Question: please answer all the questions and also explain! this is a part of my huge grade! thank you Question 3 4 pts 2. One portfolio

please answer all the questions and also explain! this is a part of my huge grade! thank you

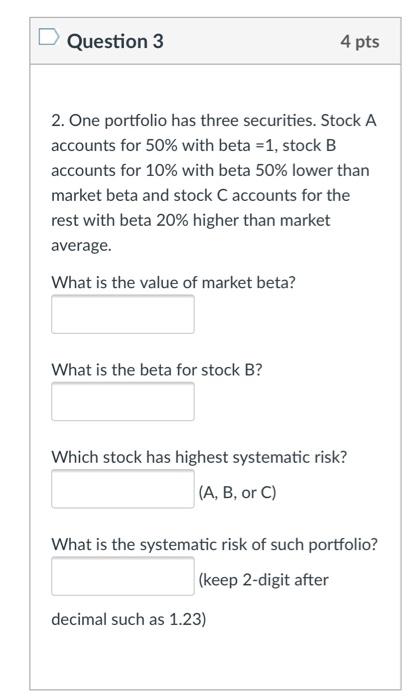

please answer all the questions and also explain! this is a part of my huge grade! thank youQuestion 3 4 pts 2. One portfolio has three securities. Stock A accounts for 50% with beta =1, stock B accounts for 10% with beta 50% lower than market beta and stock C accounts for the rest with beta 20% higher than market average. What is the value of market beta? What is the beta for stock B? Which stock has highest systematic risk? (A, B, or C) What is the systematic risk of such portfolio? (keep 2-digit after decimal such as 1.23)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock