Question: Please answer all :) Thank you so much QUESTION 20 Which of the following is FALSE regarding total risk and portfolios? On average, ilnvestors are

Please answer all :) Thank you so much

Please answer all :) Thank you so much

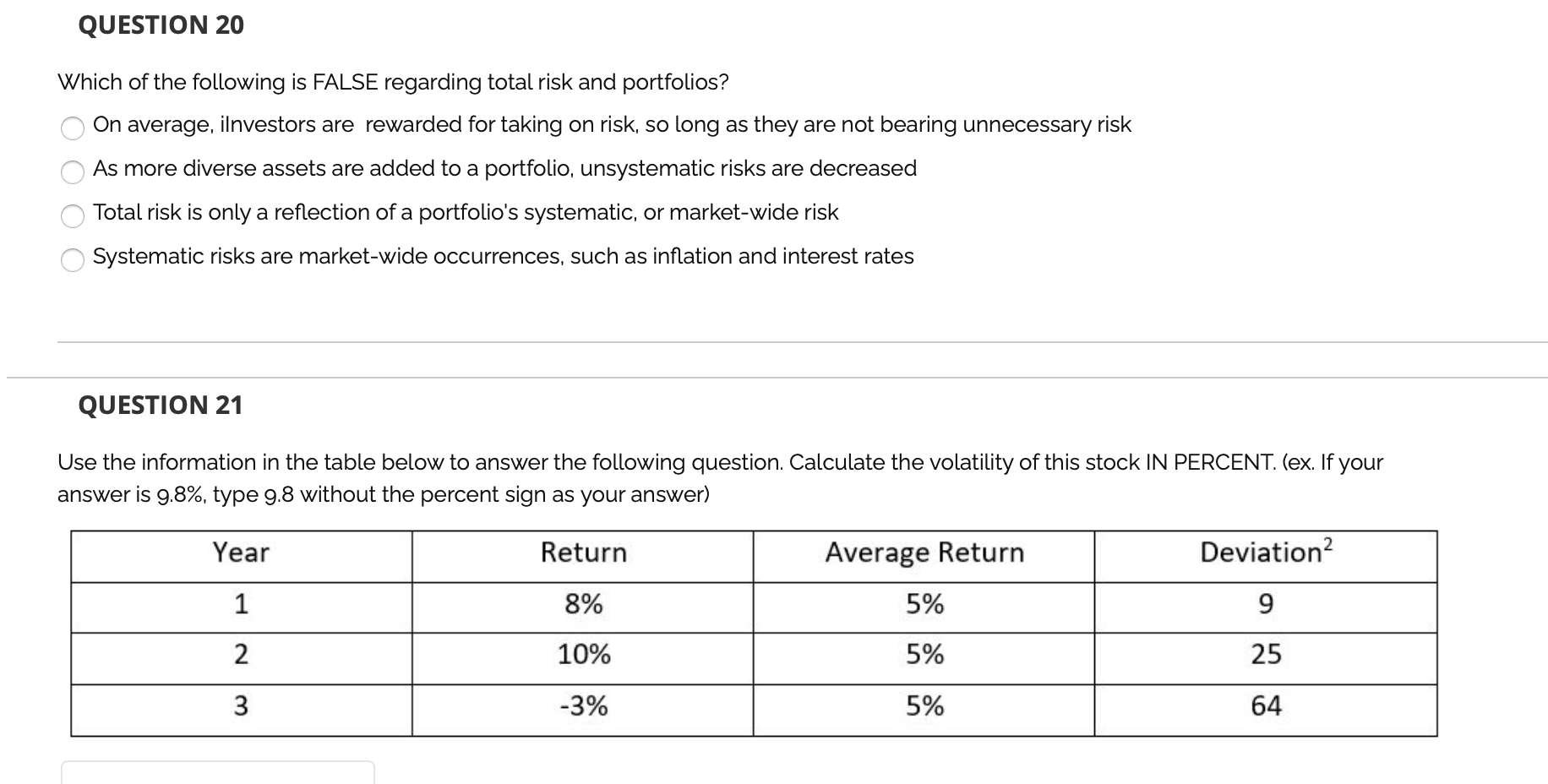

QUESTION 20 Which of the following is FALSE regarding total risk and portfolios? On average, ilnvestors are rewarded for taking on risk, so long as they are not bearing unnecessary risk As more diverse assets are added to a portfolio, unsystematic risks are decreased Total risk is only a reflection of a portfolio's systematic, or market-wide risk Systematic risks are market-wide occurrences, such as inflation and interest rates QUESTION 21 Use the information in the table below to answer the following question. Calculate the volatility of this stock IN PERCENT. (ex. If your answer is 9.8%, type 9.8 without the percent sign as your answer) Year Return Average Return Deviation? 1 8% 5% 9 2 10% 5% 25 3 -3% 5% 64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts