Question: please answer all! thanks:) 14 Nut working capital is defined A) current divided by current initi B) current mis un abilities current se divided by

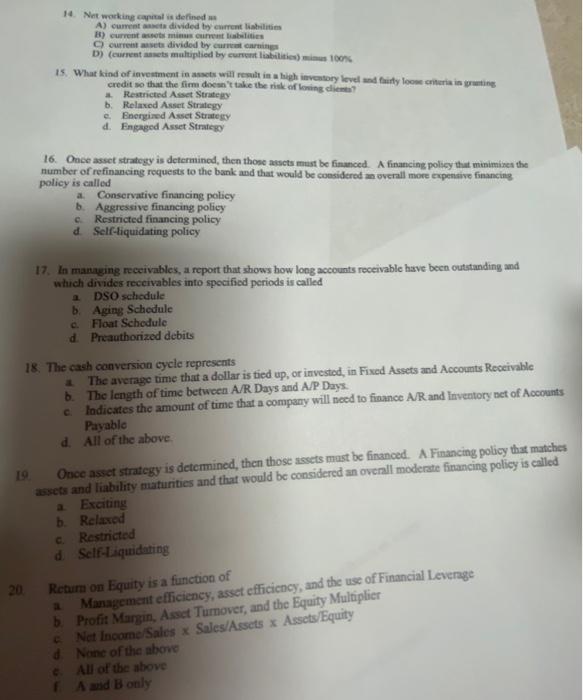

14 Nut working capital is defined A) current divided by current initi B) current mis un abilities current se divided by curcanings D) (current sets multiplied by current liabilities) 100 Is What kind of investment in a will remain in a high inventory level and intyfoon criteria in granting credit so that the fim doesn't take the risk of losing clients Restricted Asset Strategy b. Relaxed Asset Strategy e Energized Asset Strategy d. Engaged Asset Strategy 16. Once asset strategy is determined, then thone asscts must be financed. A financing policy that minimises the number of refinancing requests to the bank and that would be considered an overall more expensive financing policy is called a. Conservative financing policy b. Aggressive financing policy Restricted financing policy & Self-liquidating policy c 17. In managing receivables, a report that shows how long accounts receivable have been outstanding and which divades receivables into specified periods is called DSO schedule b. Aging Schedule Float Schedule dPreauthorized debits . 18. The cash conversion cycle represents The average time that a dollar is tied up, or investod, in Fixed Assets and Accounts Receivable b. The length of time between A/R Days and A/P Days. Indicates the amount of time that a company will need to finance A/R and Inventory net of Accounts Payable d. All of the above 19 Once asset strategy is determined, then those assets mast be financed. A Financing policy that matches assets and liability maturities and that would be considered an overall moderate financing policy is called a Exciting b. Relaxed c. Restricted d Self-Liquidating 20 Return on Equity is a function of Management efficiency, asset efficiency, and the use of Financial Levenge b. Profit Margin, Asset Turnover, and the Equity Multiplier Net Income Sales & Sales/Assets x Assets/Equity d None of the above All of the above A and B only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts