Question: Please answer all questions! will thumbs up if right! 27. The end of year stock price and the dividend paid each year for Maxwell, Inc.

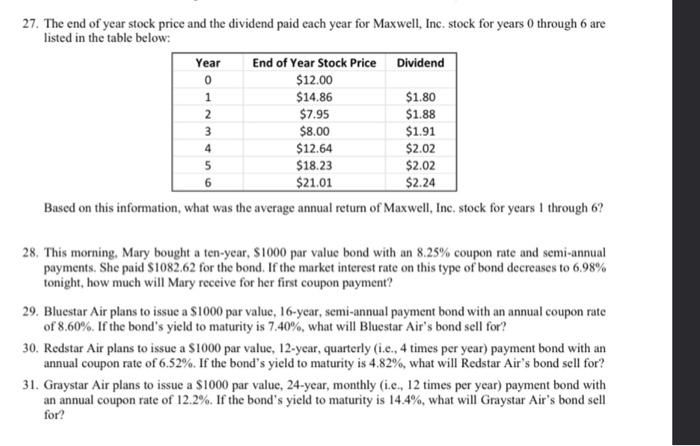

27. The end of year stock price and the dividend paid each year for Maxwell, Inc. stock for years 0 through 6 are listed in the table below: Based on this information, what was the average annual return of Maxwell, Inc. stock for years 1 through 6 ? 28. This morning, Mary bought a ten-year, $1000 par value bond with an 8.25% coupon rate and semi-annual payments. She paid $1082.62 for the bond. If the market interest rate on this type of bond decreases to 6.98% tonight, how much will Mary receive for her first coupon payment? 29. Bluestar Air plans to issue a $1000 par value, 16-year, semi-annual payment bond with an annual coupon rate of 8.60%. If the bond's yield to maturity is 7.40%, what will Bluestar Air's bond sell for? 30. Redstar Air plans to issue a $1000 par value, 12-year, quarterly (i.e., 4 times per year) payment bond with an annual coupon rate of 6.52%. If the bond's yield to maturity is 4.82%, what will Redstar Air's bond sell for? 31. Graystar Air plans to issue a $1000 par value, 24 -year, monthly (i.e., 12 times per year) payment bond with an annual coupon rate of 12.2%. If the bond's yield to maturity is 14.4%, what will Graystar Air's bond sell for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts