Question: please answer all. Suppose that California CO4 a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via

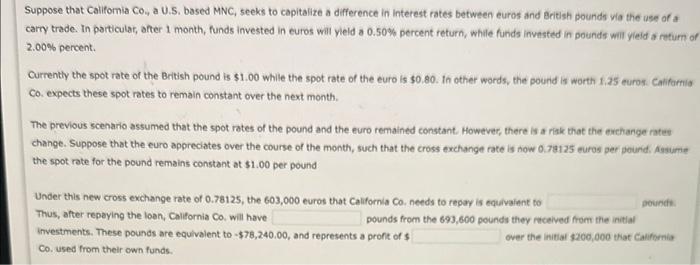

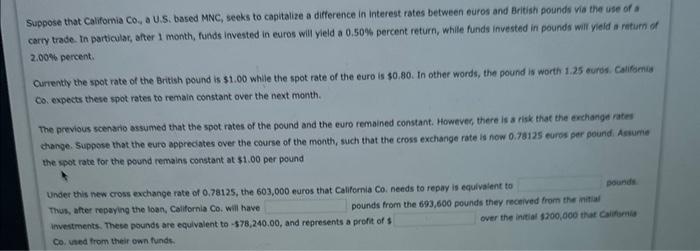

Suppose that California CO4 a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of a carry trade. In particulat, after 1 month, funds invested in euros will yleld a 0.50% percent return, while funds invisted in pounds will yieid a return o 2.00% percent. Currently the spot rate of the British pound is $1.00 while the spot rate of the euro is $0.80. In other words, the pound is worth 1.25 euros. Califarmia Co. expects these spot rates to remain constant over the next month. The previous scenario assumed that the spot rotes of the pound and the euro remained constant. However, there is a riak that the exchange ratee change. Suppose that the euro appreciates over the course of the month, such that the cross exchange rate is now 0.73125 euros per pound. Aasume the spot rate for the pound remains constant at $1.00 per pound Under this new cross exchange rate of 0.78125, the 603,000 euros that California Co. needs to repay is equivalint to Thus, after repaying the loan, California Co, will have pounds from the 693,600 pounds they received from the initial investments. These pounds are equivalent to $78,240.00, and represents a proft of $ over the initial s200,000 that calfornia Co. used from their own funds. Suppose that Califomia CO a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of a carry trade. in particular, after 1 month, funds invested in euros will yield a 0.50% percent return, while funds invested in pounds wilf yieid a matum of 2.00% percent. Qurrently the spot rate of the British pound is $1.00 whlle the spot rate of the euro is $0.80. In other words, the pound is worth 1.25 eures. Califsenia Co. expects these spot rates to remain constant over the next month. The previous scenario assumed that the spot rates of the pound and the euro remoined constant. Howevec, there is a risk that the exchange rates thange. Suppose that the euro appreciates over the course of the month, such that the eross exchange rate is now 0.78125 eures per pound. Assume the spot rate for the pound remains constant at $1.00 per pound Under this new cross exchange rate of 0.78125, the 603,000 euros that Califemia Co. nends to repay is equivaient to Thus, after repaying the loan, Calitornia Co. will have pounds from the 693,600 pounds they rechived from the mitial investrents. These pounds are equivalent to 578,240.00, and represents a profit of s over the initial 8200,000 that Caifurais Co. vhed from their own funds. Suppose that California CO4 a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of a carry trade. In particulat, after 1 month, funds invested in euros will yleld a 0.50% percent return, while funds invisted in pounds will yieid a return o 2.00% percent. Currently the spot rate of the British pound is $1.00 while the spot rate of the euro is $0.80. In other words, the pound is worth 1.25 euros. Califarmia Co. expects these spot rates to remain constant over the next month. The previous scenario assumed that the spot rotes of the pound and the euro remained constant. However, there is a riak that the exchange ratee change. Suppose that the euro appreciates over the course of the month, such that the cross exchange rate is now 0.73125 euros per pound. Aasume the spot rate for the pound remains constant at $1.00 per pound Under this new cross exchange rate of 0.78125, the 603,000 euros that California Co. needs to repay is equivalint to Thus, after repaying the loan, California Co, will have pounds from the 693,600 pounds they received from the initial investments. These pounds are equivalent to $78,240.00, and represents a proft of $ over the initial s200,000 that calfornia Co. used from their own funds. Suppose that Califomia CO a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of a carry trade. in particular, after 1 month, funds invested in euros will yield a 0.50% percent return, while funds invested in pounds wilf yieid a matum of 2.00% percent. Qurrently the spot rate of the British pound is $1.00 whlle the spot rate of the euro is $0.80. In other words, the pound is worth 1.25 eures. Califsenia Co. expects these spot rates to remain constant over the next month. The previous scenario assumed that the spot rates of the pound and the euro remoined constant. Howevec, there is a risk that the exchange rates thange. Suppose that the euro appreciates over the course of the month, such that the eross exchange rate is now 0.78125 eures per pound. Assume the spot rate for the pound remains constant at $1.00 per pound Under this new cross exchange rate of 0.78125, the 603,000 euros that Califemia Co. nends to repay is equivaient to Thus, after repaying the loan, Calitornia Co. will have pounds from the 693,600 pounds they rechived from the mitial investrents. These pounds are equivalent to 578,240.00, and represents a profit of s over the initial 8200,000 that Caifurais Co. vhed from their own funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts