Question: Please answer ALL sections. I will thumbs you up, thank you!!!! Yoshi Company completed the following transactions and events involving its delivery trucks: Year 1

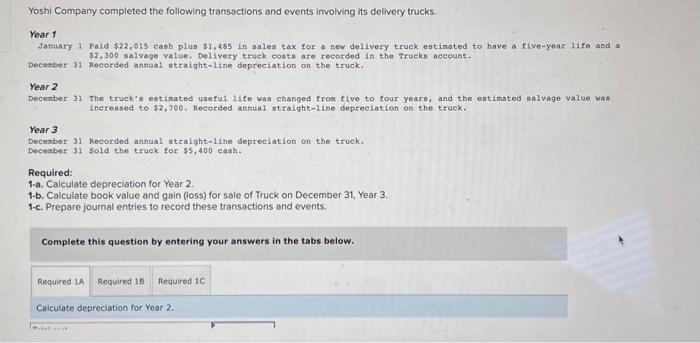

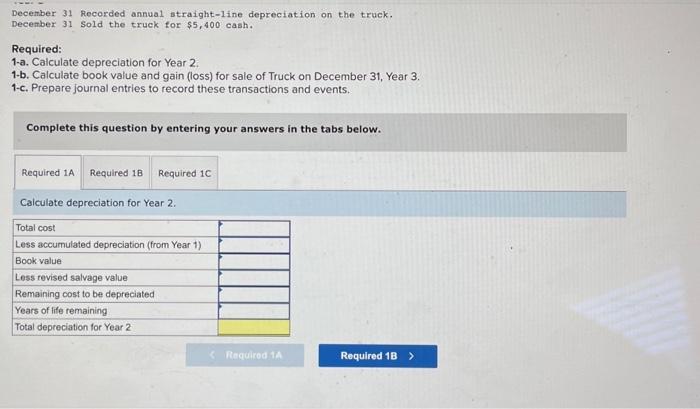

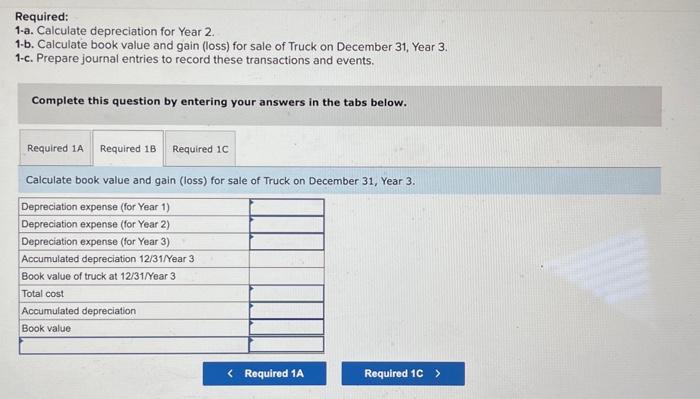

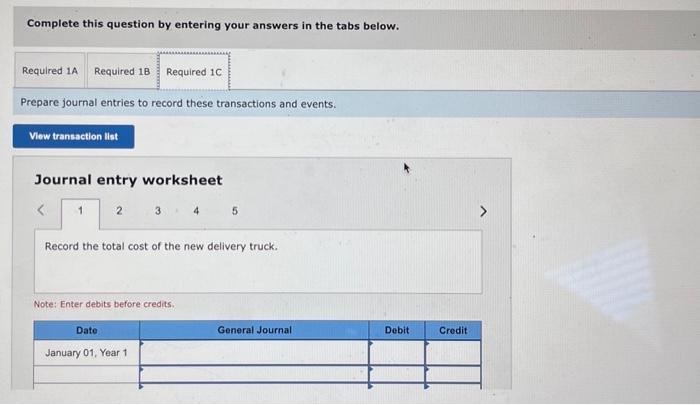

Yoshi Company completed the following transactions and events involving its delivery trucks: Year 1 Janaory 1 paid 522,015 cash plus 51,485 in sales tax for a new delivery truck estimated to have a five-year 11fo and a $2,300 salvage value. belivery truek coste are recorded in the Truckn account. Deceaber 31 Recorded annuel straight-line depreciation on the truck. Year 2 Decenber 31 The truck's estimated unefal life was changed from five to four yearo, and the entimated Balvage value was inereased to $2,700. Recorded annual straiqht-1ine depreeiation on the truek. Year 3 Decenber 31 Recorded annual straight-1ine depreoiation on the truck. Decesber 31 sold the truek for 55,400 cash. Required: 1-a. Calculate depreciation for Year 2. 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Calculate depreciation for Year 2. December 31 Recorded annual straight-1ine depreciation on the truck. December 31 Sold the truck for $5,400 cash. Required: 1-a. Caiculate depreciation for Year 2 . 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Calculate depreciation for Year 2. Required: 1-a. Calculate depreciation for Year 2. 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. Complete this question by entering your answers in the tabs below. Prepare journal entries to record these transactions and events

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts