Question: Please answer all the blanks. Express Delivery is a rapidly growing dehvery service, last year, 83% of its revenue came from the delivery of mailing

Please answer all the blanks.

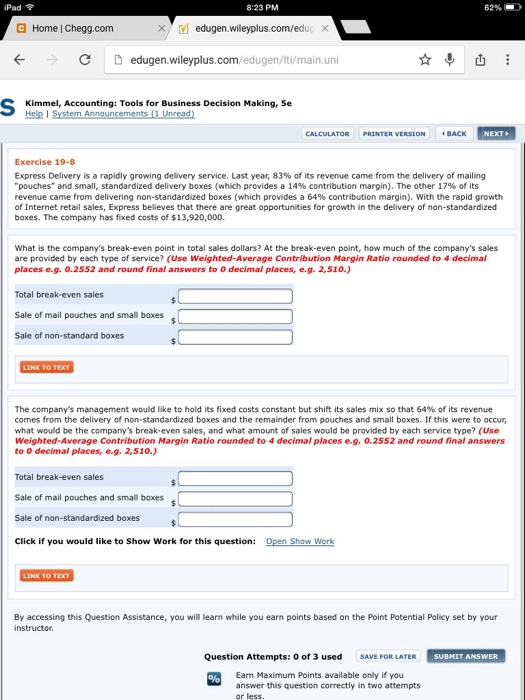

Please answer all the blanks.Express Delivery is a rapidly growing dehvery service, last year, 83% of its revenue came from the delivery of mailing "pouches* and small, standardized delivery boxes (which provides a 14% contribution margin). The other 17% of its revenue came from delivering non-standard>>zed boxes (which provides a 64% contribution margin). With the rapid growth of Internet retail sales, Express believes that there are great opportunities for growth in the delivery of non-standardized boxes. The company has fixed costs of $13,920,000. What is the company's break-even point in total sales dollars? At the break-even point, how much of the company's sales are provided by each type of service? (Use Weighted-Average Contribution Margin Ratio rounded to 4 decimal places e.g. 0.2552 and round final answers to 0 decimal places, e.g. 2,510.) The company's management would like to hold its fixed costs constant but shift its sales mix so that 64% of its revenue comes from the delivery of non-standardized boxes and the remainder from pouches and small boxes. If this were to occur, what would be the company's break-even sales, and what amount of sales would be provided by each service type? (Use Weighted-Average Contribution Margin Ratio rounded to 4 decimal places e.g. 0.2552 and round final answers to 0 decimal places, e.g. 2,510.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts