Question: please answer all SECTION B (50 marks) B1. i. Find the price of the underlying asset S given by the Mean Reverting Geometric Brownian Motion

please answer all

please answer all

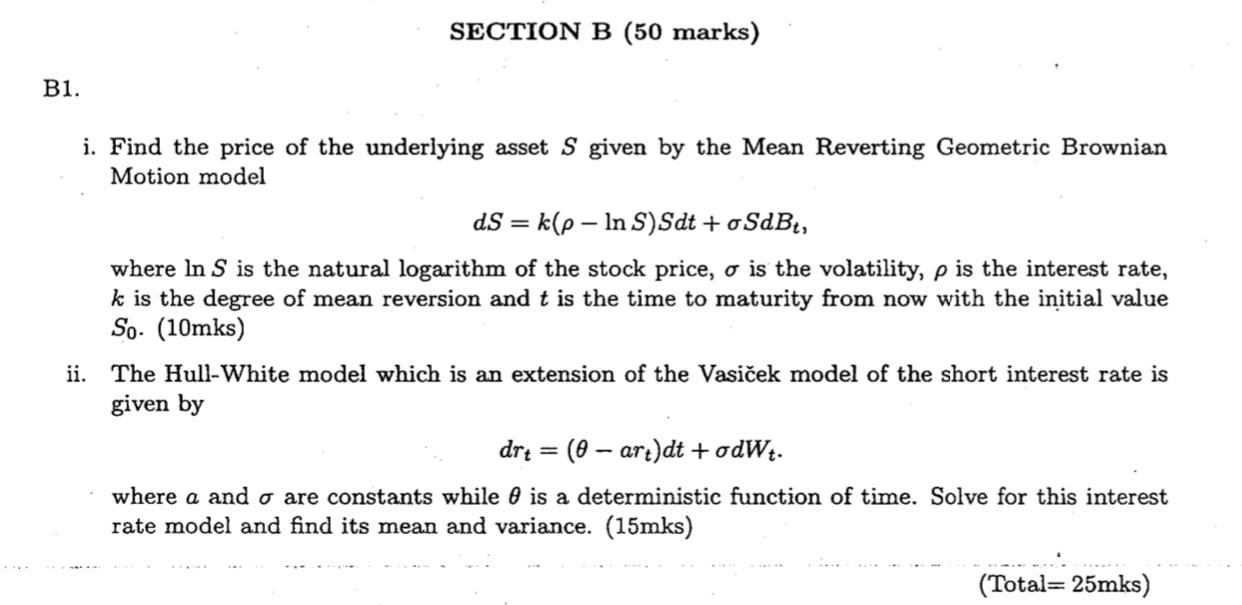

SECTION B (50 marks) B1. i. Find the price of the underlying asset S given by the Mean Reverting Geometric Brownian Motion model dS = klp - In S)Sdt + oSdBt, where In S is the natural logarithm of the stock price, o is the volatility, p is the interest rate, k is the degree of mean reversion and t is the time to maturity from now with the initial value So. (10mks) ii. The Hull-White model which is an extension of the Vasiek model of the short interest rate is given by drt = (0 - art)dt + odWt. where a and o are constants while is a deterministic function of time. Solve for this interest rate model and find its mean and variance. (15mks) (Total= 25mks) SECTION B (50 marks) B1. i. Find the price of the underlying asset S given by the Mean Reverting Geometric Brownian Motion model dS = klp - In S)Sdt + oSdBt, where In S is the natural logarithm of the stock price, o is the volatility, p is the interest rate, k is the degree of mean reversion and t is the time to maturity from now with the initial value So. (10mks) ii. The Hull-White model which is an extension of the Vasiek model of the short interest rate is given by drt = (0 - art)dt + odWt. where a and o are constants while is a deterministic function of time. Solve for this interest rate model and find its mean and variance. (15mks) (Total= 25mks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts