Question: Please answer all the problems. Thank you so much!!! Exercise 10-3 (Algo) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $326,430 for real

Please answer all the problems. Thank you so much!!!

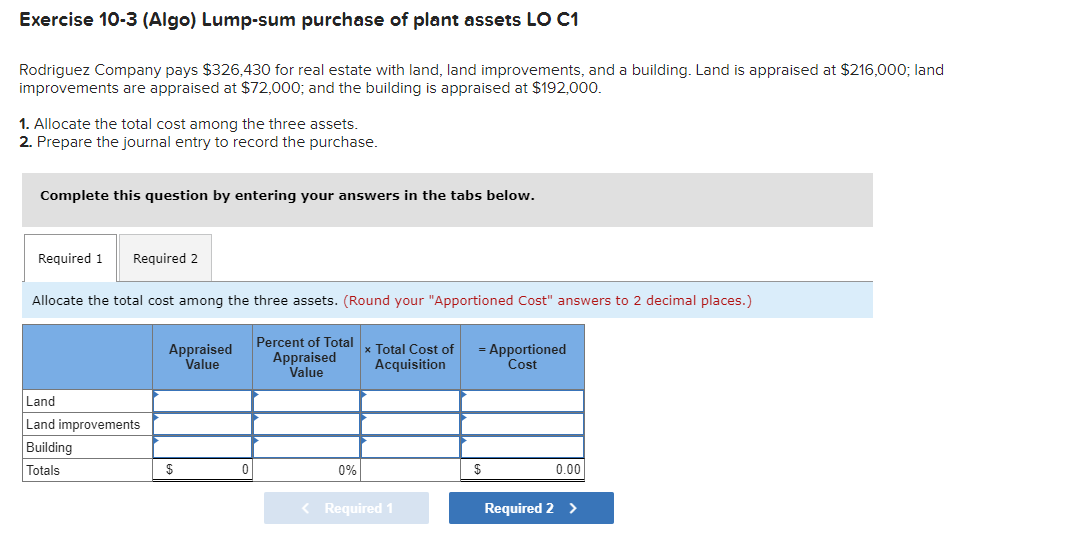

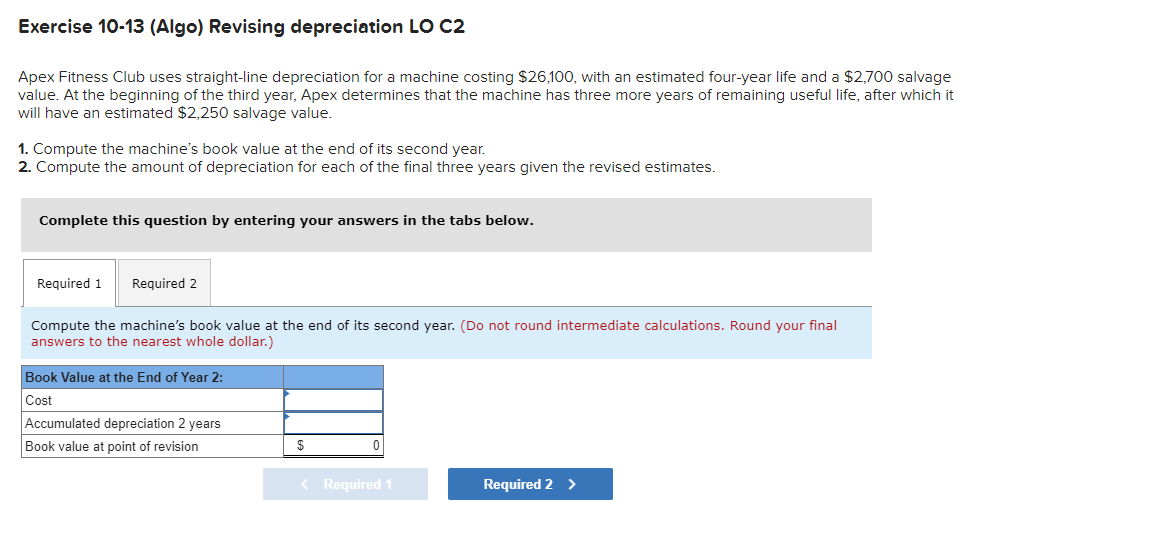

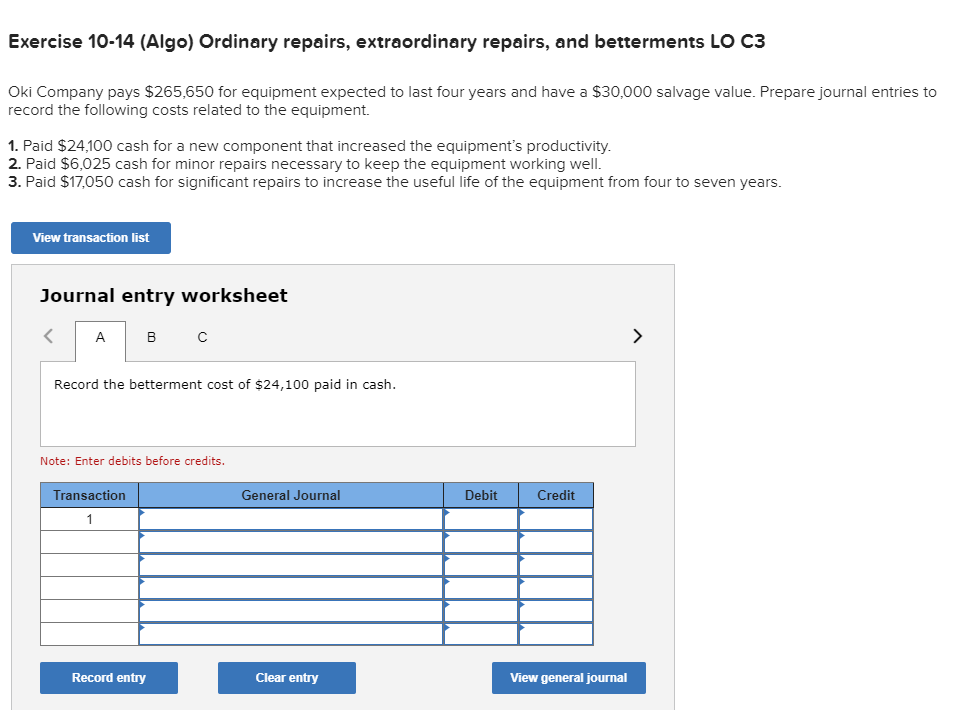

Exercise 10-3 (Algo) Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $326,430 for real estate with land, land improvements, and a building. Land is appraised at $216,000; land improvements are appraised at $72,000; and the building is appraised at $192,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Exercise 10-13 (Algo) Revising depreciation LO C2 Apex Fitness Club uses straight-line depreciation for a machine costing $26,100, with an estimated four-year life and a $2,700 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $2,250 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Compute the machine's book value at the end of its second year. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Exercise 1014 (Algo) Ordinary repairs, extraordinary repairs, and betterments LO C3 Oki Company pays $265,650 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $24,100 cash for a new component that increased the equipment's productivity. 2. Paid $6,025 cash for minor repairs necessary to keep the equipment working well. 3. Paid $17,050 cash for significant repairs to increase the useful life of the equipment from four to seven years. Journal entry worksheet Record the betterment cost of $24,100 paid in cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts