Question: PLEASE ANSWER ALL THE QUESTIONS AND LABEL THEM PROPERLY Mutual funds can effectively charge sales fees in one of three ways: front-end losd fees, 12b-1

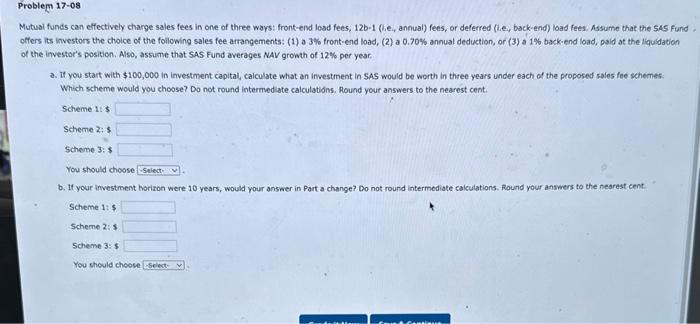

Mutual funds can effectively charge sales fees in one of three ways: front-end losd fees, 12b-1 (lie, annual) fees, or deferred (i.e, back-end) load fees. Assume that the Sas fund offers its investors the choice of the following sales fee arrangements: (1) a 3% front-end load, (2) a 0.70% annual deduction, or (3) a 1% back-end load, paid at the liquidation of the investor's position. Also, assume that SAS Fund averages NAV growth of 12% per year: a. If you start with $100,000 in investment capital, calculate what an ifvestment in 5A would be worth in three years under each of the propored sales fee schemes: Which scheme would you choose? Do not round intermediate calculations. Round your answers to the nearest cent. Scheme 1:$ Scheme 2:s scheme 3: $ You should choose b. If your investment borizon were 10 years, would your answer in Part a change? Do not round intermediate cakulations. Round your answers to the nearest cent Scheme 12$ scheme 2:5 Scheme 3:5 You should cheose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts