Question: please answer all questions with just letter answer :)) thank you QUESTION 17 Baylee is an employee of Zachy Corp. Either party can terminate the

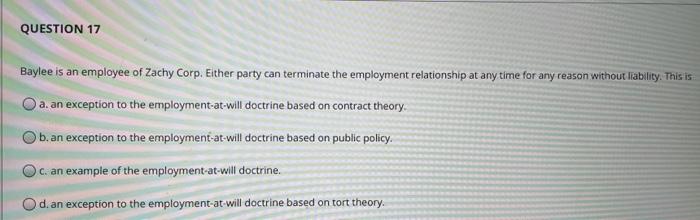

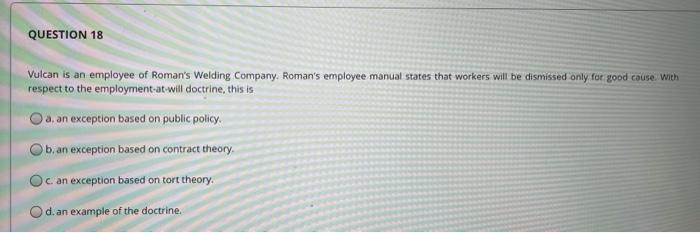

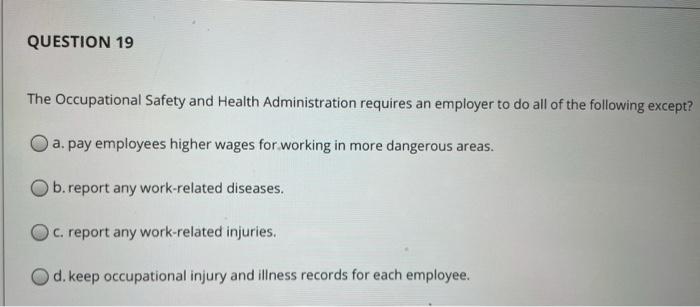

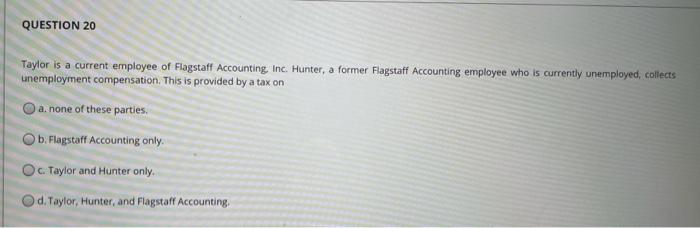

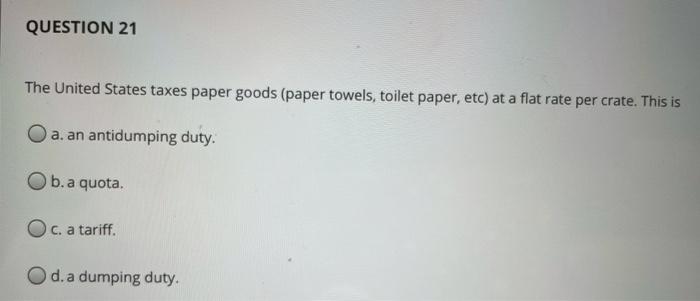

QUESTION 17 Baylee is an employee of Zachy Corp. Either party can terminate the employment relationship at any time for any reason without liability. This is a. an exception to the employment-at-will doctrine based on contract theory b. an exception to the employment-at-will doctrine based on public policy. c. an example of the employment-at-will doctrine. d. an exception to the employment-at-will doctrine based on tort theory. QUESTION 18 Vulcan is an employee of Roman's Welding Company, Roman's employee manual states that workers will be dismissed only for good cause. With respect to the employment-at will doctrine, this is a. an exception based on public policy. b. an exception based on contract theory c. an exception based on tort theory. d. an example of the doctrine QUESTION 19 The Occupational Safety and Health Administration requires an employer to do all of the following except? a. pay employees higher wages for working in more dangerous areas. b.report any work-related diseases. c. report any work-related injuries. d. keep occupational injury and illness records for each employee. QUESTION 20 Taylor is a current employee of Flagstaff Accounting Inc. Hunter, a former Flagstaff Accounting employee who is currently unemployed, collects unemployment compensation. This is provided by a tax on a. none of these parties b. Flagstaff Accounting only Oc. Taylor and Hunter only Od. Taylor, Hunter, and Flagstaff Accounting, QUESTION 21 The United States taxes paper goods (paper towels, toilet paper, etc) at a flat rate per crate. This is O a. an antidumping duty. O b. a quota O c. a tariff. O d. a dumping duty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts