Question: please answer all thanks otherwise dont answer. there are two different question.so if you can answer both than only give answet otherwise dont. one question

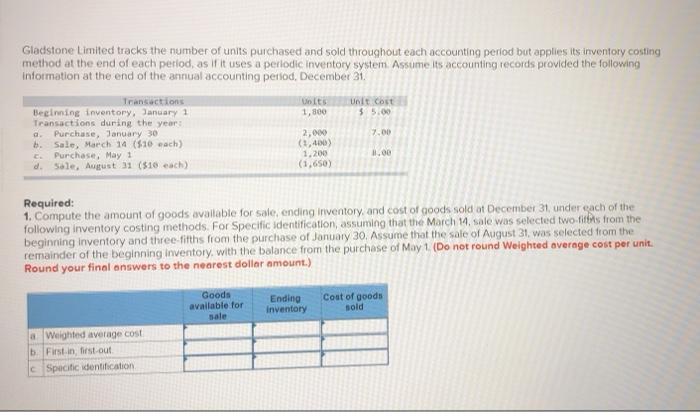

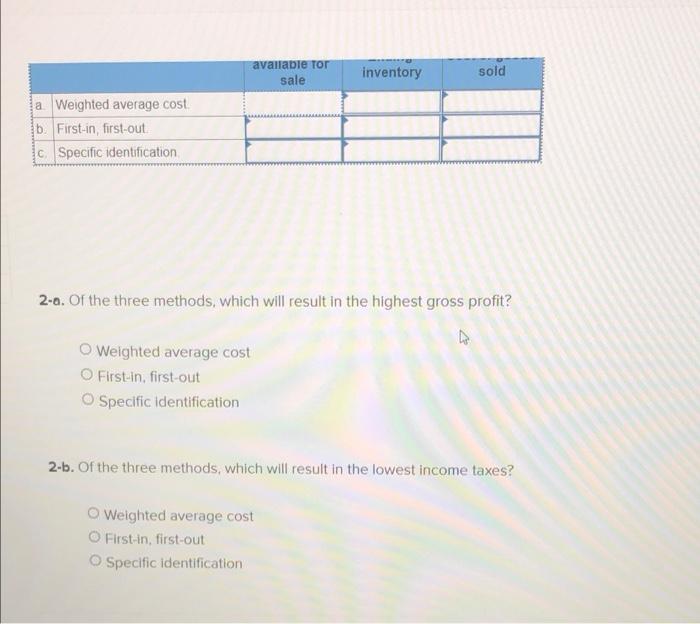

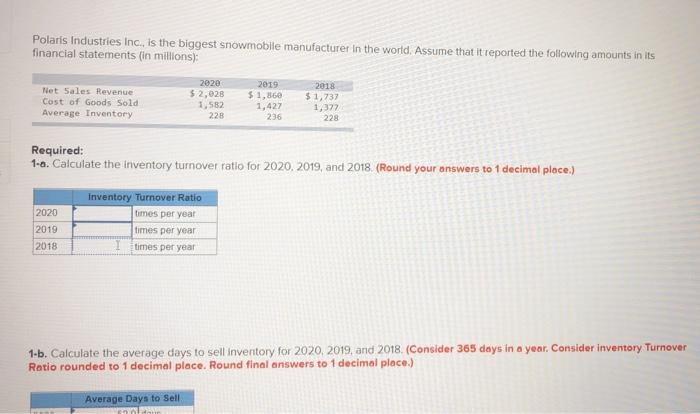

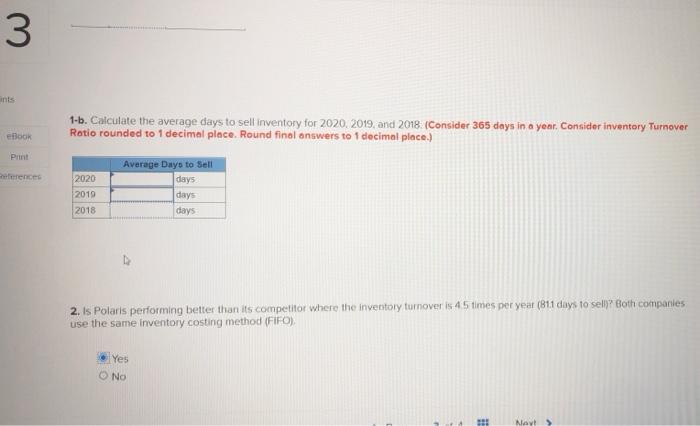

Gladstone Limited tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each perlod, as if it uses a perlodic inventory system. Assume its accounting records provided the following Information at the end of the annual accounting period, December 31 Transactions Units Unit Cost Beginning inventory, January 1 1,800 55.00 Transactions during the year Purchase, January 30 7.00 b. Sale, March 14 ($10 each) (1,400) Purchase, May 1 d. Sole, August 31 (510 each) (1.650) 2,000 C 1.200 18.00 Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold on December 31, under each of the following inventory costing methods. For Specific identification, assuming that the March 14. sale was selected two fitbits from the beginning inventory and three fifths from the purchase of January 30. Assume that the sale of August 31, was selected from the remainder of the beginning inventory with the balance from the purchase of May 1 (Do not round Weighted average cost per unit. Round your final answers to the nearest dollar amount.) Goods available for sale Ending Inventory Cout of goods sold a Weighted average cost b. First in first out cSpecific identification available for sale inventory sold a Weighted average cost First-in, first-out c. Specific identification 2-0. Of the three methods, which will result in the highest gross profit? O Weighted average cost First-in, first-out Specific identification 2-b. Of the three methods, which will result in the lowest income taxes? Weighted average cost First-in, first-out Specific identification Polaris Industries Inc., is the biggest snowmobile manufacturer in the world. Assume that it reported the following amounts in its financial statements (in millions): Net Sales Revenue Cost of Goods Sold Average Inventory 2020 $2,028 1.582 228 2019 $1,860 1,427 236 2018 $1,737 1,372 228 Required: 1-a. Calculate the inventory turnover ratio for 2020, 2019, and 2018. (Round your answers to 1 decimal place.) 2020 2019 2018 Inventory Turnover Ratio times per year times per year I times per year 1-b. Calculate the average days to sell Inventory for 2020, 2019, and 2018. (Consider 365 days in a year. Consider inventory Turnover Ratio rounded to 1 decimal place. Round final answers to 1 decimal place.) Average Days to Sell 3 ants eBook 1-b. Calculate the average days to sell inventory for 2020, 2019 and 2018 (Consider 365 days in a yenr. Consider inventory Turnover Ratio rounded to 1 decimal place. Round finel answers to 1 decimal place.) Average Days to sell Punt ferences 2020 2019 2018 days days days 2. Is Polaris performing better than its competitor where the inventory turnover is 45 times per year (811 days to sell? Both companies use the same inventory costing method (FIFO) Yes NO 111 l

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts