Question: please answer all requirements use : present value of $1 table present value of annuity of $1 table future value of $1 table future value

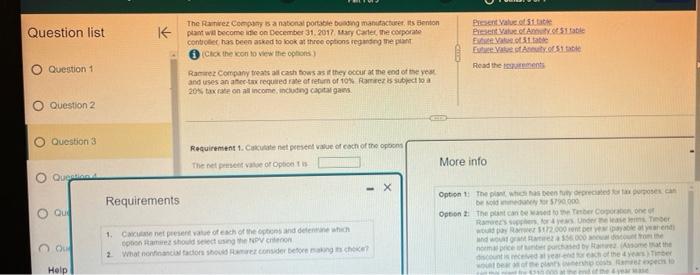

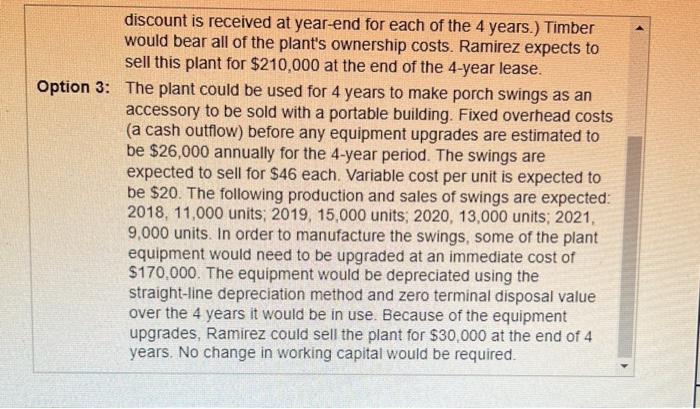

Question list Question 1 Ouestion 2 Eienthe Yatuzef Anrinoy ce is itable Focadthe isparementis Questich is discount is received at year-end for each of the 4 years.) Timber would bear all of the plant's ownership costs. Ramirez expects to sell this plant for $210,000 at the end of the 4-year lease. Option 3: The plant could be used for 4 years to make porch swings as an accessory to be sold with a portable building. Fixed overhead costs (a cash outflow) before any equipment upgrades are estimated to be $26,000 annually for the 4 -year period. The swings are expected to sell for $46 each. Variable cost per unit is expected to be $20. The following production and sales of swings are expected: 2018, 11,000 units; 2019, 15,000 units; 2020, 13,000 units; 2021. 9,000 units. In order to manufacture the swings, some of the plant equipment would need to be upgraded at an immediate cost of $170,000. The equipment would be depreciated using the straight-line depreciation method and zero terminal disposal value over the 4 years it would be in use. Because of the equipment upgrades, Ramirez could sell the plant for $30,000 at the end of 4 years. No change in working capital would be required. Question list Question 1 Ouestion 2 Eienthe Yatuzef Anrinoy ce is itable Focadthe isparementis Questich is discount is received at year-end for each of the 4 years.) Timber would bear all of the plant's ownership costs. Ramirez expects to sell this plant for $210,000 at the end of the 4-year lease. Option 3: The plant could be used for 4 years to make porch swings as an accessory to be sold with a portable building. Fixed overhead costs (a cash outflow) before any equipment upgrades are estimated to be $26,000 annually for the 4 -year period. The swings are expected to sell for $46 each. Variable cost per unit is expected to be $20. The following production and sales of swings are expected: 2018, 11,000 units; 2019, 15,000 units; 2020, 13,000 units; 2021. 9,000 units. In order to manufacture the swings, some of the plant equipment would need to be upgraded at an immediate cost of $170,000. The equipment would be depreciated using the straight-line depreciation method and zero terminal disposal value over the 4 years it would be in use. Because of the equipment upgrades, Ramirez could sell the plant for $30,000 at the end of 4 years. No change in working capital would be required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts