Question: please answer all related to same concept needs detail but fine to have short answer for reasoning ect. wil give positive rating alsong as answered

please answer all related to same concept needs detail but fine to have short answer for reasoning ect.

wil give positive rating alsong as answered correctly

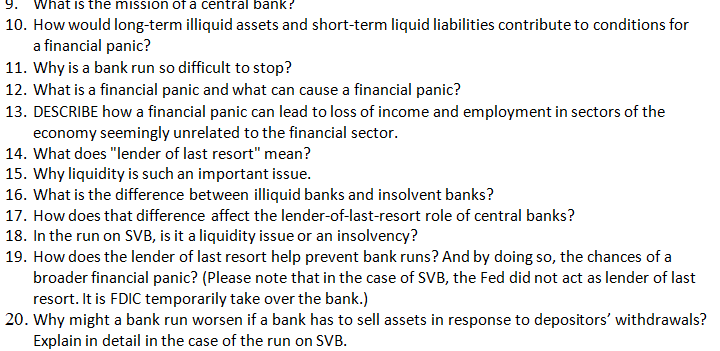

10. How would long-term illiquid assets and short-term liquid liabilities contribute to conditions for a financial panic? 11. Why is a bank run so difficult to stop? 12. What is a financial panic and what can cause a financial panic? 13. DESCRIBE how a financial panic can lead to loss of income and employment in sectors of the economy seemingly unrelated to the financial sector. 14. What does "lender of last resort" mean? 15. Why liquidity is such an important issue. 16. What is the difference between illiquid banks and insolvent banks? 17. How does that difference affect the lender-of-last-resort role of central banks? 18. In the run on SVB, is it a liquidity issue or an insolvency? 19. How does the lender of last resort help prevent bank runs? And by doing so, the chances of a broader financial panic? (Please note that in the case of SVB, the Fed did not act as lender of last resort. It is FDIC temporarily take over the bank.) 20. Why might a bank run worsen if a bank has to sell assets in response to depositors' withdrawals? Explain in detail in the case of the run on SVB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts