to price the sock of the Tom, Inc. a. Present value of annuity b. Present value of perperuity c. Furure value of annuity d. Present value of growing perpetuity 3. Based on the information provided above, what will be the price of the bond? (i7) $1,197.93 b. 51,196.36 c. $1,815,42 d. $1,000 4. Based on the information provided above, what will be the price of the stock a. 125 b. 128.75 ca- 73.57 ob- 71.43 5. How much will the price of the bond change by if the yield to maturity increases from 8% to 10% a. $+197.93 b. SO c. $197.93 d. Cannot be computed 6. Determme the market value ( $ rounded) of a $1,000 par value Cardinal Comporation bond with a 10mo coupon rite (paying interest annually at the end of cach year) and maturing in 25 years for an imvestor whose required rate of retarn is 8% a. $1,057 b. 51,098 c. 51,161 d 51,213

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts