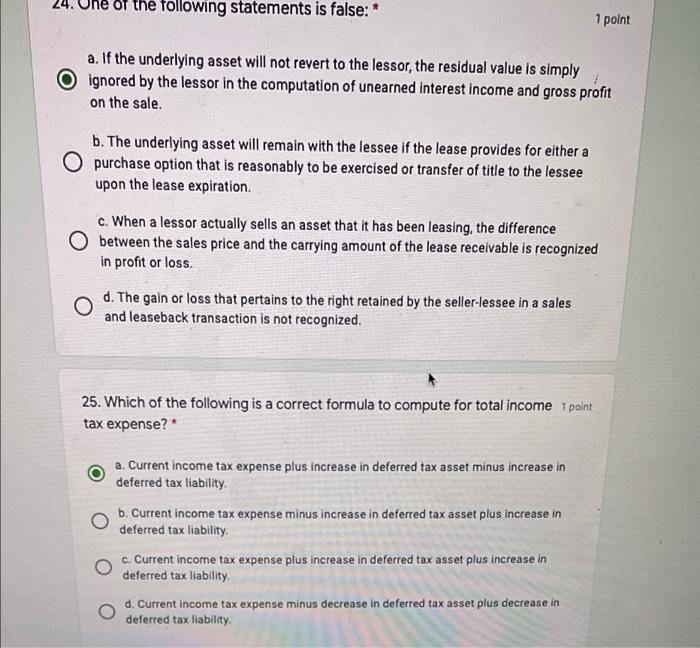

Question: Please answer all the following statements is false:* 1 point a. If the underlying asset will not revert to the lessor, the residual value is

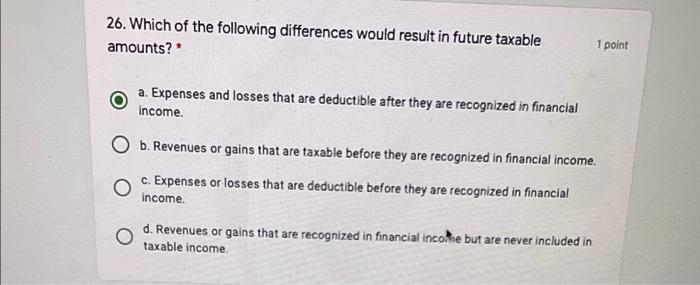

the following statements is false:* 1 point a. If the underlying asset will not revert to the lessor, the residual value is simply ignored by the lessor in the computation of unearned interest income and gross profit on the sale. b. The underlying asset will remain with the lessee if the lease provides for either a O purchase option that is reasonably to be exercised or transfer of title to the lessee upon the lease expiration c. When a lessor actually sells an asset that it has been leasing, the difference between the sales price and the carrying amount of the lease receivable is recognized in profit or loss. d. The gain or loss that pertains to the right retained by the seller-lessee in a sales and leaseback transaction is not recognized. 25. Which of the following is a correct formula to compute for total income 1 point tax expense? * a. Current income tax expense plus increase in deferred tax asset minus increase in deferred tax liability b. Current income tax expense minus increase in deferred tax asset plus increase in deferred tax liability c. Current income tax expense plus increase in deferred tax asset plus increase in deferred tax liability d. Current income tax expense minus decrease in deferred tax asset plus decrease in deferred tax liability 26. Which of the following differences would result in future taxable amounts? 1 point a. Expenses and losses that are deductible after they are recognized in financial income b. Revenues or gains that are taxable before they are recognized in financial income. c. Expenses or losses that are deductible before they are recognized in financial Income O d. Revenues or gains that are recognized in financial income but are never included in taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts