Question: Please answer all the question Q.6.10 Problem 6-10 You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviations

Please answer all the question Q.6.10

| Problem 6-10 You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviations for five different well-diversified portfolios of risky assets:

| ||||||||||||||||||||||||||||||||||||||

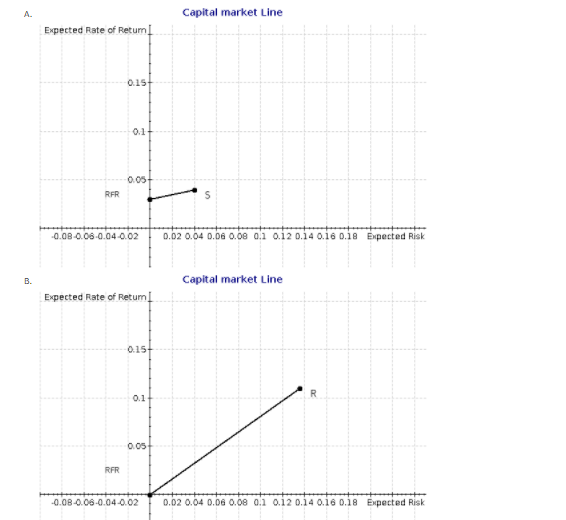

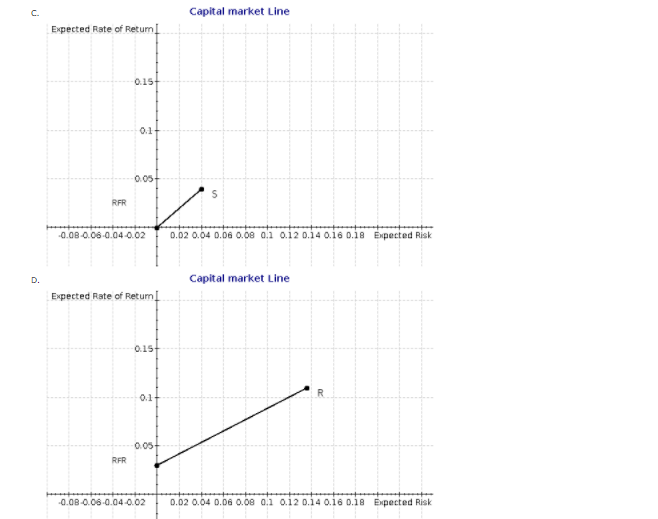

A Capital market Line Expected Rate of Return! 0.15+ 01 0.05 RFR 5 -0.0B 0.06 0.04 0.02 0.02 0.04 0.06 0.08 0.1 0.120.14 0.18 0.18 Expected Risk B. Capital market Line Expected Rate of Retum 0.154 0.1 0.05 RFR -0.08-0.08-0.04-0.02 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 Expected Risk C. Capital market Line Expected Rate of Retum 0.15 0.17 0.05 RFR -0.0B 0.06 0.04 0.02 0.62 0.64 0.06 0.68 0.1 0.120.14 0.16 0.18 Expected Risk D. Capital market Line Expected Rate of Retum! 0.15 0.1 R RFR -0.0B 0.06 0.04 0.02 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 Expected Risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts