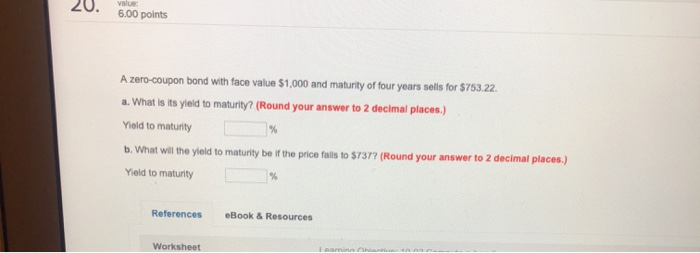

Question: please answer all the questions 20. value 6.00 points A zero-coupon bond with face value $1,000 and maturity of four years sells for $753.22 a.

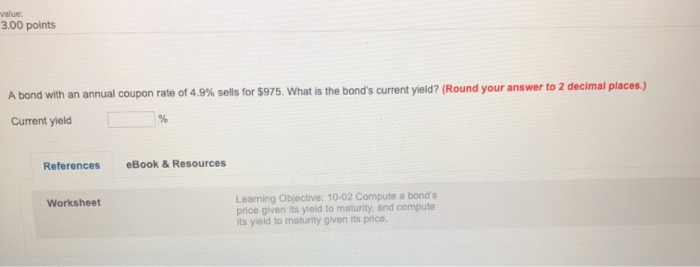

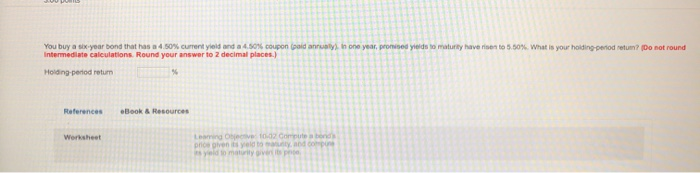

20. value 6.00 points A zero-coupon bond with face value $1,000 and maturity of four years sells for $753.22 a. What is its yield to maturity? (Round your answer to 2 decimal places.) Yield to maturity b. What will the yleld to maturity be if the price falls to $737? (Round your answer to 2 decimal places.) Yield to maturity % References eBook & Resources Worksheet Learnina Obiective: 10 02 C value: 3.00 points to 2 decimal places.) A bond with an annual coupon rate of 4.9% sells for $975. What is the bond's current yield? (Round your answer % Current yield eBook & Resources References Leaning Objective: 10-02 Compute a bond's price given its yield to maturity, and compute its yield to maturity given its price. Worksheet You buy a six-year bond that has a 4.50 % current yield and a 4.50% coupon (paid annualy). in one year, pronised yields to maturity have risen to 5.50 % What is your hoidingpenod retun? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Holding-period return References eBook & Resources Leaming Ojecive t002 Compute a bond's price ghven ts yeld to mauty, and copune is yeld to maturity given its pre Worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts