Question: please answer all The default risk premium in an interest rate is the compensation demanded by the buyer of the debt security for the possibility

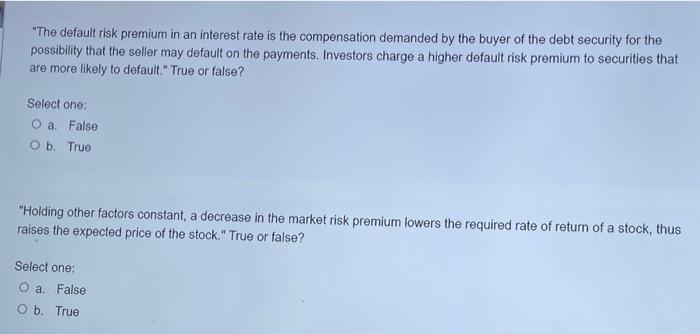

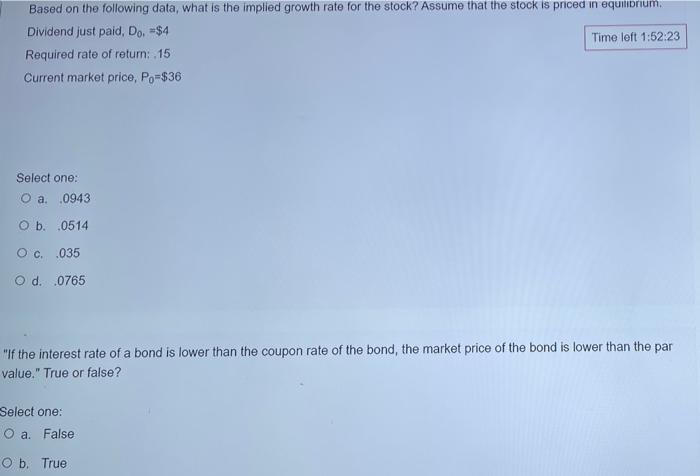

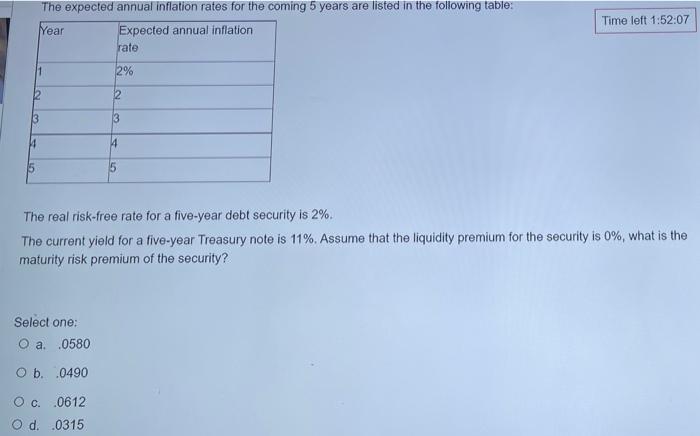

"The default risk premium in an interest rate is the compensation demanded by the buyer of the debt security for the possibility that the seller may default on the payments. Investors charge a higher default risk premium to securities that are more likely to default." True or false? Select one: O a. False O b. True "Holding other factors constant, a decrease in the market risk premium lowers the required rate of return of a stock, thus raises the expected price of the stock." True or false? Select one: O a. False O b. True Based on the following data, what is the implied growth rate for the stock? Assume that the stock is priced in equilibrium, Dividend just paid, Do. $4 Time left 1:52:23 Required rate of return: 15 Current market price, Po=$36 Select one: Oa: 0943 O b. .0514 Oc. .035 O d. 0765 "If the interest rate of a bond is lower than the coupon rate of the bond, the market price of the bond is lower than the par value." True or false? Select one: O a False O b. True The expected annual inflation rates for the coming 5 years are listed in the following table: Year Expected annual inflation rate Time left 1:52:07 2% 2 2 3 14 4 5 The real risk-free rate for a five-year debt security is 2%. The current yield for a five-year Treasury note is 11%. Assume that the liquidity premium for the security is 0%, what is the maturity risk premium of the security? Select one: O a .0580 O b. .0490 Oc..0612 O d..0315

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts