Question: please answer all step by step THANK YOU! 1. If a bond earns an YTM of 12%, the current yield is 7%. the coupon rate

please answer all step by step THANK YOU!

1. If a bond earns an YTM of 12%, the current yield is 7%. the coupon rate is 9%, how much should be the capital gains yield (CGY)?

3%

5%

4%

2%

6%

2. Morin Company's bonds mature in 8 years, have a par value of $1,000, and makes an annual coupon interest payment of $65. The market requires an interest rate of 8.2% on these bonds. What is the bond's price?

925.62

948.76

903.04

996.79

972.48

3. A company 7-year bonds are yielding 6.75 percent per year. treasury bonds with the same maturity are yielding 4.3 percent per year and the real risk =free rate (r*) is 1.3 percent. The average inflation premium is 1.5 percent. And the maturity risk premium is estimated to be 0.1*(t-1) %, where t=+ number to years to maturity. If the liquidity premium is 1.1percent, what is the default risk premium on the corporate bonds?

4.suppose the interest rate on a 1= year T-bond is 3.0% and that on a 2-year T-bill is 5.0%. Assuming the pure expectation theory is correct, what is the markets forecast for 1- year rate 1

year from now?

5.suppose the correlation between the two security returns is + 1.0. if the securities are combined in the correct proportions, the resulting 2- assets portfolio will have less risk than either security held alone.

True or false?

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

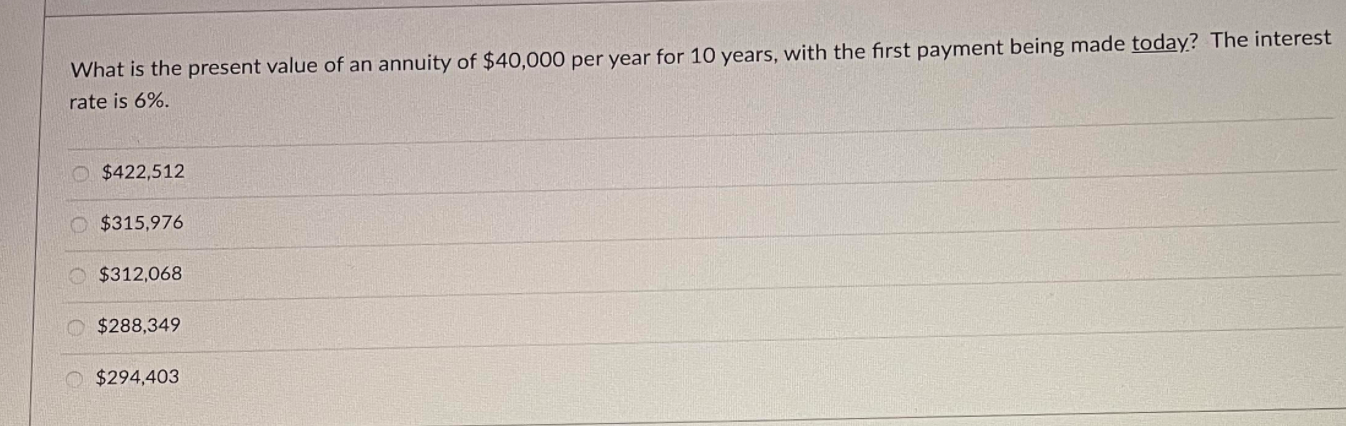

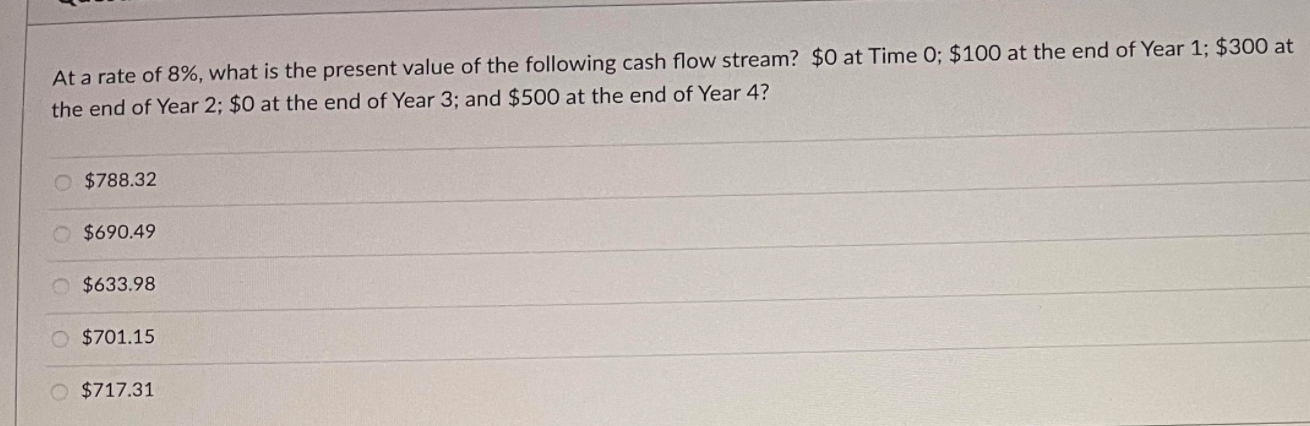

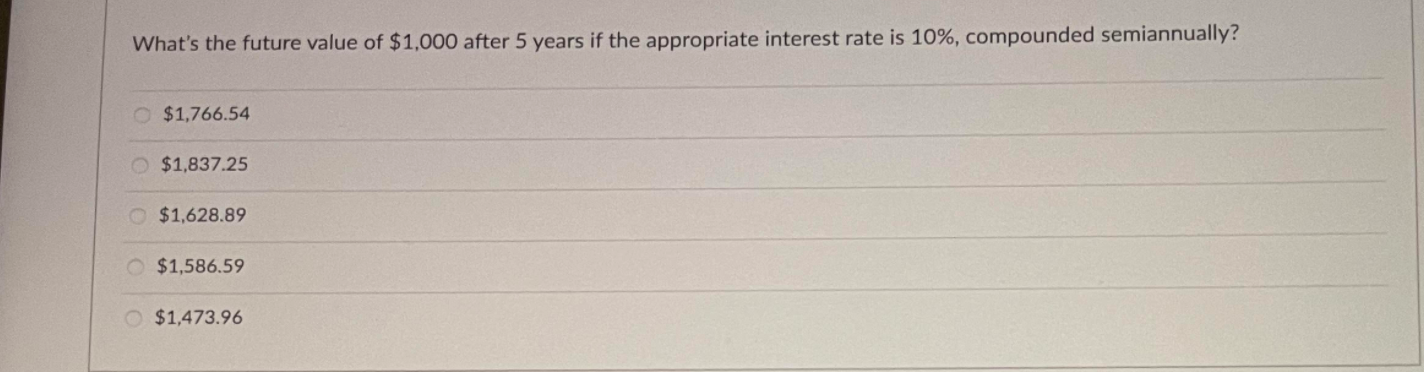

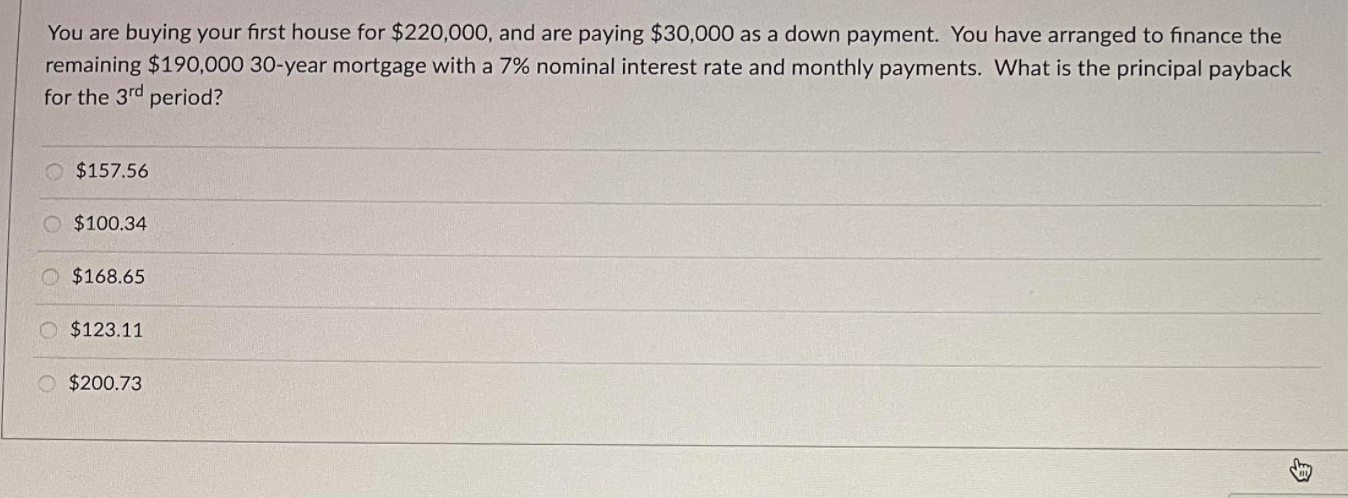

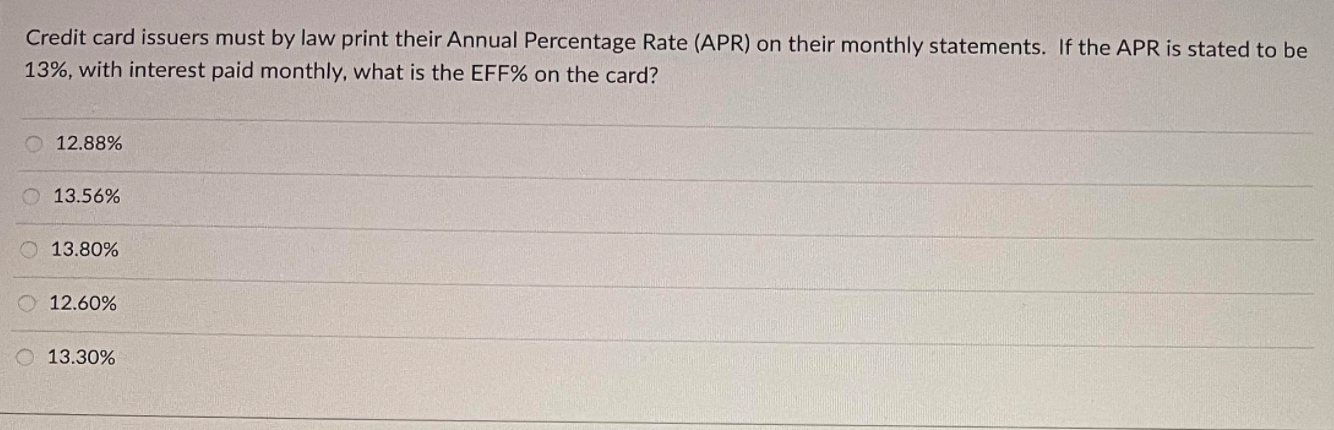

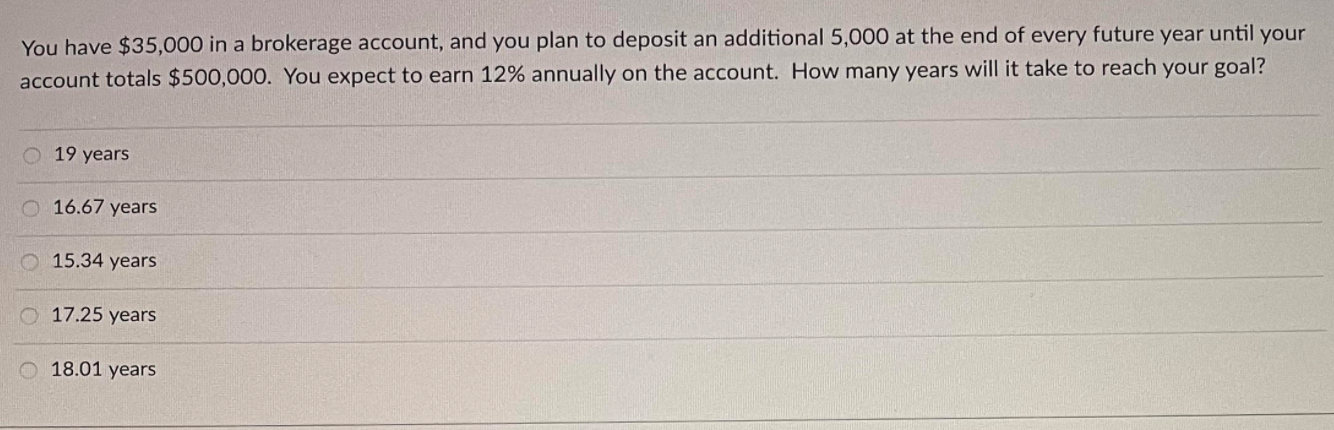

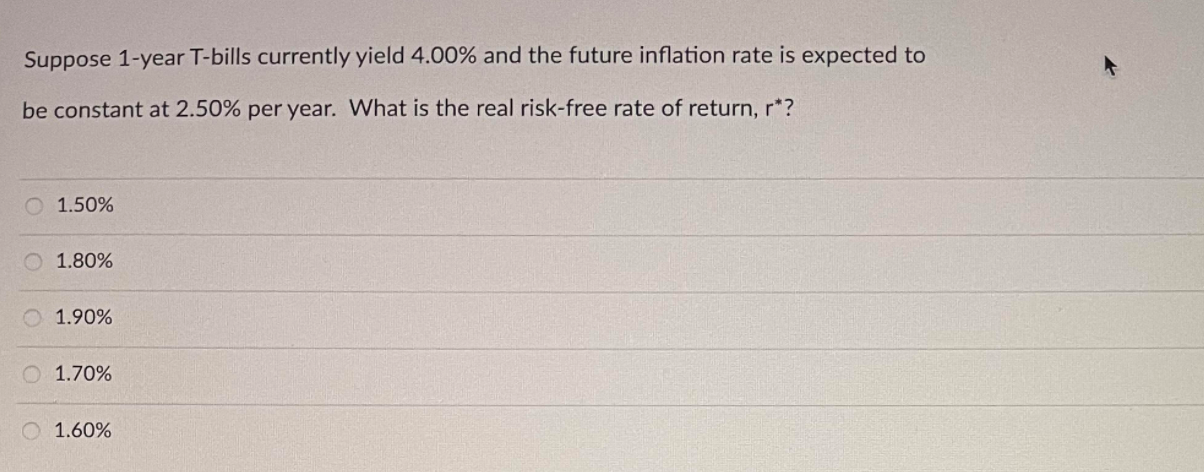

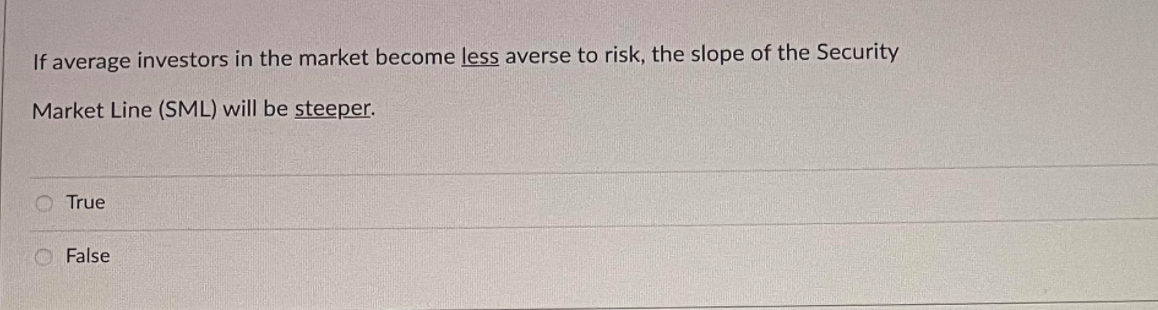

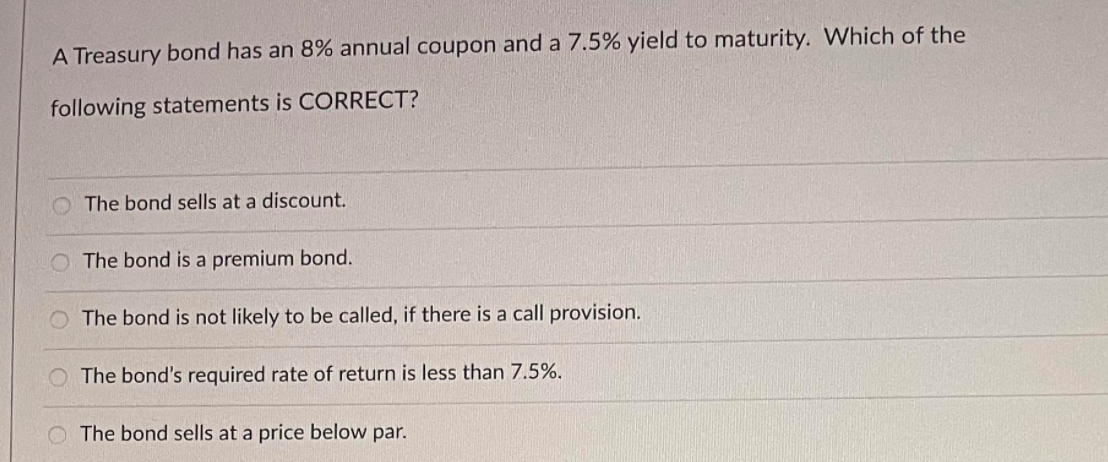

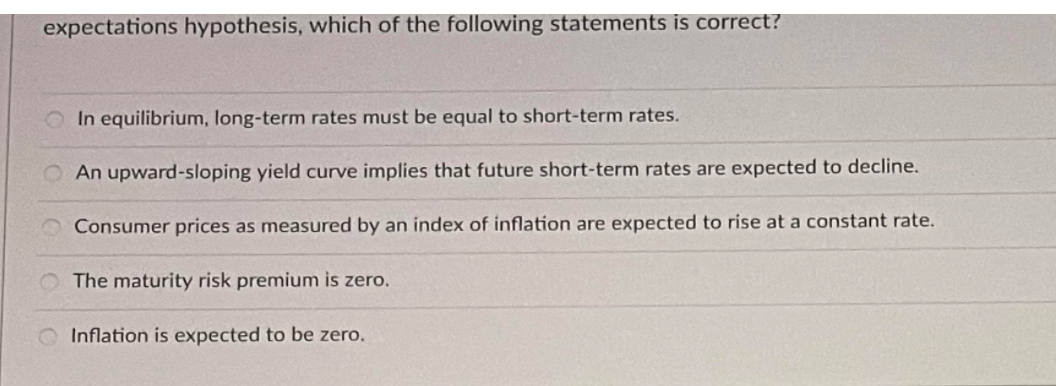

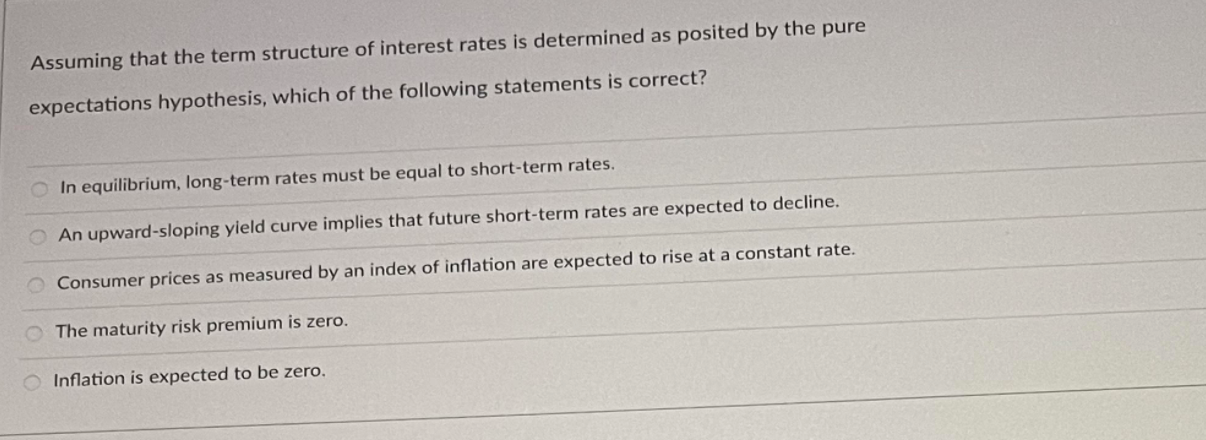

What is the present value of an annuity of $40,000 per year for 10 years, with the first payment being made today? The interest rate is 6%. $422,512 $315,976 $312,068 $288,349 O $294,403 At a rate of 8%, what is the present value of the following cash flow stream? $0 at Time 0; $100 at the end of Year 1; $300 at the end of Year 2; $0 at the end of Year 3; and $500 at the end of Year 4? $788.32 $690.49 $633.98 $701.15 $717.31 What's the future value of $1,000 after 5 years if the appropriate interest rate is 10%, compounded semiannually? $1,766.54 $1,837.25 $1,628.89 $1,586.59 $1,473.96 You are buying your first house for $220,000, and are paying $30,000 as a down payment. You have arranged to finance the remaining $190,000 30-year mortgage with a 7% nominal interest rate and monthly payments. What is the principal payback for the 3rd period? $157.56 $100.34 $168.65 $123.11 O $200.73 Credit card issuers must by law print their Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 13%, with interest paid monthly, what is the EFF% on the card? 12.88% 13.56% 13.80% 12.60% 13.30% You have $35,000 in a brokerage account, and you plan to deposit an additional 5,000 at the end of every future year until your account totals $500,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal? 19 years 16.67 years 15.34 years 0 17.25 years 18.01 years Suppose 1-year T-bills currently yield 4.00% and the future inflation rate is expected to be constant at 2.50% per year. What is the real risk-free rate of return, r*? 1.50% 1.80% 1.90% 0 1.70% 1.60% If average investors in the market become less averse to risk, the slope of the Security Market Line (SML) will be steeper. True False A Treasury bond has an 8% annual coupon and a 7.5% yield to maturity. Which of the following statements is CORRECT? The bond sells at a discount. The bond is a premium bond. The bond is not likely to be called, if there is a call provision. The bond's required rate of return is less than 7.5%. The bond sells at a price below par. expectations hypothesis, which of the following statements is correct? In equilibrium, long-term rates must be equal to short-term rates. ololo An upward-sloping yield curve implies that future short-term rates are expected to decline. Consumer prices as measured by an index of inflation are expected to rise at a constant rate. The maturity risk premium is zero. Inflation is expected to be zero. Assuming that the term structure of interest rates is determined as posited by the pure expectations hypothesis, which of the following statements is correct? In equilibrium, long-term rates must be equal to short-term rates. An upward-sloping yield curve implies that future short-term rates are expected to decline. Consumer prices as measured by an index of inflation are expected to rise at a constant rate. Tolo The maturity risk premium is zero. Inflation is expected to be zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts