Question: please answer all sections there are three of them and I provided an example as well I'm having trouble understanding what goes where. Problem 14-10AB

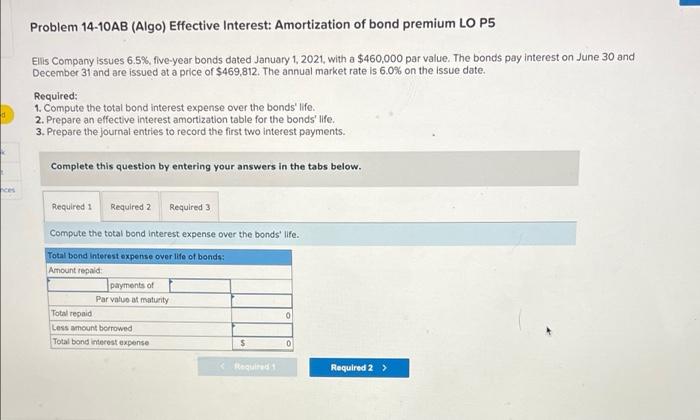

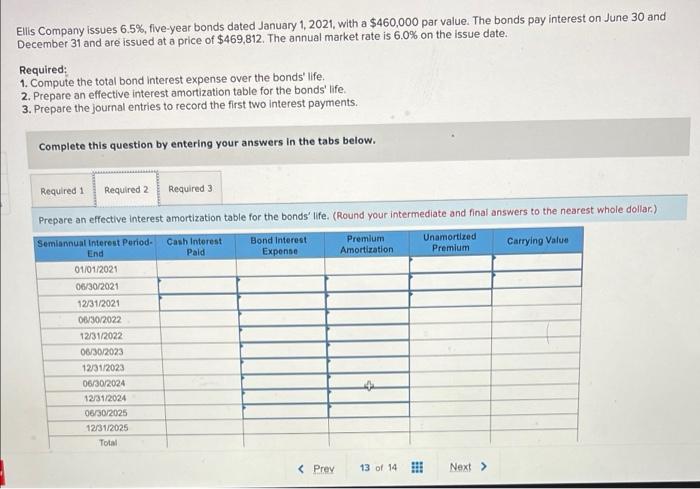

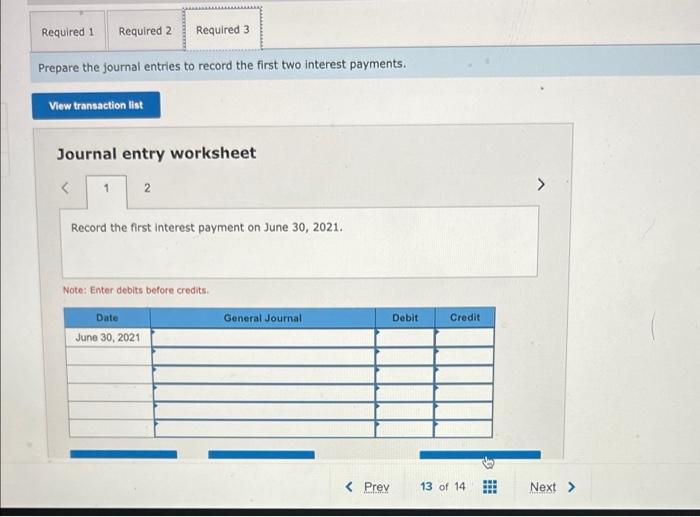

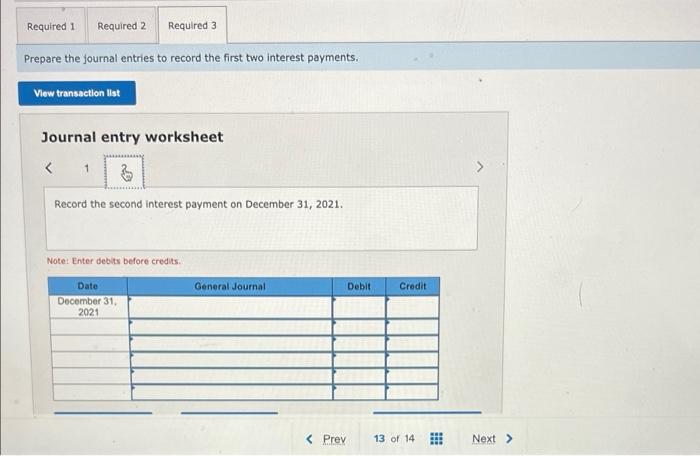

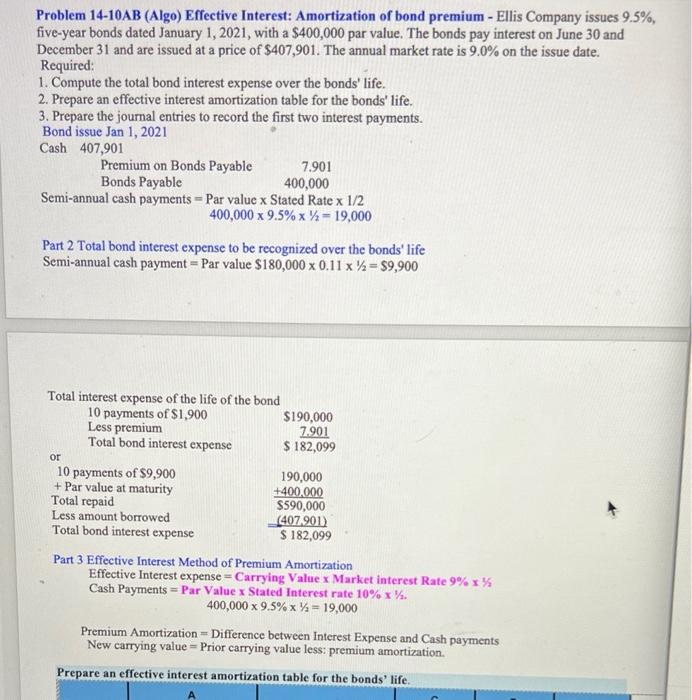

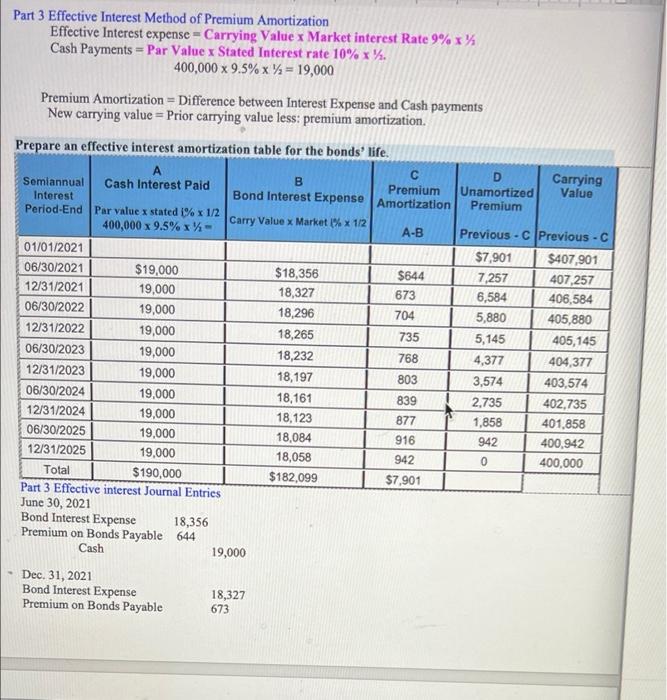

Problem 14-10AB (Algo) Effective Interest: Amortization of bond premium LO P5 Els Company issues 6.5%, five-year bonds dated January 1, 2021, with a $460,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $469,812. The annual market rate is 6.0% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life, 3. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Required i Required 2 Required 3 Compute the total bond Interest expense over the bonds life. Total bond Interest expense over life of bonds: Amount repaid payments of Par value at maturity Totalrepaid Less amount borrowed Total bond interest expense 0 0 Required Required 2 > Ellis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $460,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $469,812. The annual market rate is 6.0% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an effective interest amortization table for the bonds' life. (Round your intermediate and final answers to the nearest whole dollar) Semiannual Interest Period Cash Interest Bond Interest Premium Unamortized End Pald Carrying Value Expense Amortization Premium 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Total Required 1 Required 2 Required 3 Prepare the journal entries to record the first two interest payments. View transaction list Journal entry worksheet : Required 1 Required 2 Required 3 Prepare the journal entries to record the first two interest payments. View transaction list Journal entry worksheet Problem 14-10AB (Algo) Effective Interest: Amortization of bond premium - Ellis Company issues 9.5%, five-year bonds dated January 1, 2021, with a $400,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $407,901. The annual market rate is 9.0% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Bond issue Jan 1, 2021 Cash 407,901 Premium on Bonds Payable 7.901 Bonds Payable 400,000 Semi-annual cash payments - Par value x Stated Rate x 1/2 400,000 x 9.5% xy - 19,000 Part 2 Total bond interest expense to be recognized over the bonds' life Semi-annual cash payment = Par value $180,000 x 0.11 x 1 = $9,900 or Total interest expense of the life of the bond 10 payments of $1,900 $190,000 Less premium 7.901 Total bond interest expense $ 182,099 10 payments of $9,900 190,000 + Par value at maturity +400.000 Total repaid $590,000 Less amount borrowed (407.901) Total bond interest expense $ 182,099 Part 3 Effective Interest Method of Premium Amortization Effective Interest expense Carrying Value x Market interest Rate 9%x% Cash Payments = Par Value x Stated Interest rate 10%x%. 400,000 x 9.5% xy = 19,000 Premium Amortization = Difference between Interest Expense and Cash payments New carrying value = Prior carrying value less: premium amortization. Prepare an effective interest amortization table for the bonds' life. Part 3 Effective Interest Method of Premium Amortization Effective Interest expense = Carrying Value x Market interest Rate 9%x% Cash Payments = Par Value x Stated Interest rate 10% x'. 400,000 x 9.5% xyz = 19,000 Premium Amortization = Difference between Interest Expense and Cash payments New carrying value=Prior carrying value less: premium amortization. Prepare an effective interest amortization table for the bonds' life. A D Carrying Semiannual Cash Interest Paid B Premium Unamortized Value Interest Bond Interest Expense Amortization Premium Period-End Par value x stated % x 1/2 Carry Value x Market 1% x 1/2 400,000 x 9.5% x- A-B Previous - Previous - C 01/01/2021 $7.901 $407,901 06/30/2021 $19,000 $18,356 $644 7,257 407,257 12/31/2021 19,000 18,327 673 6,584 406,584 06/30/2022 19,000 18,296 704 5,880 405,880 12/31/2022 19,000 18,265 735 5,145 405,145 06/30/2023 19,000 18,232 768 4,377 404,377 12/31/2023 19,000 18,197 803 3,574 403,574 06/30/2024 19,000 18,161 839 2.735 402,735 12/31/2024 19,000 18,123 877 1,858 401,858 06/30/2025 19,000 18,084 916 942 400,942 12/31/2025 19,000 18,058 942 0 400,000 Total $190,000 $182,099 $7,901 Part 3 Effective interest Journal Entries June 30, 2021 Bond Interest Expense 18,356 Premium on Bonds Payable 644 Cash 19,000 Dec 31, 2021 Bond Interest Expense 18,327 Premium on Bonds Payable 673

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts