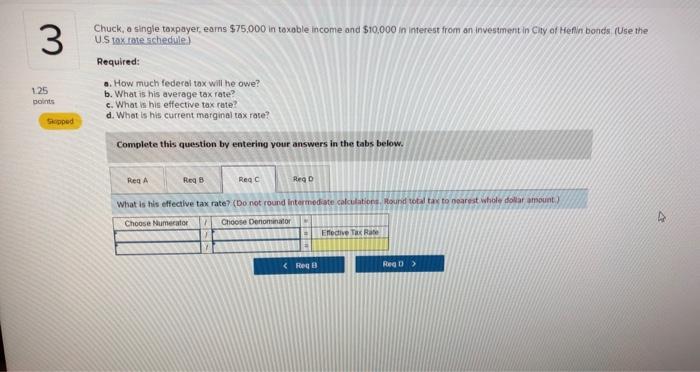

Question: please answer all sections and for section C choose from dropdown for all boxes! thank you! Chuck, a single toxpayer, earns $75,000 in toxable income

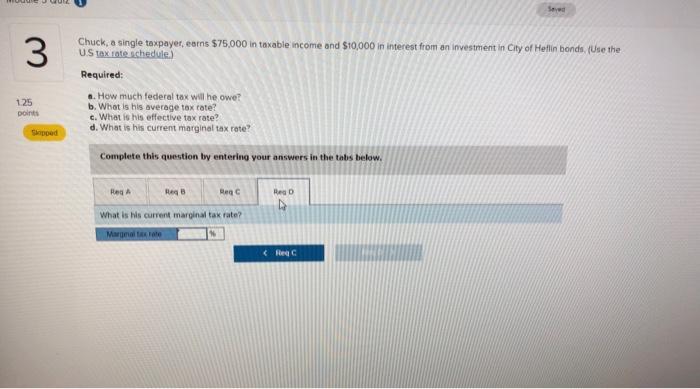

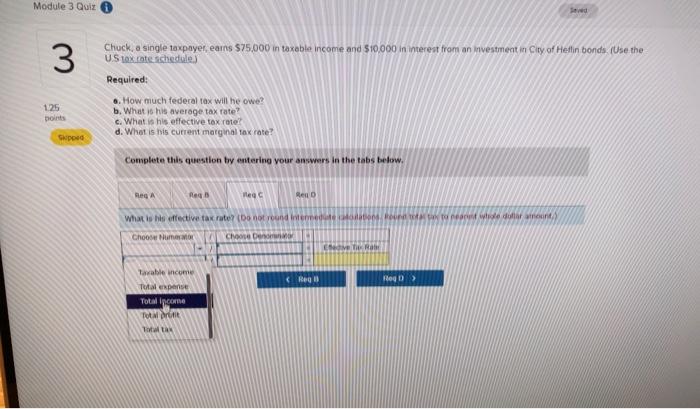

Chuck, a single toxpayer, earns $75,000 in toxable income and $10,000 in interest from an investment in City af Hefin bonds (Use the U.S bax tate schedule) Required: a. How much federal tox will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Chuck, a single taxpayet, earns $75,000 in taxable income and $10,000 in interest from an investment in City of Hellin bonds, (Use the U.S tax rate uchedule.) Required: a. How much federal tax will he owe? b. What is his average tax tate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. What is his current marginal tak rate? Chuck, a single taxpayer, eams $75,000 in taxeble income and $10.000 in interest from an mvestmeat in City of Heflin bonds, (Use the US lox rate sichedule ) Required: 6. How much federal tax will he owe? b. What is his averoge tax rate? c. What is his effective tox rote? d. What is tris currem marginal tax rate? Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts