Question: ________________________________________________ __________________________________________________ __________________________________________________ Please answer all questions. You have been offered the opportunity to invest in a project that will pay $2,011 per year at

________________________________________________

__________________________________________________

__________________________________________________

Please answer all questions.

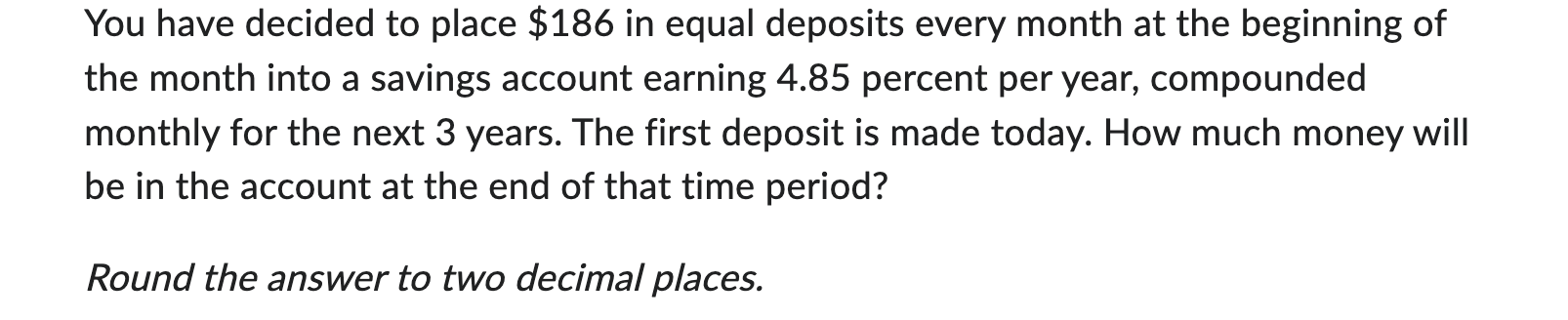

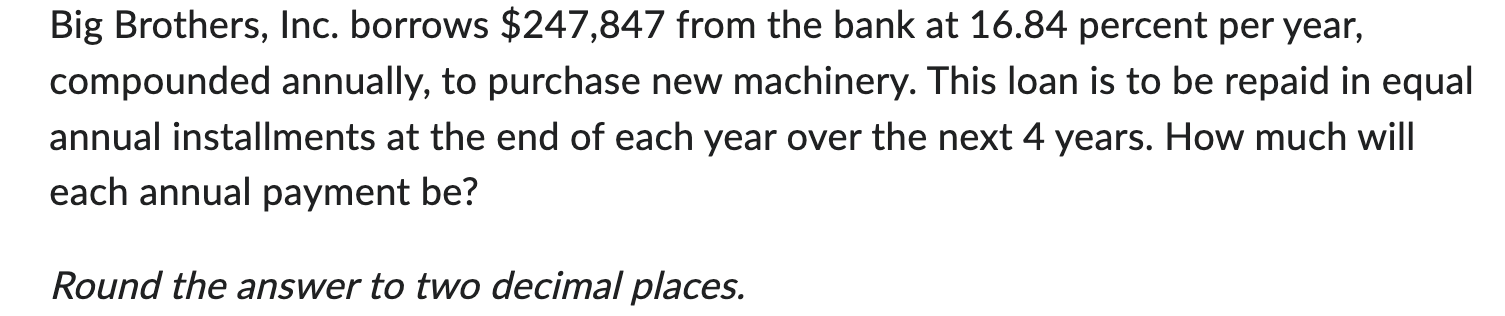

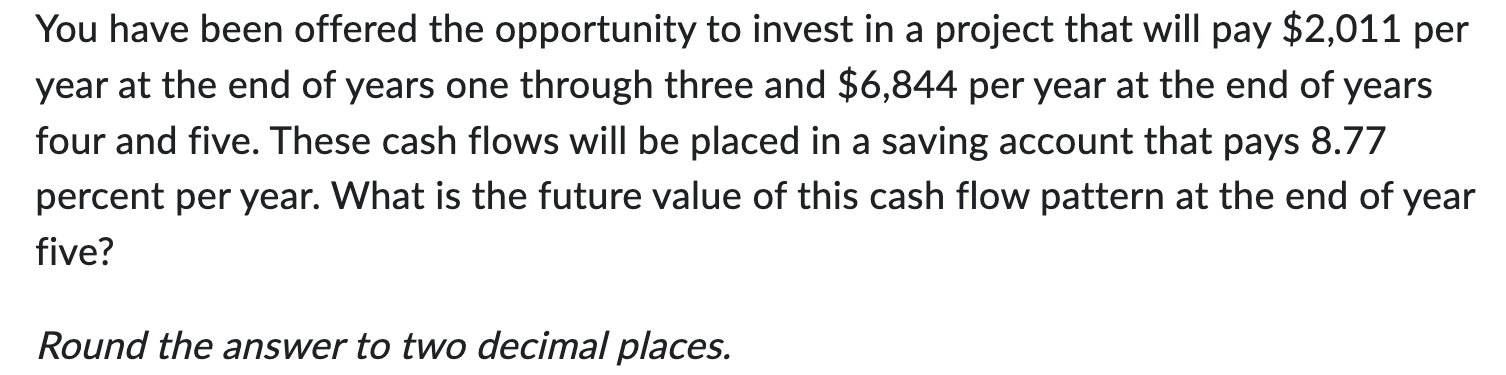

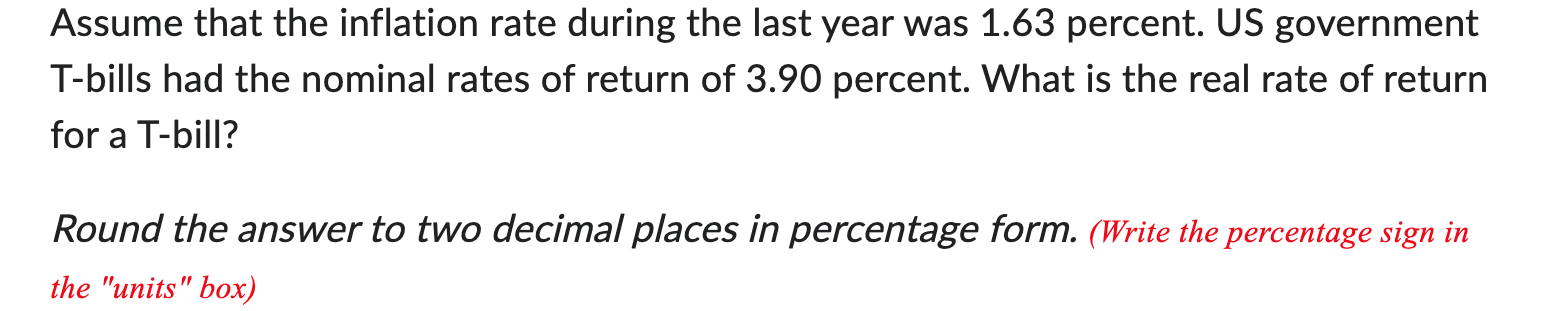

You have been offered the opportunity to invest in a project that will pay $2,011 per year at the end of years one through three and $6,844 per year at the end of years four and five. These cash flows will be placed in a saving account that pays 8.77 percent per year. What is the future value of this cash flow pattern at the end of year five? Round the answer to two decimal places. You have decided to place $186 in equal deposits every month at the beginning of the month into a savings account earning 4.85 percent per year, compounded monthly for the next 3 years. The first deposit is made today. How much money will be in the account at the end of that time period? Round the answer to two decimal places. Big Brothers, Inc. borrows $247,847 from the bank at 16.84 percent per year, compounded annually, to purchase new machinery. This loan is to be repaid in equal annual installments at the end of each year over the next 4 years. How much will each annual payment be? Round the answer to two decimal places. Assume that the inflation rate during the last year was 1.63 percent. US government T-bills had the nominal rates of return of 3.90 percent. What is the real rate of return for a T-bill? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts