Question: Please answer all. Thank you ! (24 points. Project Cash Flows.) Califormia Drinks, Inc. is considering a new line of drinks with a new production

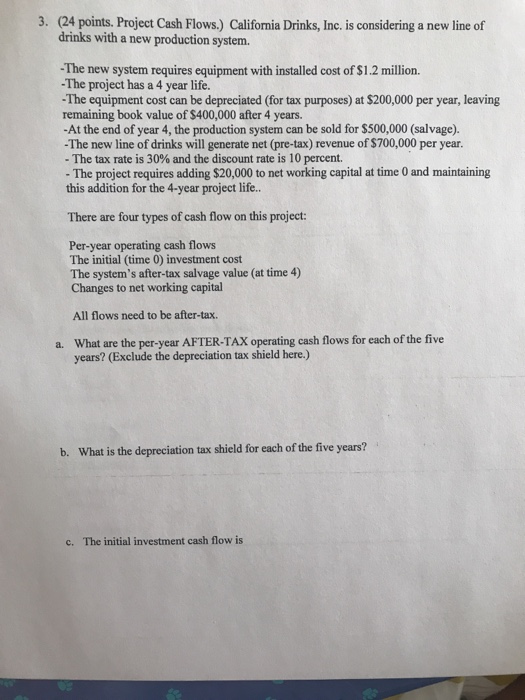

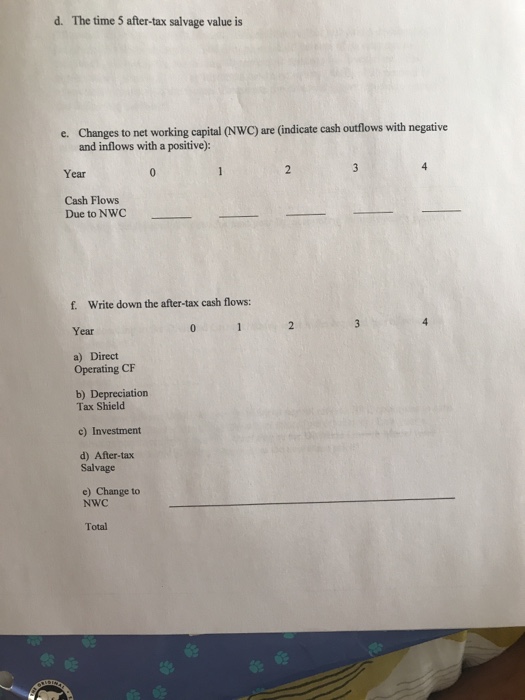

(24 points. Project Cash Flows.) Califormia Drinks, Inc. is considering a new line of drinks with a new production system. 3. -The new system requires equipment with installed cost of $1.2 million. -The project has a 4 year life. -The equipment cost can be depreciated (for tax purposes) at $200,000 per year, leaving remaining book value of $400,000 after 4 years. -At the end of year 4, the production system can be sold for $500,000 (salvage). -The new line of drinks will generate net (pre-tax) revenue of $700,000 per year. The tax rate is 30% and the discount rate is 10 percent. - The project requires adding $20,000 to net working capital at time 0 and maintaining this addition for the 4-year project life.. There are four types of cash flow on this project Per-year operating cash flows The initial (time 0) investment cost The system's after-tax salvage value (at time 4) Changes to net working capital All flows need to be after-tax. What are the per-year AFTER-TAX operating cash flows for each of the five years? (Exclude the depreciation tax shield here.) a. b. What is the depreciation tax shield for each of the five years? c The initial investment cash flow is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts