Question: please answer all the blanks and i will give a like!! (: thank you! Caciulate the NPV (net present value) of each plan. Begin by

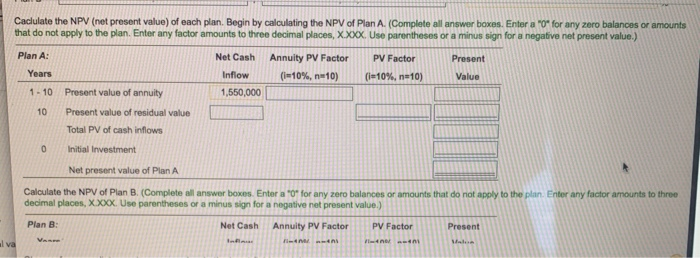

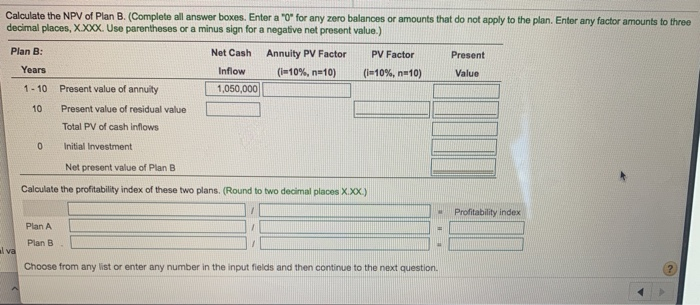

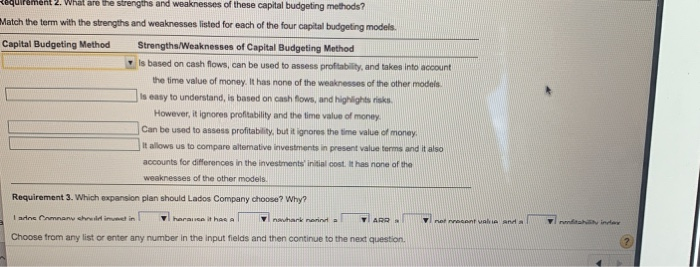

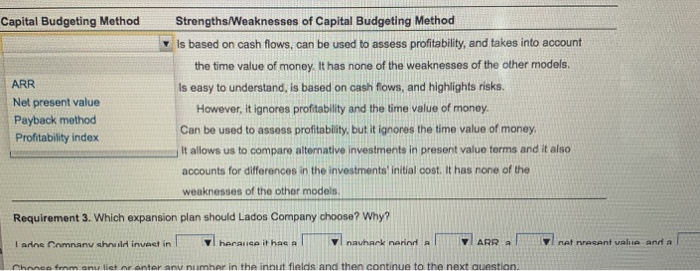

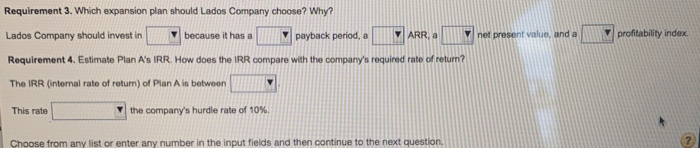

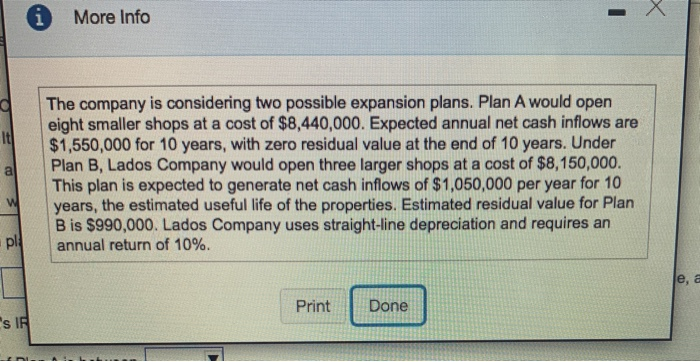

Caciulate the NPV (net present value) of each plan. Begin by calculating the NPV of Plan A. (Complete all answer boxes. Enter a "Ofor any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, XXXX. Use parentheses or a minus sign for a negative net present value.) Plan A: Net Cash Annuity PV Factor PV Factor Present Years Inflow (i=10%, n=10) (i=10%, n=10) Value 1 - 10 Prosent value of annuity 1,550,000 10 Present value of residual value Total PV of cash inflows 0 Initial Investment Net present value of Plan A Calculate the NPV of Plan B. (Complete all answer boxes. Enter a *o* for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Net Cash Annuity PV Factor Plan B PV Factor Present Web Iva Calculate the NPV of Plan B. (Complete all answer boxes. Enter a "O" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net prosent value.) Plan B: Net Cash Annuity PV Factor PV Factor Present Years Inflow (i=10%, n=10) (-10%, na 10) Value 1 - 10 Present value of annuity 1,050,000 10 Present value of residual value Total PV of cash inflows 0 Initial Investment Net present value of Plan B Calculate the profitability index of these two plans. (Round to two decimal places X.XX.) Profitability index Plan A Plan B Iva Choose from any list or enter any number in the input fields and then continue to the next question. quirement 2. What are the strengths and weaknesses of these capital budgeting methods? Match the term with the strengths and weaknesses listed for each of the four capital budgeting models Capital Budgeting Method Strengths/Weaknesses of Capital Budgeting Method Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other models. Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money, Can be used to assess profitability, but it ignores the time value of money It allows us to compare alternative investments in present value terms and it also accounts for differences in the investments initial cost. It has none of the weaknesses of the other models. Requirement 3. Which expansion plan should Lados Company choose? Why? Iarna Comnan chuid immet in horance it has Vlnawarkan VI ARO not contain and Choose from any list or enter any number in the input fields and then continue to the next question Vlinde Capital Budgeting Method Strengths/Weaknesses of Capital Budgeting Method Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other models. ARR is easy to understand, is based on cash flows, and highlights risks. Net present value However, it ignores profitability and the time value of money. Payback method Profitability index Can be used to assess profitability, but it ignores the time value of money It allows us to compare alternative investments in present value terms and it also accounts for differences in the investments initial cost. It has none of the weaknesses of the other models Requirement 3. Which expansion plan should Lados Company choose? Why? I arine Comany should invest in heralise it had a vl navhark narind R VARR a I nat recent value and a Chance from anu liet ar antarany number in the input fields and then continue to the next question ARR, a profitability index Requirement 3. Which expansion plan should Lados Company choose? Why? Lados Company should invest in because it has a payback period, a V net present value, and a Requirement 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? The IRR (internal rate of return) of Plan A is between This rate the company's hurdle rate of 10% Choose from any list or enter any number in the input fields and then continue to the next question. More Info g It a The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,440,000. Expected annual net cash inflows are $1,550,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Lados Company would open three larger shops at a cost of $8,150,000. This plan is expected to generate net cash inflows of $1,050,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan Bis $990,000. Lados Company uses straight-line depreciation and requires an annual return of 10%. w pl e, a Print Done SIR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts