Question: Please answer all the answers correctly. No need to explain. Thank you in advance. 1: An employee works 50 hours (50 - 40 were overtime

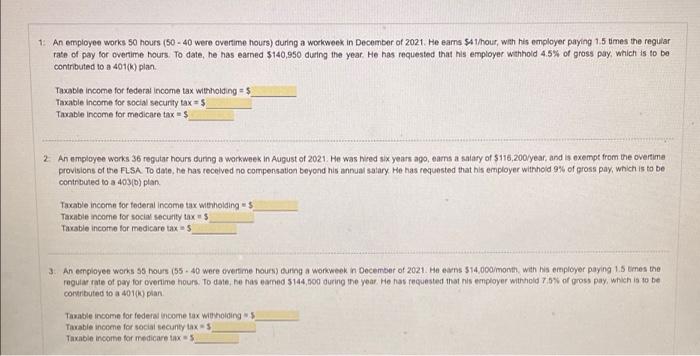

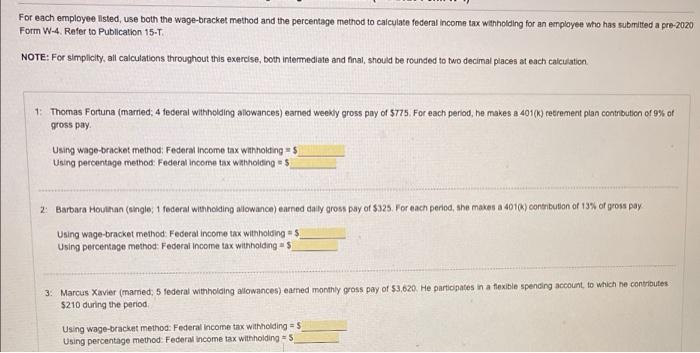

1: An employee works 50 hours (50 - 40 were overtime hours) during a workweek in December of 2021. He earns $41/hour, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $140,950 during the year. He has requested that his employer withhold 4.5% of gross puy, which is to be contributed to a 401(k) plan Taxable income for federal income tax withholding = 5 Taxable income for social security tax $ Taxable income for medicare tax = $ 2. An employee works 36 regutor hours during a workweek in August of 2021. He was hired six years ago, era a salary of $116,200/year, and is exempt from the overtime provisions of the FLSA Todan, he has received no compensation beyond his annual salary. He has requested that his employer withhold 9% of gross pay, which is to be contributed to a 403b) plan Taxable income for federal income tax withholding - $ Taxable income for soci security taxes Taxable income for medicare taxes 3. An employee works 55 hours (55.40 were overtime hours) cuning a workweek in December of 2021. Hoewn 314,000/month with his employer paying 1.5 times the regular rate of pay for overtime hours. To dato no has eamed 5144,100 during the year. He has requested that his employer withhold 76% of gross pay, which is to be Corviributed to a 401(k) plan Taxable income for federal income tax will holding 5 Taxable income for social secunty tax - 3 Taxable income for medicare tax For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to Publication 15-T NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation 1: Thomas Fortuna (married, 4 tederal withholding allowances) earned weekly gross pay of 5775. For each period, he makes a 401(K) retrement plan contbution of 9% of gross pay Using wage-bracket method: Federal Income tax withholding = $ Using percentage method: Federal Income tax withholding - 5 2: Barbara Houthan (single: 1 federal withholding allowance) earned daily gross pay of 325. Por each period, she makes a 4016) contribution of 13% of gross pay Using wage bracket method: Federal income tax withholding Using percentage method Federal income tax withholdings 3. Marcus Xavier (married, 5 federal withholding allowances) earned monthly gross pay of $3,620. He participates in a texible spending account, to which no contributes $210 during the period Using wage-bracket method: Federal income tax with holding = $ Using percentage method Federal income tax withholding = 5 Psa 3-6 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method (2020/2021 Form W-4) For each employee listed, use the wage-bracket method to calcutate federal income tax withholding for an employee who has submitted a 2020 Form W4. Refer to Publication 15-T 1: Noah Singer files as married ting jointly on his tax retum and earned weekly gross pay of $908. For each pay period he makes a 401(k) contribution of 5% of gross pay Noah checked box 2c on Form W-4 and did not enter any information in steps 3-4 of the form Federal income tax withholding as 2. Ashley Laughlin files as single on her tax return and earned weekly gross pay of S615. She does not make any retirement plan contributions Ashley entered $4000 on line 4b of Form W-4 and did not enter any information in steps 2 & 3 of the form Federal income tax withholding = 5 3: Zoey Segales married fling jointly on her tax return and eamed weekly rost Day of $1230. For each pay period she makes a flexible spending account contribution of 9% of gross pay Zoey entered $2000 in step 3 of Form W-4 and did not enter any information in steps 2 & 4 of the form Federal income tax witholdings Tentative Federal income Tax Withholdings 1: An employee works 50 hours (50 - 40 were overtime hours) during a workweek in December of 2021. He earns $41/hour, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $140,950 during the year. He has requested that his employer withhold 4.5% of gross puy, which is to be contributed to a 401(k) plan Taxable income for federal income tax withholding = 5 Taxable income for social security tax $ Taxable income for medicare tax = $ 2. An employee works 36 regutor hours during a workweek in August of 2021. He was hired six years ago, era a salary of $116,200/year, and is exempt from the overtime provisions of the FLSA Todan, he has received no compensation beyond his annual salary. He has requested that his employer withhold 9% of gross pay, which is to be contributed to a 403b) plan Taxable income for federal income tax withholding - $ Taxable income for soci security taxes Taxable income for medicare taxes 3. An employee works 55 hours (55.40 were overtime hours) cuning a workweek in December of 2021. Hoewn 314,000/month with his employer paying 1.5 times the regular rate of pay for overtime hours. To dato no has eamed 5144,100 during the year. He has requested that his employer withhold 76% of gross pay, which is to be Corviributed to a 401(k) plan Taxable income for federal income tax will holding 5 Taxable income for social secunty tax - 3 Taxable income for medicare tax For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to Publication 15-T NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation 1: Thomas Fortuna (married, 4 tederal withholding allowances) earned weekly gross pay of 5775. For each period, he makes a 401(K) retrement plan contbution of 9% of gross pay Using wage-bracket method: Federal Income tax withholding = $ Using percentage method: Federal Income tax withholding - 5 2: Barbara Houthan (single: 1 federal withholding allowance) earned daily gross pay of 325. Por each period, she makes a 4016) contribution of 13% of gross pay Using wage bracket method: Federal income tax withholding Using percentage method Federal income tax withholdings 3. Marcus Xavier (married, 5 federal withholding allowances) earned monthly gross pay of $3,620. He participates in a texible spending account, to which no contributes $210 during the period Using wage-bracket method: Federal income tax with holding = $ Using percentage method Federal income tax withholding = 5 Psa 3-6 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method (2020/2021 Form W-4) For each employee listed, use the wage-bracket method to calcutate federal income tax withholding for an employee who has submitted a 2020 Form W4. Refer to Publication 15-T 1: Noah Singer files as married ting jointly on his tax retum and earned weekly gross pay of $908. For each pay period he makes a 401(k) contribution of 5% of gross pay Noah checked box 2c on Form W-4 and did not enter any information in steps 3-4 of the form Federal income tax withholding as 2. Ashley Laughlin files as single on her tax return and earned weekly gross pay of S615. She does not make any retirement plan contributions Ashley entered $4000 on line 4b of Form W-4 and did not enter any information in steps 2 & 3 of the form Federal income tax withholding = 5 3: Zoey Segales married fling jointly on her tax return and eamed weekly rost Day of $1230. For each pay period she makes a flexible spending account contribution of 9% of gross pay Zoey entered $2000 in step 3 of Form W-4 and did not enter any information in steps 2 & 4 of the form Federal income tax witholdings Tentative Federal income Tax Withholdings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts