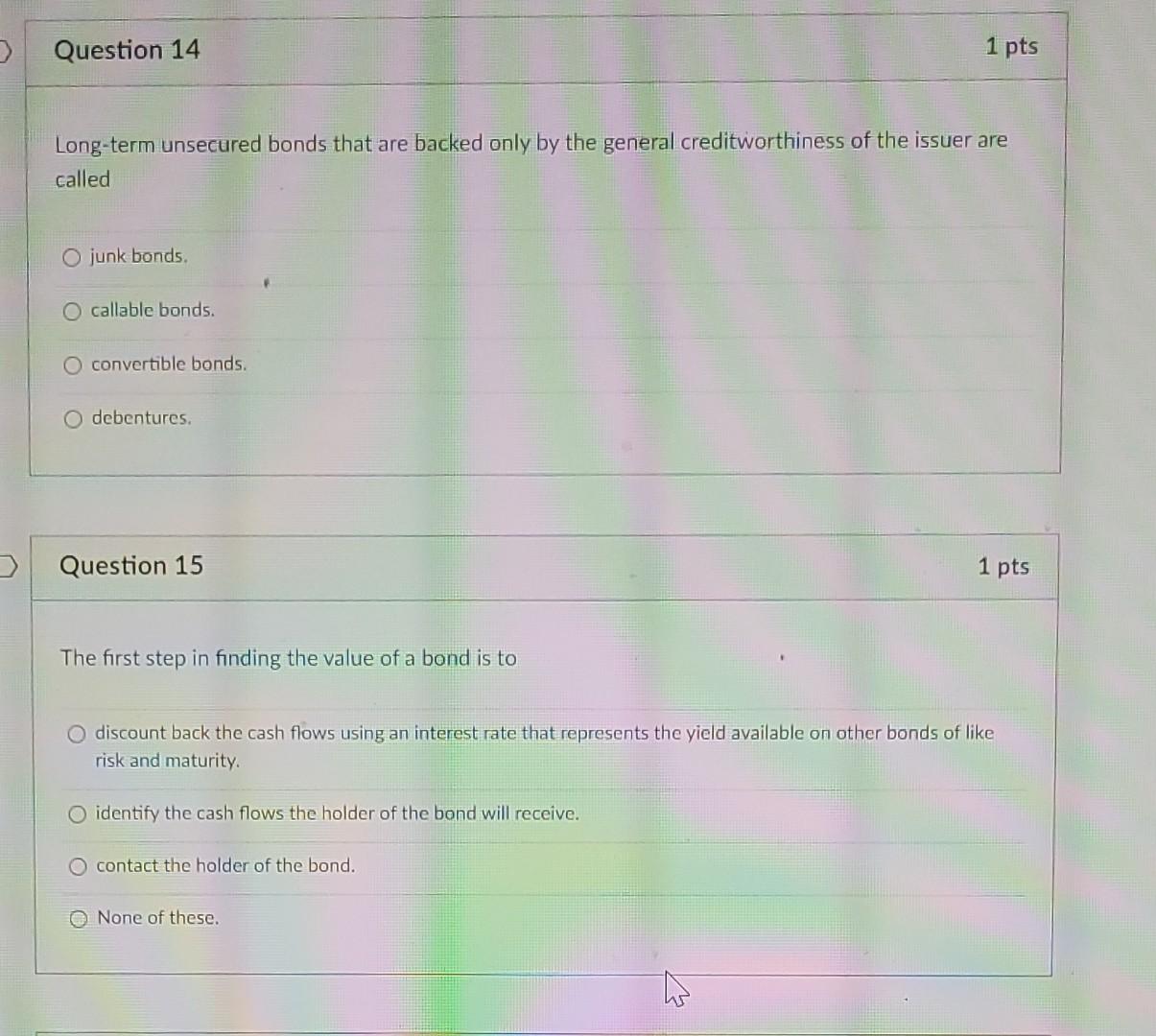

Question: please answer all questions - will give thumbs up Long-term unsecured bonds that are backed only by the general creditworthiness of the issuer are called

please answer all questions - will give thumbs up

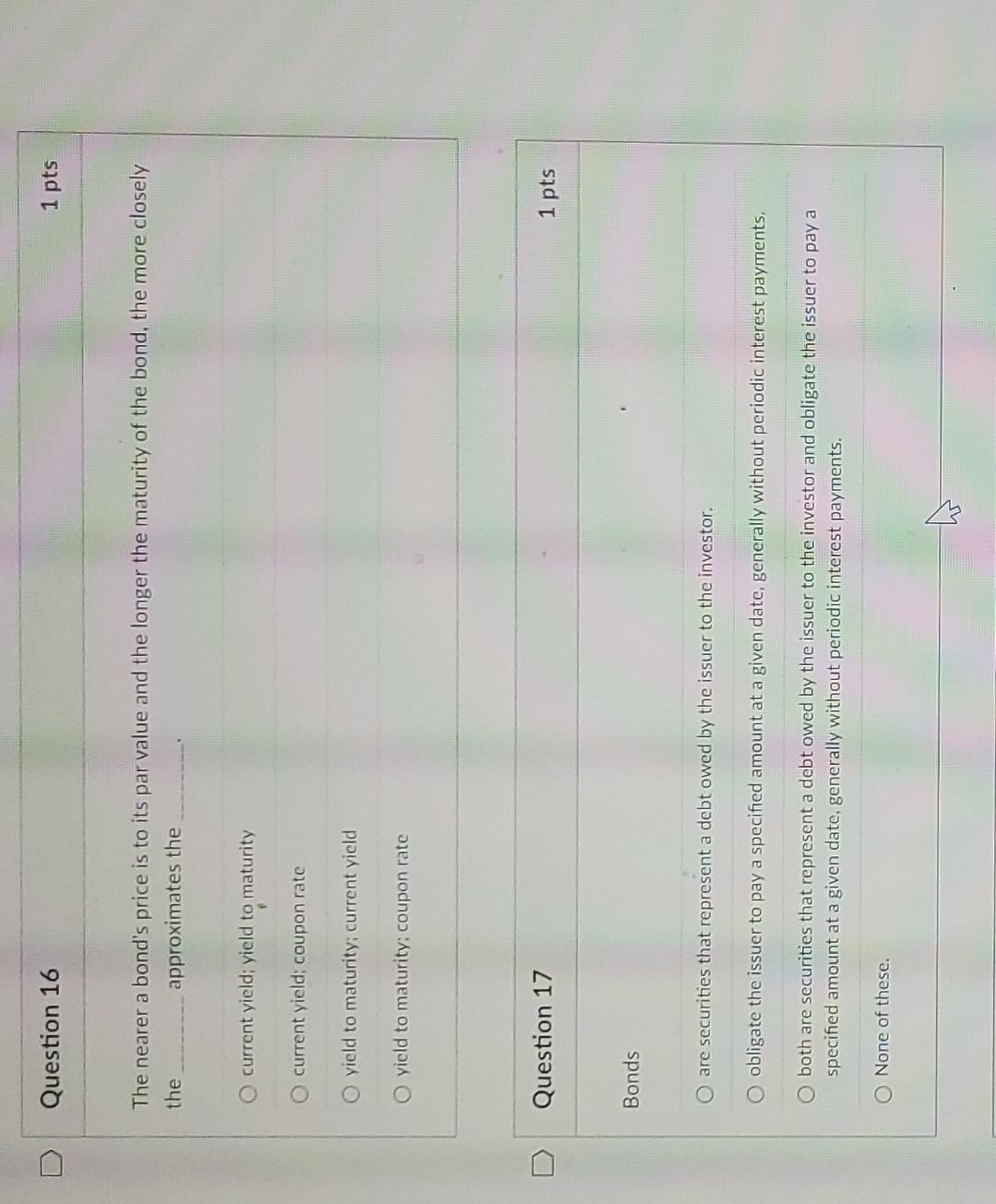

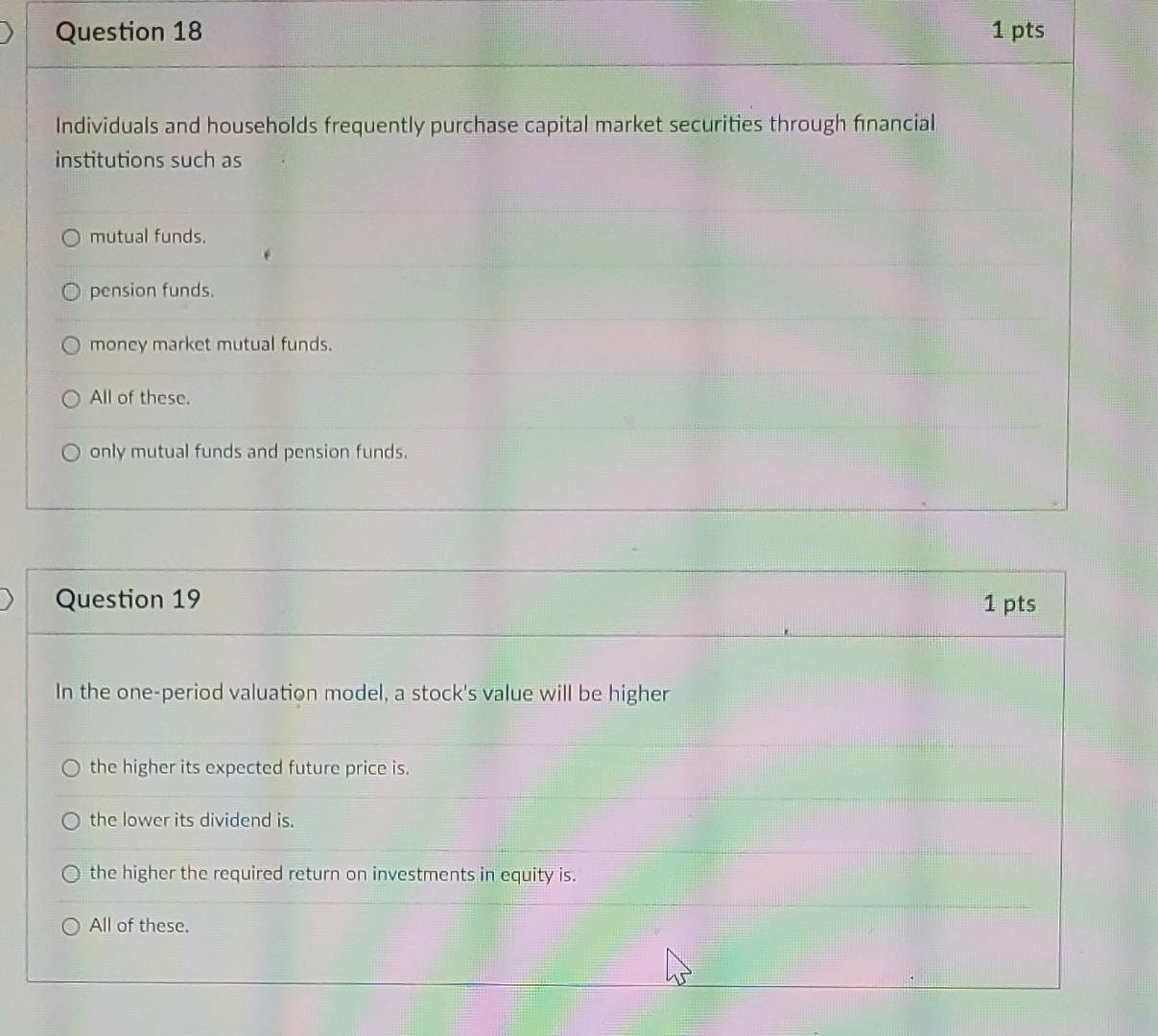

Long-term unsecured bonds that are backed only by the general creditworthiness of the issuer are called junk bonds. callable bonds. convertible bonds. debentures. Question 15 1pts The first step in finding the value of a bond is to discount back the cash flows using an interest rate that represents the yield available on other bonds of like risk and maturity. identify the cash flows the holder of the bond will receive. contact the holder of the bond. None of these. current yield; yield to maturity current yield: coupon rate yield to maturity; current yicld yicld to maturity; coupon rate Question 17 1pts Bonds are securities that represent a debt owed by the issuer to the investor. obligate the issuer to pay a specified amount at a given date, generally without periodic interest payments. both are securities that represent a debt owed by the issuer to the investor and obligate the issuer to pay a specified amount at a given date, generally without periodic interest payments. None of these. Individuals and households frequently purchase capital market securities through financial institutions such as mutual funds. pension funds. moncy market mutual funds. All of these. only mutual funds and pension funds. Question 19 1 pts In the one-period valuation model, a stock's value will be higher the higher its expected future price is. the lower its dividend is. the higher the required return on investments in equity is. All of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts