Question: Please answer all questions with workings: Question 5: Congratulations! You just won $50 million in the Illinois State Lottery. The Lottery Commission offers you a

Please answer all questions with workings:

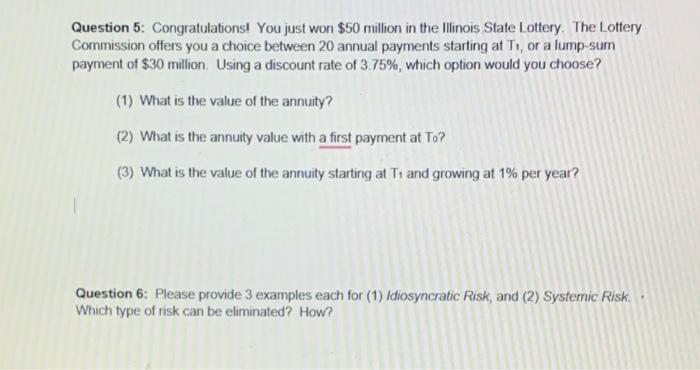

Question 5: Congratulations! You just won $50 million in the Illinois State Lottery. The Lottery Commission offers you a choice between 20 annual payments starting at T1, or a lump-sum payment of $30 million. Using a discount rate of 3.75%, which option would you choose?

(1) What is the value of the annuity?

(2) What is the annuity value with a first payment at T0?

(3) What is the value of the annuity starting at T1 and growing at 1% per year?

Question 6: Please provide 3 examples each for (1) Idiosyncratic Risk, and (2) Systemic Risk. Which type of risk can be eliminated? How?

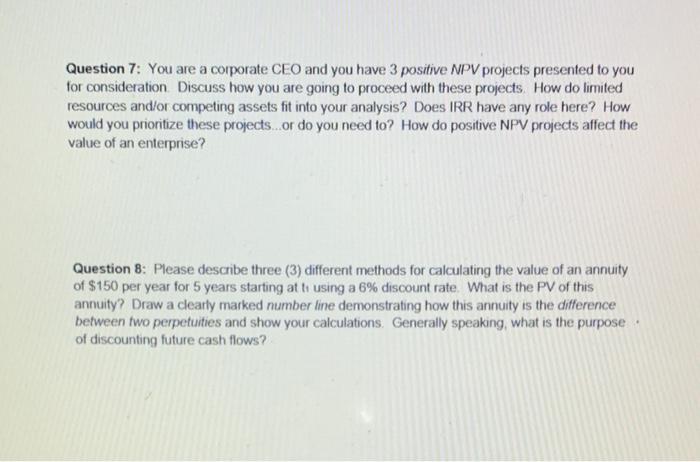

Question 7: You are a corporate CEO and you have 3 positive NPV projects presented to you for consideration. Discuss how you are going to proceed with these projects. How do limited resources and/or competing assets fit into your analysis? Does IRR have any role here? How would you prioritize these projects...or do you need to? How do positive NPV projects affect the value of an enterprise?

7b) Which one of our Core Concepts is represented by the following metaphor:

No matter how many ways you slice the pizza, you cannot change its size.

Question 5: Congratulations! You just won $50 million in the Illinois State Lottery. The Lottery Commission offers you a choice between 20 annual payments starting at T1, or a lump-sum payment of $30 million. Using a discount rate of 3.75%, which option would you choose? (1) What is the value of the annuity? (2) What is the annuity value with a first payment at T0 ? (3) What is the value of the annuity starting at T1 and growing at 1% per year? Question 6: Please provide 3 examples each for (1) Idiosyncratic Risk, and (2) Systemic Risk. . Which type of risk can be eliminated? How? Question 7: You are a corporate CEO and you have 3 positive NPV projects presented to you for consideration. Discuss how you are going to proceed with these projects. How do limited resources and/or competing assets fit into your analysis? Does IRR have any role here? How would you prioritize these projects...or do you need to? How do positive NPV projects affect the value of an enterprise? Question 8: Please describe three (3) different methods for calculating the value of an annuity of $150 per year for 5 years starting at ti using a 6% discount rate. What is the PV of this annuity? Draw a clearly marked number line demonstrating how this annuity is the difference between two perpetuities and show your calculations. Generally speaking, what is the purpose of discounting future cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts