Question: PLEASE ANSWER ALL QUESTIONS!!! WILL UP VOTE PART B only A project has annual cash flows of $3,500 for the next 10 years and then

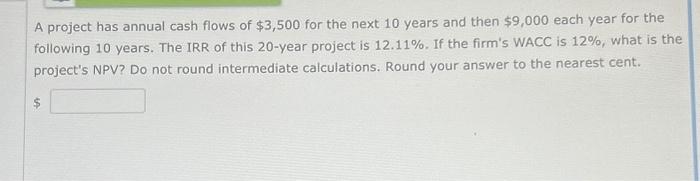

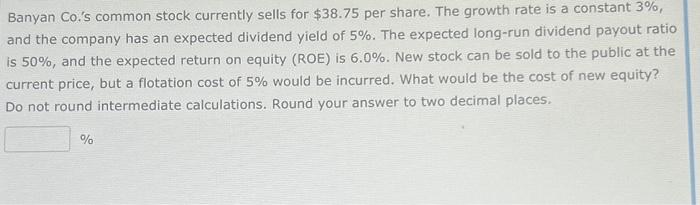

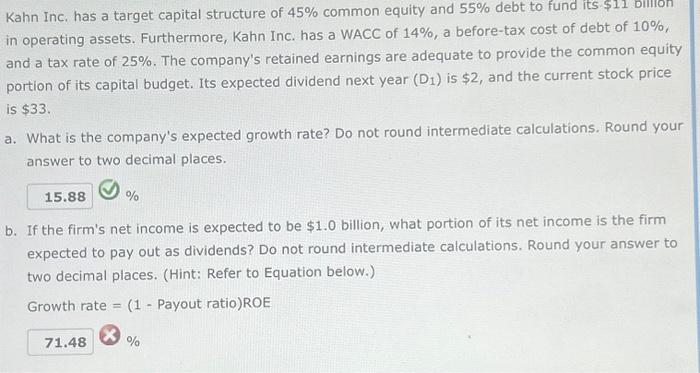

A project has annual cash flows of $3,500 for the next 10 years and then $9,000 each year for the following 10 years. The IRR of this 20 -year project is 12.11%. If the firm's WACC is 12%, what is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $ Banyan Co.'s common stock currently sells for $38.75 per share. The growth rate is a constant 3%, and the company has an expected dividend yield of 5%. The expected long-run dividend payout ratio is 50%, and the expected return on equity (ROE) is 6.0%. New stock can be sold to the public at the current price, but a flotation cost of 5% would be incurred. What would be the cost of new equity? Do not round intermediate calculations. Round your answer to two decimal places. % Kahn Inc. has a target capital structure of 45% common equity and 55% debt to fund its $11. in operating assets. Furthermore, Kahn Inc. has a WACC of 14%, a before-tax cost of debt of 10%, and a tax rate of 25%. The company's retained earnings are adequate to provide the common equity portion of its capital budget. Its expected dividend next year (D1) is $2, and the current stock price is $33. a. What is the company's expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. % b. If the firm's net income is expected to be $1.0 billion, what portion of its net income is the firm expected to pay out as dividends? Do not round intermediate calculations. Round your answer to two decimal places. (Hint: Refer to Equation below.) Growth rate =(1 - Payout ratio ) ROE %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts