Question: please answer all, thank you! D Question 6 1 pts Harrimon Industries bonds have 4 years left to maturity. Interest is paid annually, and the

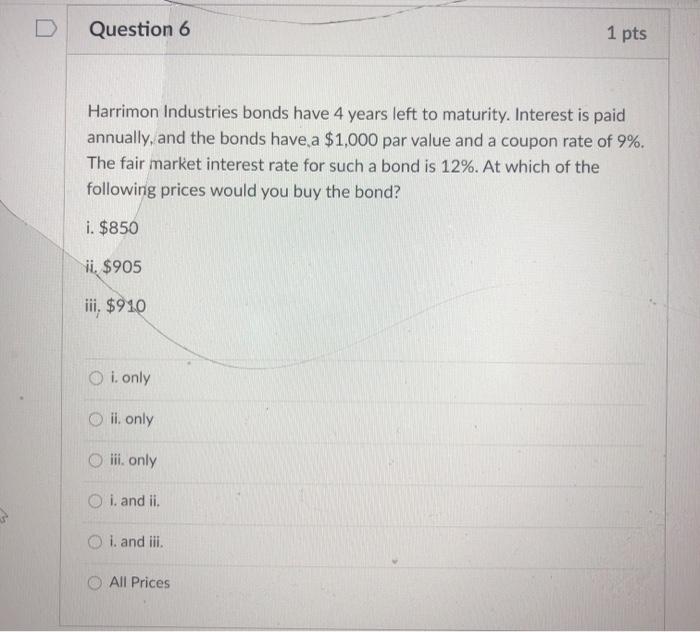

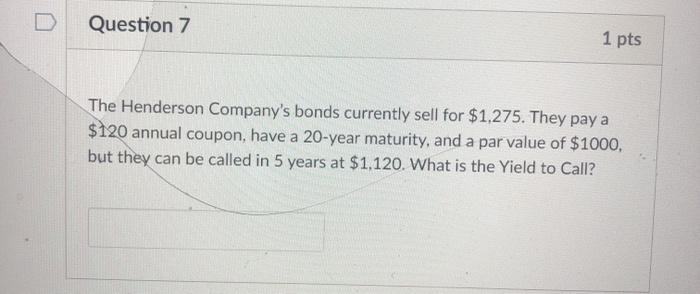

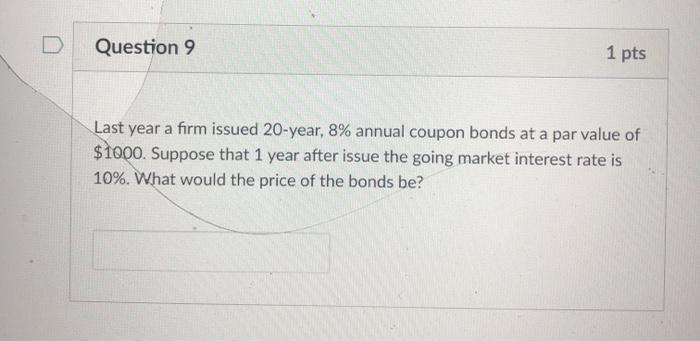

D Question 6 1 pts Harrimon Industries bonds have 4 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 9%. The fair market interest rate for such a bond is 12%. At which of the following prices would you buy the bond? i. $850 ji. $905 iii, $910 O i. only Oil, only iii. only O i. and ii. O i. and ill. All Prices Question 7 1 pts The Henderson Company's bonds currently sell for $1.275. They pay a $120 annual coupon, have a 20-year maturity, and a par value of $1000, but they can be called in 5 years at $1,120. What is the Yield to Call? Question 9 1 pts Last year a firm issued 20-year, 8% annual coupon bonds at a par value of $1000. Suppose that 1 year after issue the going market interest rate is 10%. What would the price of the bonds be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts