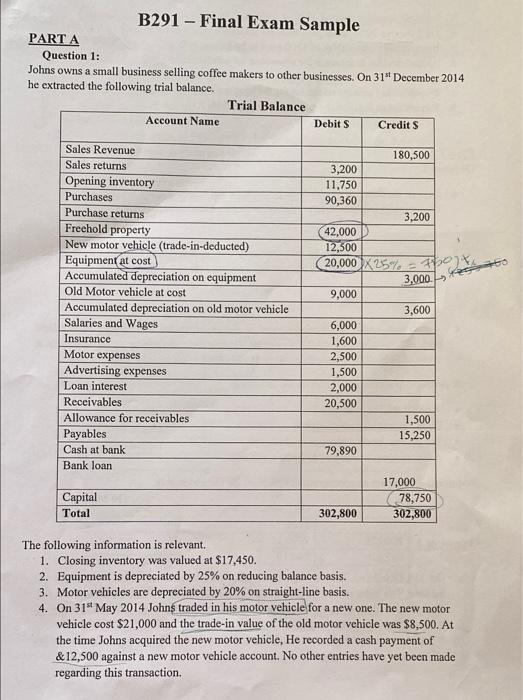

Question: please answer all required B291 - Final Exam Sample PART A Question 1: Johns owns a small business selling coffee makers to other businesses. On

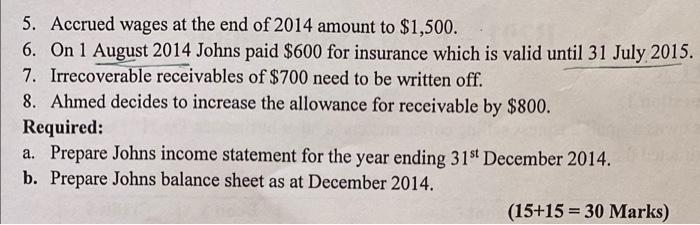

B291 - Final Exam Sample PART A Question 1: Johns owns a small business selling coffee makers to other businesses. On 31* December 2014 he extracted the following trial balance. Trial Balance Account Name Debits Credits 180,500 3,200 11,750 90,360 3,200 42,000 12,500 20,000 X254 3,000.- 9,000 Sales Revenue Sales returns Opening inventory Purchases Purchase returns Freehold property New motor vehicle (trade-in-deducted) Equipment at cost Accumulated depreciation on equipment Old Motor vehicle at cost Accumulated depreciation on old motor vehicle Salaries and Wages Insurance Motor expenses Advertising expenses Loan interest Receivables Allowance for receivables Payables Cash at bank Bank loan 3,600 6,000 1,600 2,500 1,500 2,000 20,500 1,500 15,250 79,890 Capital Total 17,000 78,750 302,800 302,800 The following information is relevant 1. Closing inventory was valued at $17.450. 2. Equipment is depreciated by 25% on reducing balance basis. 3. Motor vehicles are depreciated by 20% on straight-line basis. 4. On 31" May 2014 Johns traded in his motor vehicle for a new one. The new motor vehicle cost $21,000 and the trade-in value of the old motor vehicle was $8,500. At the time Johns acquired the new motor vehicle, He recorded a cash payment of & 12,500 against a new motor vehicle account. No other entries have yet been made regarding this transaction. 5. Accrued wages at the end of 2014 amount to $1,500. 6. On 1 August 2014 Johns paid $600 for insurance which is valid until 31 July 2015. 7. Irrecoverable receivables of $700 need to be written off. 8. Ahmed decides to increase the allowance for receivable by $800. Required: a. Prepare Johns income statement for the year ending 31st December 2014. b. Prepare Johns balance sheet as at December 2014. (15+15 = 30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts