Question: Please answer ALL, thanks! Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $47,000 and

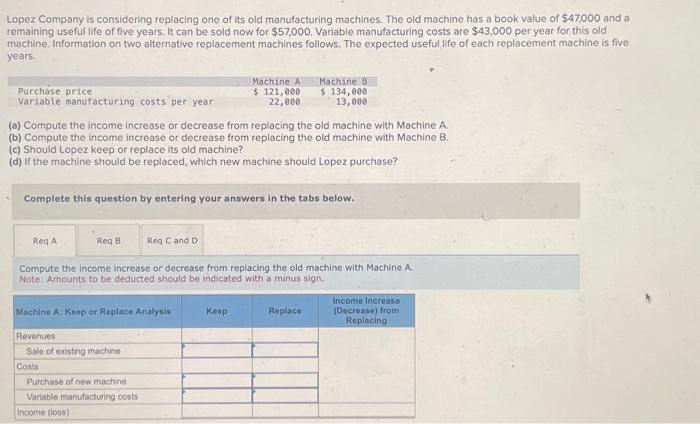

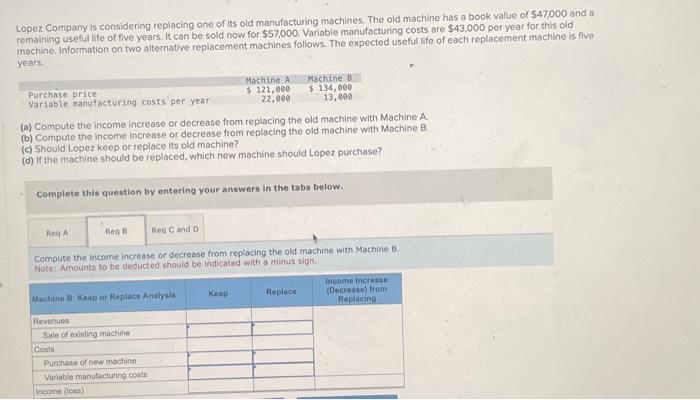

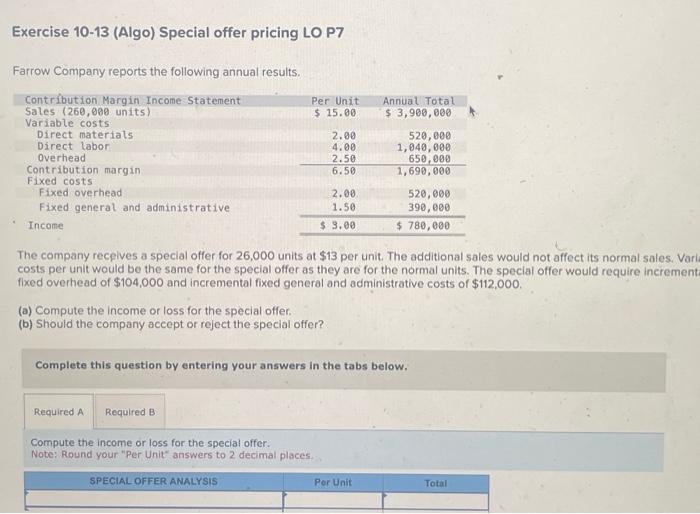

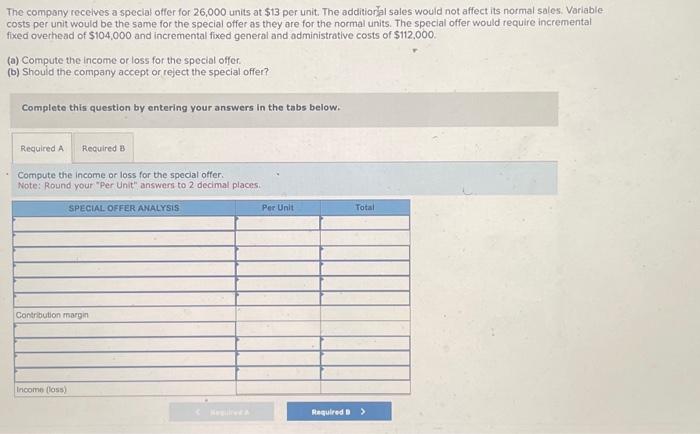

Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $47,000 and a remaining useful life of five years. It can be sold now for $57,000. Variable manufacturing costs are $43,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine A. Note: Amounts to be deducted should be indicated with a minus sign. Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $47,000 and a remaining usefut the of five years. It can be sold now for $57,000. Variable manufacturing costs are $43,000 per year for this old mochine. Information on two alternative replacement machines follows. The expected usefult ife of cach replacement mnchine is five: years. (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Mochine B. (c) Should Lopez keep of replace its old machine? (d) If the mochine should be replaced, which new machine should topez purchase? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine B. Note: Amounts to be deducted should be indicated with a minus sign. Exercise 10-13 (Algo) Special offer pricing LO P7 Farrow Company reports the following annual results. The company recelves a special offer for 26,000 units at $13 per unit. The additional sales would not affect its normal sales. Va costs per unit would be the same for the special offer as they are for the normal units. The special offer would require incremen fixed overhead of $104,000 and incremental fixed general and administrative costs of $112,000. (a) Compute the income or loss for the special offer. (b) Should the company accept or reject the special offer? Complete this question by entering your answers in the tabs below. Compute the income or loss for the special offer. Note: Round your "Per Unit" answers to 2 decimal places. The company recelves a special offer for 26,000 units at $13 per unit. The additional sales would not affect its normal sales. Variable costs per unit would be the same for the special offer as they are for the normal units. The special offer would require incremental fixed overhead of $104,000 and incremental fixed general and administrative costs of $112,000. (a) Compute the income or loss for the special offer. (b) Should the company accept or reject the special offer? Complete this question by entering your answers in the tabs below. Compute the income or loss for the special offer. Note: Round your "Per Unit" answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts