Question: please answer all the questions and provide sufficient steps. I will give you a like!!!! QUESTION 1 HAS THREE PARTS (A, B, C) FOR A

please answer all the questions and provide sufficient steps. I will give you a like!!!!

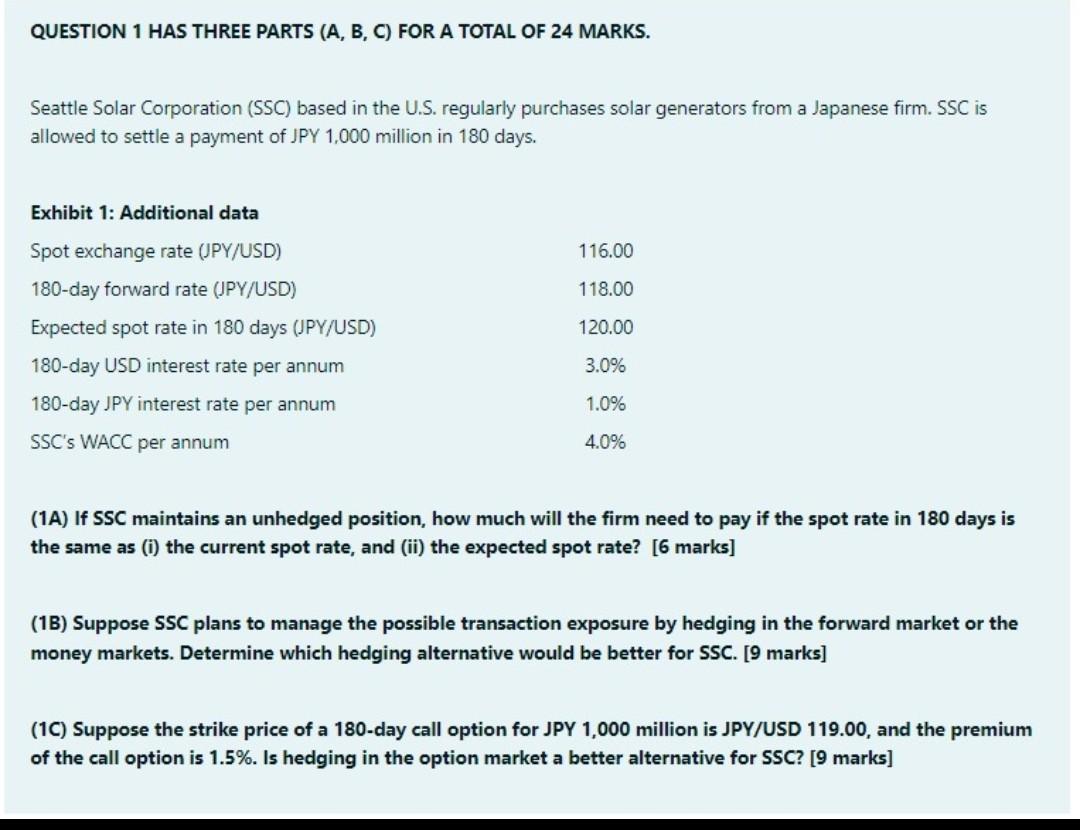

QUESTION 1 HAS THREE PARTS (A, B, C) FOR A TOTAL OF 24 MARKS. Seattle Solar Corporation (SSC) based in the U.S. regularly purchases solar generators from a Japanese firm. SSC is allowed to settle a payment of JPY 1,000 million in 180 days. Exhibit 1: Additional data Spot exchange rate (JPY/USD) 116.00 180-day forward rate (JPY/USD) 118.00 Expected spot rate in 180 days (JPY/USD) 120.00 180-day USD interest rate per annum 3.0% 180-day JPY interest rate per annum 1.0% SSC's WACC per annum 4.0% (1A) If SSC maintains an unhedged position, how much will the firm need to pay if the spot rate in 180 days is the same as (i) the current spot rate, and (ii) the expected spot rate? [6 marks] (1B) Suppose SSC plans to manage the possible transaction exposure by hedging in the forward market or the money markets. Determine which hedging alternative would be better for SSC. [9 marks] (1C) Suppose the strike price of a 180-day call option for JPY 1,000 million is JPY/USD 119.00, and the premium of the call option is 1.5%. Is hedging in the option market a better alternative for SSC? [9 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts