Question: PLEASE ANSWER ALL SECTIONS PLEASE ANSWER ALL SECTIONS An investor with mean-variance preferences chooses to invest 70% of her wealth in a risky asset P

PLEASE ANSWER ALL SECTIONS

PLEASE ANSWER ALL SECTIONS

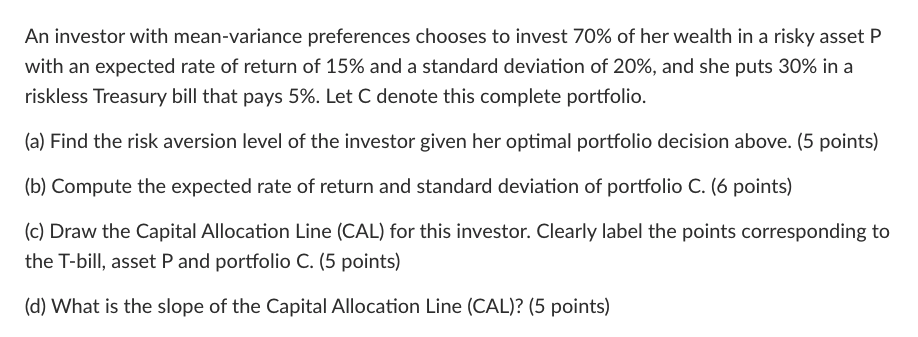

An investor with mean-variance preferences chooses to invest 70% of her wealth in a risky asset P with an expected rate of return of 15% and a standard deviation of 20%, and she puts 30% in a riskless Treasury bill that pays 5%. Let C denote this complete portfolio. (a) Find the risk aversion level of the investor given her optimal portfolio decision above. (5 points) (b) Compute the expected rate of return and standard deviation of portfolio C. (6 points) (c) Draw the Capital Allocation Line (CAL) for this investor. Clearly label the points corresponding to the T-bill, asset P and portfolio C. (5 points) (d) What is the slope of the Capital Allocation Line (CAL)? (5 points) An investor with mean-variance preferences chooses to invest 70% of her wealth in a risky asset P with an expected rate of return of 15% and a standard deviation of 20%, and she puts 30% in a riskless Treasury bill that pays 5%. Let C denote this complete portfolio. (a) Find the risk aversion level of the investor given her optimal portfolio decision above. (5 points) (b) Compute the expected rate of return and standard deviation of portfolio C. (6 points) (c) Draw the Capital Allocation Line (CAL) for this investor. Clearly label the points corresponding to the T-bill, asset P and portfolio C. (5 points) (d) What is the slope of the Capital Allocation Line (CAL)? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts