Question: please answer all the question for this assignment. Part A Financial Statement Analysis You have been hired to be the assistant to the Chief Financial

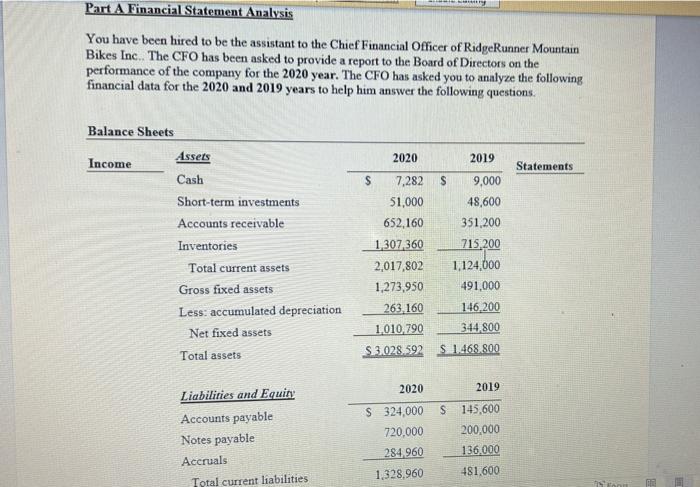

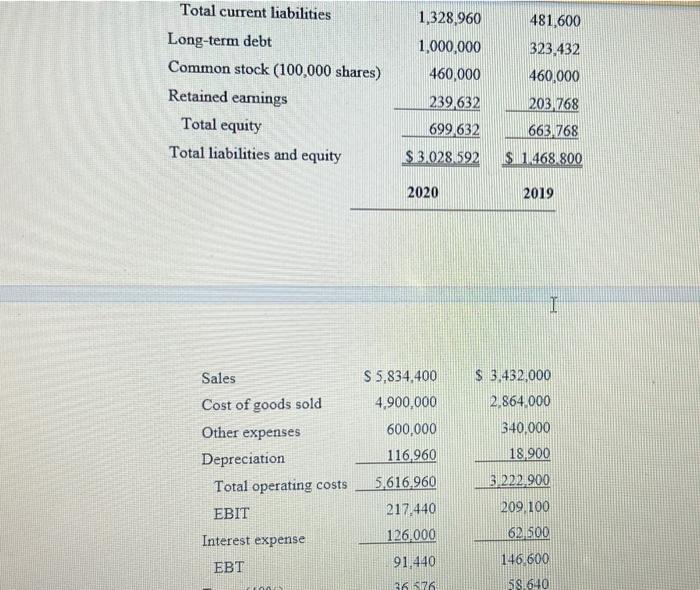

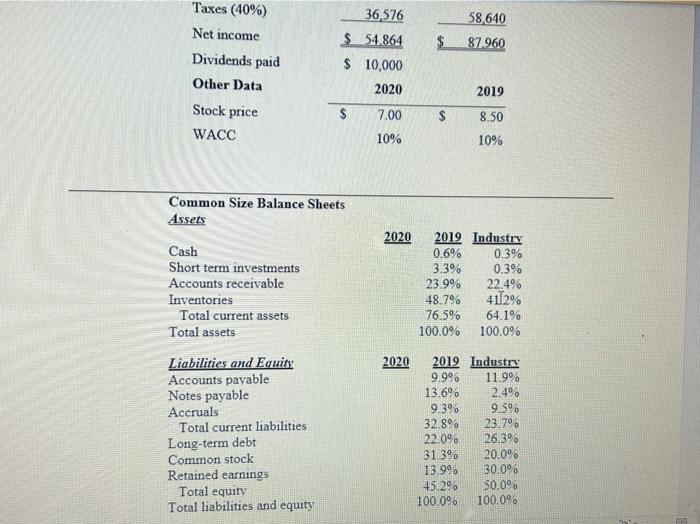

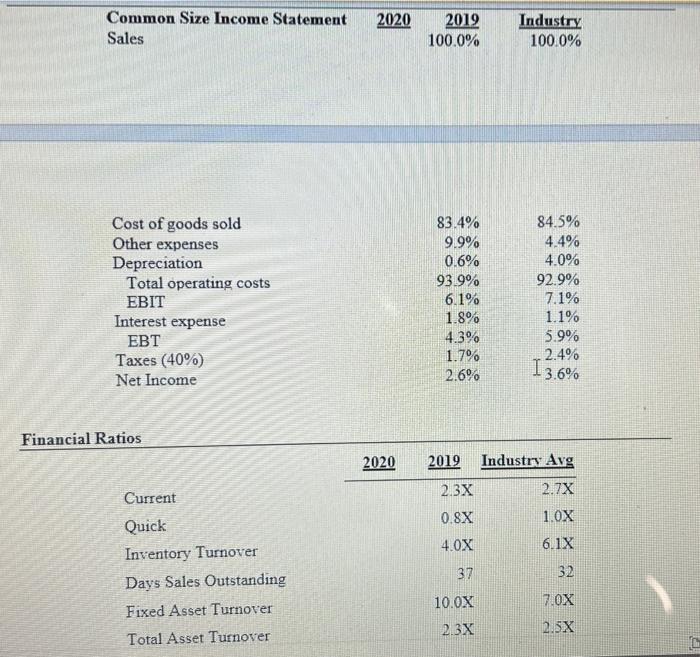

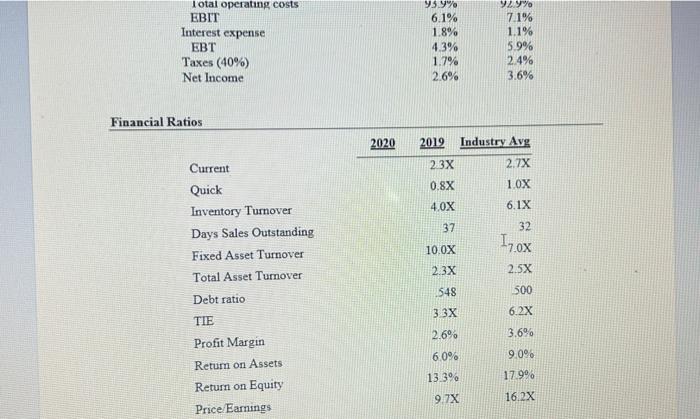

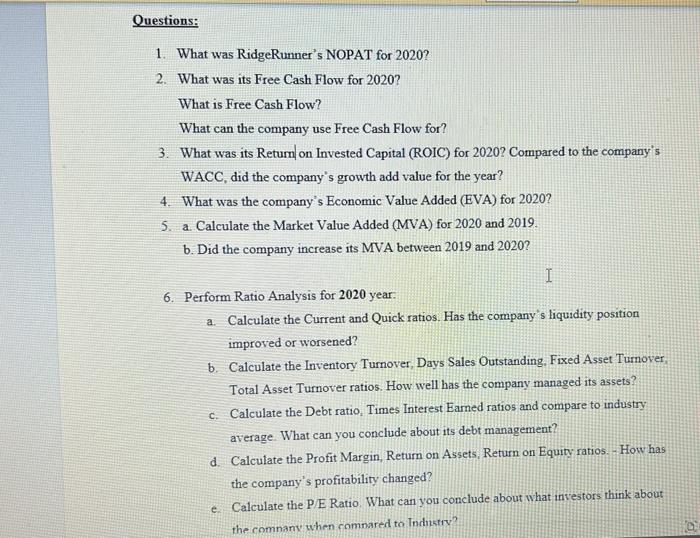

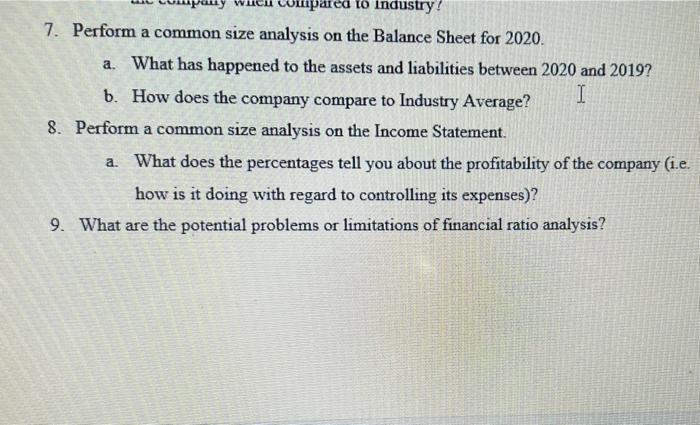

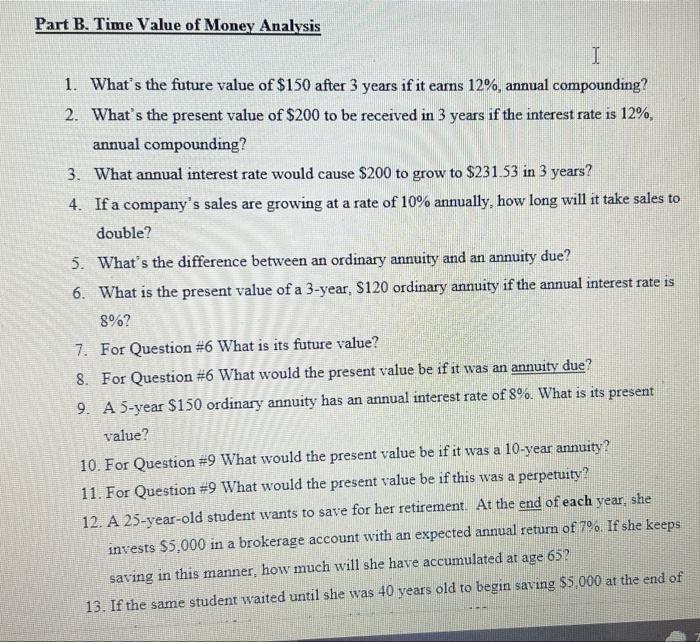

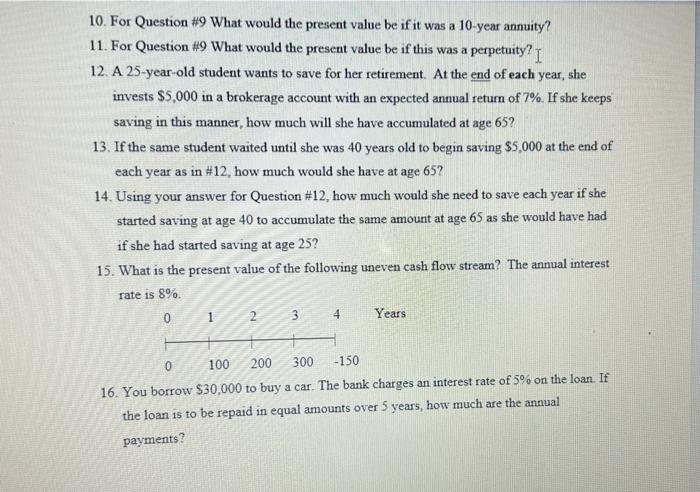

Part A Financial Statement Analysis You have been hired to be the assistant to the Chief Financial Officer of RidgeRunner Mountain Bikes Inc. The CFO has been asked to provide a report to the Board of Directors on the performance of the company for the 2020 year. The CFO has asked you to analyze the following financial data for the 2020 and 2019 years to help him answer the following questions 2020 2019 Statements Balance Sheets Income Assets Cash Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: accumulated depreciation Net fixed assets 7,282 51,000 652,160 1,307,360 2,017.802 1,273,950 263.160 1.010,790 S3028.592 9,000 48,600 351,200 715,200 1,124,000 491,000 146,200 344,800 Total assets S 1.468 800 2020 2019 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities $ 324,000 720,000 284 960 1.328,960 S 145,600 200,000 136,000 481.600 Total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings Total equity Total liabilities and equity 1,328,960 1,000,000 460,000 239.632 699632 $ 3028 592 481,600 323,432 460,000 203.768 663.768 $1468 800 2020 2019 I Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT S 5,834,400 4,900,000 600,000 116.960 5.616.960 217.440 126,000 91.440 $ 3.432.000 2.864.000 340,000 18.900 3 222.900 209.100 62.500 146.600 58.610 Interest expense 56 576 Taxes (40%) Net income Dividends paid Other Data 58.640 87.960 $ 36 576 $ 54.864 $ 10,000 2020 2019 Stock price $ 7.00 $ WACC 8.50 10% 10% Common Size Balance Sheets Assets 2020 Cash Short term investments Accounts receivable Inventories Total current assets Total assets 2019 Industry 0.6% 0.3% 3.3% 0.3% 23.9% 22.4% 48.7% 4112% 76.5% 64.1% 100.0% 100.0% 2020 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total equity Total liabilities and equity 2019 Industry 9.99 11.99 13.6% 2.49% 9.36 9.596 32.8% 23.79% 22.09 26.3% 31 3% 20.09 13.99 30.0% 45.29 50.0% 100.09 100.0% Common Size Income Statement Sales 2020 2019 100.0% Industry 100.0% Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net Income 83.4% 9.9% 0.6% 93.9% 6.1% 1.8% 4.3% 1.7% 2.6% 84.5% 4.4% 4.0% 92.9% 7.1% 1.1% 5.9% 2.4% 13.6% Financial Ratios 2020 2019 Industry Avg 2.7X 1.0X Current 2.3X 0.8X 4.0X 6.1X 37 32 Quick Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover 10.0X 7.0X 2.3X 2.5X Total operating costs EBIT Interest expense Taxes (40%) Net Income 93.9% 6.1% 1.8% 4.3% 1.7% 2.6% Y2.9% 7.1% 1.1% 5.9% 2.4% 3.6% Financial Ratios 2020 2019 Current 2.3X Industry Avg 2.7X 1.0X 0.8X 4.0X 6.1X 37 32 Quick Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover 17.0x 100X 2.3X 2.5X 548 500 Debt ratio 3.3X 6.2x TIE 2.6% 3.6% 6.0% 9.0% Profit Margin Retum on Assets Return on Equity Price/Earnings 13.39 17.996 9.7x 16.2X Questions: 1. What was RidgeRunner's NOPAT for 2020? 2. What was its Free Cash Flow for 2020? What is Free Cash Flow? What can the company use Free Cash Flow for? 3. What was its Return on Invested Capital (ROIC) for 2020? Compared to the company's WACC, did the company's growth add value for the year? 4. What was the company's Economic Value Added (EVA) for 2020? 5. a. Calculate the Market Value Added (MVA) for 2020 and 2019. b. Did the company increase its MVA between 2019 and 2020? I 6. Perform Ratio Analysis for 2020 year. a. Calculate the Current and Quick ratios. Has the company's liquidity position improved or worsened? b. Calculate the Inventory Turnover, Days Sales Outstanding, Fixed Asset Turnover, Total Asset Turnover ratios. How well has the company managed its assets? c. Calculate the Debt ratio, Times Interest Earned ratios and compare to industry average. What can you conclude about its debt management? d. Calculate the Profit Margin Return on Assets Return on Equity ratios. - How has the company's profitability changed? e Calculate the P/E Ratio. What can you conclude about what investors think about the company when compared to Industry? impared to Industry! 7. Perform a common size analysis on the Balance Sheet for 2020. a. What has happened to the assets and liabilities between 2020 and 2019? b. How does the company compare to Industry Average? I 8. Perform a common size analysis on the Income Statement. a. What does the percentages tell you about the profitability of the company (i.e. how is it doing with regard to controlling its expenses)? 9. What are the potential problems or limitations of financial ratio analysis? Part B. Time Value of Money Analysis I 1. What's the future value of $150 after 3 years if it earns 12%, annual compounding? 2. What's the present value of $200 to be received in 3 years if the interest rate is 12%, annual compounding? 3. What annual interest rate would cause $200 to grow to $231.53 in 3 years? 4. If a company's sales are growing at a rate of 10% annually, how long will it take sales to double? 5. What's the difference between an ordinary annuity and an annuity due? 6. What is the present value of a 3-year, 5120 ordinary annuity if the annual interest rate is 8%? 7. For Question #6 What is its future value? 8. For Question #6 What would the present value be if it was an annuity due? 9. A 5-year $150 ordinary annuity has an annual interest rate of 8%. What is its present value? 10. For Question #9 What would the present value be if it was a 10-year annuity? 11. For Question #9 What would the present value be if this was a perpetuity? 12. A 25-year-old student wants to save for her retirement. At the end of each year, she invests $5,000 in a brokerage account with an expected annual return of 7%. If she keeps saving in this manner, how much will she have accumulated at age 652 13. If the same student waited until she was 40 years old to begin saving $5,000 at the end of 10. For Question #9 What would the present value be if it was a 10-year annuity? 11. For Question #9 What would the present value be if this was a perpetuity? I 12. A 25-year-old student wants to save for her retirement. At the end of each year, she invests $5,000 in a brokerage account with an expected annual return of 7%. If she keeps saving in this manner, how much will she have accumulated at age 65? 13. If the same student waited until she was 40 years old to begin saving $5,000 at the end of each year as in #12. how much would she have at age 652 14. Using your answer for Question #12, how much would she need to save each year if she started saving at age 40 to accumulate the same amount at age 65 as she would have had if she had started saving at age 25? 15. What is the present value of the following uneven cash flow stream? The annual interest rate is 8% 0 4 Years 1 2 3 0 100 200 300 - 150 16. You borrow $30,000 to buy a car. The bank charges an interest rate of 5% on the loan. If the loan is to be repaid in equal amounts over 5 years, how much are the annual payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts